LG 2003 Annual Report Download - page 84

Download and view the complete annual report

Please find page 84 of the 2003 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

84

Notes to Non-Consolidated Financial Statements

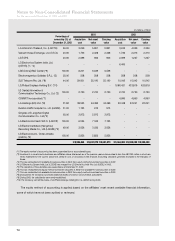

For the years ended December 31, 2003 and 2002

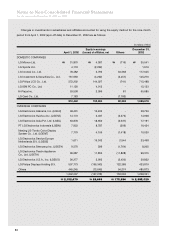

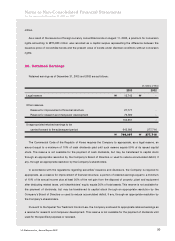

Amortization of intangible assets for the year ended December 31, 2003 and the nine-month period from April 1,

2002 (spin-off date) to December 31, 2002 consist of the following:

(in millions of Won)

2003 2002

Manufacturing costs ₩34,631 ₩25,032

Selling and administrative expenses 180,992 130,628

₩215,623 ₩155,660

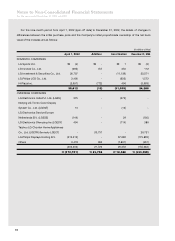

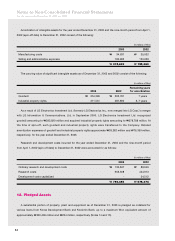

The carrying value of significant intangible assets as of December 31, 2003 and 2002 consist of the following:

(in millions of Won)

Remaining years

2003 2002 for amortization

Goodwill ₩254,399 ₩293,781 7 years

Industrial property rights 311,531 387,890 2~7 years

As a result of LG Electronics Investment Ltd. (formerly LG Electronics Inc., now merged into LG Corp.)’s merger

with LG Information & Communications, Ltd. in September 2000, LG Electronics Investment Ltd. recognized

goodwill amounting to ₩393,820 million and acquired industrial property rights amounting to ₩578,788 million. At

the time of spin-off, such goodwill and industrial property rights were transferred to the Company. Related

amortization expenses of goodwill and industrial property rights approximate ₩39,282 million and ₩76,359 million,

respectively, for the year ended December 31, 2003.

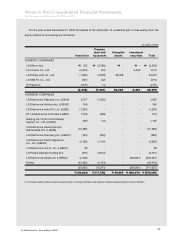

Research and development costs incurred for the year ended December 31, 2003 and the nine-month period

from April 1, 2002 (spin-off date) to December 31, 2002 were accounted for as follows:

(in millions of Won)

2003 2002

Ordinary research and development costs ₩136,847 ₩88,949

Research costs 662,608 434,913

Development costs capitalized - 54,512

₩799,455 ₩578,374

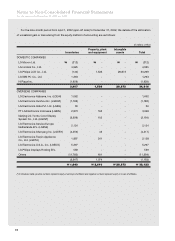

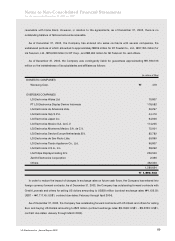

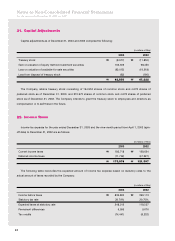

12. Pledged Assets

A substantial portion of property, plant and equipment as of December 31, 2003 is pledged as collateral for

various loans from Korea Development Bank and Kookmin Bank, up to a maximum Won equivalent amount of

approximately ₩300,469 million and ₩264 million, respectively (Notes 14 and 15).