LG 2003 Annual Report Download - page 94

Download and view the complete annual report

Please find page 94 of the 2003 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

94

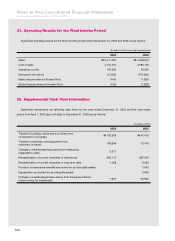

Notes to Non-Consolidated Financial Statements

For the years ended December 31, 2003 and 2002

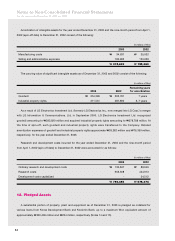

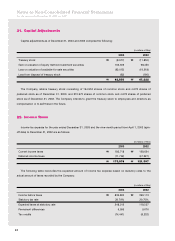

21. Capital Adjustments

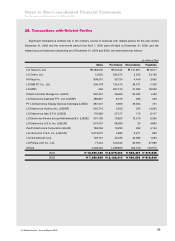

Capital adjustments as of December 31, 2003 and 2002 comprise the following:

(in millions of Won)

2003 2002

Treasury stock ₩(8,977) ₩(11,850)

Gain on valuation of equity method investment securities 163,609 98,456

Loss on valuation of available-for-sale securities (92,012) (19,218)

Loss from disposal of treasury stock (62) (166)

₩62,558 ₩67,222

The Company retains treasury stock consisting of 194,953 shares of common stock and 4,678 shares of

preferred stock as of December 31, 2003, and 215,973 shares of common stock and 4,678 shares of preferred

stock as of December 31, 2002. The Company intends to grant the treasury stock to employees and directors as

compensation or to sell these in the future.

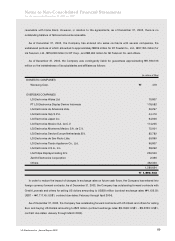

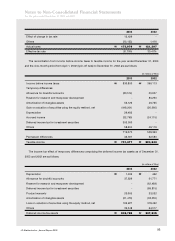

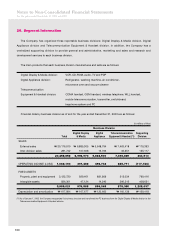

22. Income Taxes

Income tax expense for the year ended December 31, 2003 and the nine-month period from April 1, 2002 (spin-

off date) to December 31, 2002 are as follows:

(in millions of Won)

2003 2002

Current income taxes ₩185,718 ₩168,624

Deferred income taxes (11,742) (47,227)

₩173,976 ₩121,397

The following table reconciles the expected amount of income tax expense based on statutory rates to the

actual amount of taxes recorded by the Company:

(in millions of Won)

2003 2002

Income before taxes ₩836,800 ₩399,113

Statutory tax rate 29.70% 29.70%

Expected taxes at statutory rate 248,516 118,537

Permanent differences 9,595 9,676

Tax credits (74,441) (8,232)