LG 2003 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2003 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

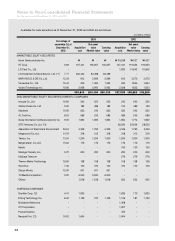

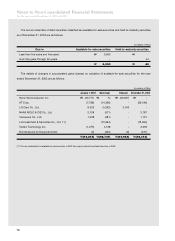

Notes to Non-Consolidated Financial Statements

For the years ended December 31, 2003 and 2002

Accounting Standards (“SKFAS”) No. 8, Securities. This statement requires investments in equity and debt

securities to be classified into three categories: trading, available-for-sale and held-to-maturity.

Securities are initially carried at cost, including incidental expenses, with cost being determined using the gross

average method. Debt securities, which the Company has the intent and ability to hold to maturity, are generally

carried at cost, adjusted for the amortization of discounts or premiums. Premiums and discounts on debt securities

are amortized over the term of the debt using the effective interest rate method. Trading and available-for-sale

securities are carried at fair value, except for non-marketable securities classified as available-for-sale securities

whose fair value may not be determined, which are carried at cost. Non-marketable debt securities are carried at a

value using the present value of future cash flows, discounted at a reasonable interest rate determined considering

the credit ratings by independent credit rating agencies.

Unrealized valuation gains or losses on trading securities are charged to current operations, and those resulting

from available-for-sale securities are charged to capital adjustments, the accumulated amount of which shall be

charged to current operations when the related securities are sold, or when an impairment loss on the securities is

recognized. Impairment losses are recognized in the statement of income when the recoverable amounts are less

than the acquisition cost of securities or adjusted cost of debt securities after the amortization of discounts or

premiums.

Investments in equity securities of companies, over which the Company exercises a significant control or

influence (controlled investees), are recorded using the equity method of accounting. Under the equity method, the

Company records changes in its proportionate ownership of the book value of the investee in current operations, as

capital adjustments or as adjustments to retained earnings, depending on the nature of the underlying change in

book value of the investee.

The Company discontinues the equity method of accounting for investments when the Company’s share in the

accumulated losses of the investees equals the costs of the investments, and until the subsequent cumulative

changes in its proportionate net income of the investees equal its cumulative proportionate net losses not

recognized during the periods when the equity method was suspended. Differences between the initial purchase

price and the Company’s initial proportionate ownership of the net book value of the investee are amortized over

five years using the straight-line method, and the amortization is charged to current operations.

Unrealized profit arising from sales by the Company to equity method investees is fully eliminated. Unrealized

profit arising from sales by the equity method investees to the Company or sales between equity-method investees

is also eliminated considering the percentage of ownership.

Foreign currency financial statements of equity method investees are translated into Korean Won using the

basic exchange rates in effect as of the balance sheet date for assets and liabilities, and annual average exchange

rates for income and expenses. Any resulting translation gain or loss is included in the capital adjustments account,

a component of shareholders’ equity.

Allowance for Doubtful Accounts

The Company provides an allowance for doubtful accounts based on the aggregate estimated collectibility of

the accounts.