LG 2003 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2003 LG annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

LG Electronics Inc._Annual Report 2003 61

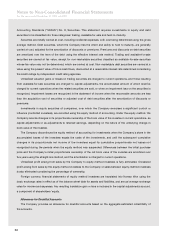

Notes to Non-Consolidated Financial Statements

For the years ended December 31, 2003 and 2002

Inventories

Inventories are stated at the lower of cost or market, with cost being determined using the weighted-average

method, except for inventories in-transit which is determined using the specific identification method. If the net

realizable value of the inventory is less than its cost, the carrying amount is reduced to the net realizable value.

Property, Plant and Equipment

Property, plant and equipment are recorded at cost, less accumulated depreciation. Depreciation is computed

using the straight-line method over the following estimated useful lives of the assets, as described below.

Estimated useful life (years)

Buildings 20 - 40 years

Structures 20 - 40 years

Machinery and equipment 5 - 10 years

Tools, furniture and fixtures, and vehicles 5 years

Routine maintenance and repairs are charged to current operations as incurred. Betterments and renewals

which enhance the value of the assets over their most recently appraised value are capitalized.

The Company assesses the potential impairment of property, plant and equipment when there is evidence that

events or changes in circumstances have made the recovery of an asset’s carrying value to be unlikely, and

recognizes an impairment loss when the carrying value of an asset exceeds the value of its future economic

benefits. The carrying value of the impaired assets is reduced to the estimated realizable value, and an impairment

loss is recorded as a reduction in the carrying value of the related asset and charged to current operations.

However, the recovery of the impaired assets would be recorded in current operations up to the cost of the assets,

net of accumulated depreciation before impairment, when the estimated value of the assets exceeds the carrying

value after impairment.

Lease Transactions

Lease agreements that include a bargain purchase option, result in the transfer of ownership at the end of the

lease term, have a term longer than 75% of the estimated economic life of the leased property, or have a present

value of the minimum lease payments at the beginning of the lease term amounting to more than 90% of the fair

value of the leased property, are accounted for as capital leases. Leases that do not meet these criteria are

accounted for as operating leases, of which the total minimum lease payments are charged to expense over the

lease period on a straight-line basis.

Research and Development Costs

Research costs are expensed as incurred. Development costs directly relating to a new technology or new

products, for which the estimated future benefits are probable, are recognized as intangible assets. Amortization of

development costs is computed using the straight-line method over five years from the commencement of the

commercial production of the related products. Such costs are subject to continual analysis of recoverability. In the