Konica Minolta 2013 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2013 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

New Business Domains

Sales of color equipment in the United States and Japan increased despite a challenging market environment. The bizhub PRO 951, bizhub

PRESS 1250, and bizhub PRESS 1052–the new monochrome equipment launched in the second half–were a success, resulting in sales of

color and monochrome equipment both exceeding the previous fi scal year and securing almost double-digit growth. Also, our sales alliance

with Komori Corporation resulted in the achievement of our initial aim of enhancing our sales capacity for major commercial printing customers

and extending our reach to large companies in North America, which contributed to an increase in the number of high-end units installed.

In the industrial inkjet printer fi eld, which holds good prospects for future growth, a structure for full-

scale sales promotion of high-end models from FY March 2014 has been established in the domain of

inkjet printers for textile POD, in which we lead the market. In addition to enabling the production of

multiple models and small lots, inkjet textile printers are receiving attention for facilitating a drastic reduction

in environmental impact. We aim to expand this domain in order to make it a new pillar of growth.

We are also jointly developing digital inkjet machines with Komori Corporation, with the goal of expanding into the commercial printing market.

We are currently conducting joint development of a next-generation, high-speed inkjet digital press that combines Konica Minolta’s

inkjet technology with Komori Corporation’s paper handling technology. This product will target the commercial printing market,

where digitalization is expected to drive further business expansion.

To strengthen our sales, service, and solution proposal capabilities in the in-

house printing market, we acquired the leading company in on-demand output

services in Japan, FedEx Kinko’s Japan Co., Ltd., in May 2012 and FedEx

Kinko’s Korea Ltd. in January 2013.

In Europe, we acquired the major print management service company

Charterhouse PM Limited (HO: U.K.) which, in addition to having extensive

resources relating to the production of printed material for customers,

specializes in cost optimization and marketing planning and has a record of

business development in 18 countries in the region.

Through these M&As, we have strengthened our capability to make

proposals to major companies and avenues for central reproduction department

(CRD) projects are steadily increasing with large projects from major companies

in Japan having already been ordered.

•

Inkjet printer business for textile print-on-demand (POD)

moves to full-scale expansion phase

•

Global M&As completed with the aim of strengthening capabilities in proposing

solutions to major companies

Summary of Business Technologies Business

Lower profi ts due to falling short of cost reduction targets

despite increased sales in growth fi elds

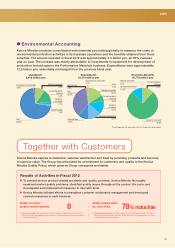

As a result, sales in the Business

Technologies Business for the fi scal

year were ¥581.6 billion (YoY

+6.2%) and operating income was

¥31.6 billion (YoY -19.8%). The

sales expansion of new color

multifunctional peripherals and

production print units contributed

along with the effect of M&As,

resulting in a year on year increase

in sales. The overall decrease in

operating income was due to the

effect of delays in cost reduction

planning for new products and

worsening market conditions in Europe.

bizhub PRESS C8000

Color B/W

*Base index: FY2010=100

FY2012FY2011FY2010

0

50

100

150

100

56

44

97

40

93

38

137 131

Production print sales (Units)

Ofce eld Production print eld

*Base index: FY2010=100

FY2012FY2011FY2010

0

50

100

150

100

17

83

20

84

25

87

104 112

Non-hardware sales

(excl. currency exchange rate effects)

Operating income marginNet sales Operating income

15

30

45

60

75

90

(Billions of yen)(Billions of yen)

0

150

300

450

600

750

900

0FY2012FY2011FY2010

6.9% 7. 2% 5.4%

539.6

37.4

547.5

39.4

581.6

31.6

Net sales, operating income, and

operating income margin

Review of Operations

•

In the production printing fi eld, we have been expanding our business domain from

light production to commercial printing with electrophotographic technology, an area

in which we have excelled.

• Color and monochrome equipment performs strongly

Nassenger PRO1000

High-end neckties printed

out on a Konica Minolta

textile printer

8