LG 2003 Annual Report Download - page 81

Download and view the complete annual report

Please find page 81 of the 2003 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc._Annual Report 2003 81

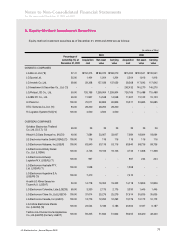

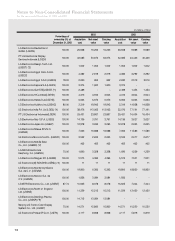

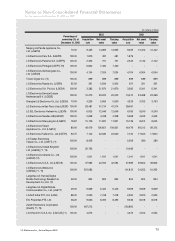

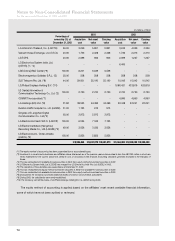

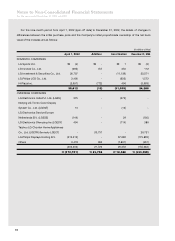

Notes to Non-Consolidated Financial Statements

For the years ended December 31, 2003 and 2002

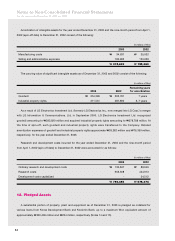

As of December 31, 2003, accumulated losses of equity investees to which the equity method of accounting has

been suspended due to accumulated losses are follows:

(in millions of Won)

LG Electronics Australia PTY, Ltd. (LGEAP) ₩10,551

LG Electronics Gulf FZE (LGEGF) 6,366

LG Electronics United Kingdom Ltd. (LGEUK) 14,038

LG Electronics Wales Ltd. (LGEWA) 80,937

Zenith Electronics Corporation (Zenith) 92,594

LG Infocomm U.S.A. Inc. (LGICUS) 6,690

Others 2,365

₩213,541

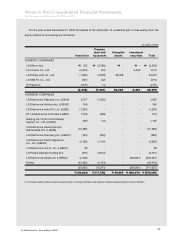

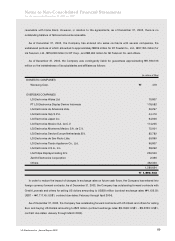

The use of the equity method had been suspended until December 31, 2002, for the investments in LG

Electronics Espana S.A. (LGEES), LG Electronics Peru S.A. (LGEPR) and LG Electronics United Kingdom Ltd.

(LGEUK), due to the negative book value of investments. During 2003, LG Electronics Espana S.A. (LGEES) and LG

Electronics Peru S.A. (LGEPR) both recorded a net income, and LG Electronics United Kingdom Ltd. (LGEUK)

issued new shares. Consequently, the losses of those three subsidiaries which had not been recognized until

December 31, 2002, amounting to ₩13,576 million were deducted from retained earnings.

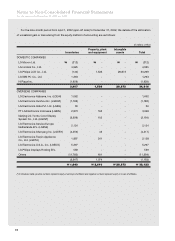

Upon a resolution of the Board of Directors on September 25, 2003, the Company participated in the issuance

of new shares of Zenith Electronics Corporation (“Zenith”), a wholly-owned subsidiary located in the U.S.A.,

amounting to US$214 million, and collected senior secured notes of and loans to Zenith amounting to ₩246,225

million in October, 2003. Consequently, the Company recognized the loss on valuation of securities using the equity

method, which has been suspended due to the negative net book value of the investment, up to the additional

invested amount, and reversed the bad debt provision amounting to ₩119,110 million during 2003.

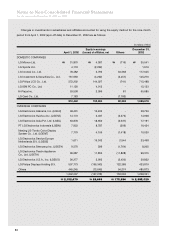

Upon a resolution of the Board of Directors on December 9, 2003, the Company invested its 27,841 shares

(40.8%) of LG.Philips Displays Holding B.V. into LG Electronics Wales Ltd., a wholly-owned subsidiary located in

the U.K., at the value of ₩500,821 million (GBP238 million). The acquisition cost of LG.Philips Displays Holding B.V.

was fully written down due to decrease in book value of the investment resulting from restructuring losses in 2003.

Consequently, the disposal value of ₩500,821 million was accounted for as a gain on disposal of investment

securities, and the same amount was accounted for as a loss on valuation of securities using the equity method,

which had no effect on net income or shareholders’ equity.

Upon a resolution of the Board of Directors on December 23, 2003, the Company purchased 1,614,675 shares

(20%) of the common stock of Hankook Electric Glass Co., Ltd. from LG Corp., at the price of ₩119,163 million in

January, 2004.