LG 2003 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2003 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

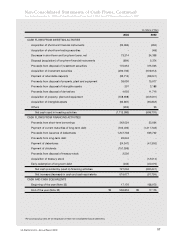

Non-Consolidated Statements of Cash Flows

Year Ended December 31, 2003 and Nine-Month Period from April 1, 2002 (Spin-Off Date) to December 31, 2002

(in millions of Won)

2003 2002

CASH FLOWS FROM OPERATING ACTIVITIES

Net income ₩662,824 ₩277,716

Adjustments to reconcile net income to net cash provided by operating activities

Depreciation and amortization 617,894 447,809

Amortization of discounts on debentures 17,981 3,031

Provision for severance benefits 135,750 102,618

Loss from transfer of trade accounts and notes receivable 96,871 72,121

Bad debt expense 31,273 85,719

Loss (gain) on foreign currency translation, net 25,640 (29,283)

Gain from disposal of investment securities, net (500,920) (2,955)

Loss on impairment of investment securities 29,273 -

Loss from disposal of property, plant and equipment, net 61,750 58,451

Loss (gain) on valuation of securities using the equity method 584,571 (26,666)

Loss (gain) on valuation of derivatives, net 9,206 (1,576)

Gain on settlement of derivatives, net (3,027) (11,716)

Provision for product warranty 4,782 38,979

Others (104,473) (3,774)

1,006,571 732,758

Changes in operating assets and liabilities

Decrease (increase) in trade accounts and notes receivable 59,626 (67,074)

Increase in other accounts receivable (213,827) (33,711)

Increase in accrued income (30,508) (61,431)

Decrease (increase) in advances 139,003 (44,012)

Decrease (increase) in other current assets 21 (671)

Increase in inventories (308,259) (325,609)

Decrease (increase) in prepaid expenses 10,277 (19,112)

Increase in deferred income tax assets (7,354) (47,297)

Increase (decrease) in trade accounts and notes payable (170,511) 394,742

Increase in other accounts payable 39,633 593,967

Increase (decrease) in accrued expenses 27,209 (585)

Increase (decrease) in withholdings (14,385) 13,653

Increase (decrease) in advances from customers (80,938) 57,031

Increase (decrease) in income taxes payable (107,848) 156,609

Payment of severance benefits (81,297) (86,363)

Increase in severance insurance deposits (27,341) (36,170)

Decrease in contributions to the National Pension Fund 2,667 3,048

Others - (265)

(763,832) 496,750

Net cash provided by operating activities 905,563 1,507,224