Konica Minolta 2013 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2013 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

38

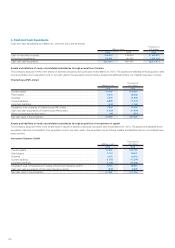

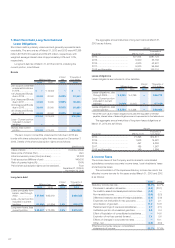

At March 31, 2013 and 2012, the signifi cant components of deferred

tax assets and liabilities in the consolidated fi nancial statements are as

follows:

Millions of yen

Thousands of

U.S. dollars

2013 2012 2013

Deferred tax assets:

Net operating tax loss

carried forward ................ ¥ 50,283 ¥ 49,046 $ 534,641

Accrued retirement benefi ts

... 22,099 22,348 234,971

Depreciation and

amortization .................... 4,323 3,928 45,965

Write-down of assets ......... 3,460 3,177 36,789

Accrued bonuses .............. 3,405 3,614 36,204

Elimination of unrealized

intercompany profi ts ......... 3,009 3,018 31,994

Tax effects related to

investments .................... 1,866 1,905 19,841

Accrued enterprise taxes .... 975 778 10,367

Allowance for doubtful

accounts ........................ 966 992 10,271

Other ............................... 10,687 8,483 113,631

Gross deferred tax assets ... 101,077 97,292 1,074,716

Valuation allowance ........... (37,682) (31,036) (400,659)

Total deferred tax assets..... ¥ 63,395 ¥ 66,255 $ 674,056

Deferred tax liabilities:

Retained earnings of

overseas subsidiaries ....... (3,226) (2,316) (34,301)

Intangible assets recognized

in business combinations

... (2,859) — (30,399)

Gains on securities

contributed to employees’

retirement benefi t trust ..... (2,083) (2,134) (22,148)

Unrealized gains on

securities ........................ (1,413) (381) (15,024)

Special tax-purpose

reserve for condensed

booking of fi xed assets ..... (15) (27) (159)

Other ............................... (3,948) (3,741) (41,978)

Total deferred tax liabilities .. ¥ (13,546) ¥ (8,601) $ (144,030)

Net deferred tax assets ...... ¥ 49,849 ¥ 57,654 $ 530,027

Deferred tax liabilities

related to revaluation:

Deferred tax liabilities on

land revaluation ............... ¥ (3,269) ¥ (3,269) $ (34,758)

Net deferred tax assets are included in the following items in the

consolidated balance sheets:

Millions of yen

Thousands of

U.S. dollars

2013 2012 2013

Current assets—deferred tax

assets .............................. ¥20,259 ¥20,100 $215,407

Fixed assets—deferred tax

assets .............................. 33,000 38,281 350,877

Current liabilities—other

current liabilities ................ (711) (606) (7,560)

Long-term liabilities—other

long-term liabilities ............. (2,699) (120) (28,698)

Net deferred tax assets ........ ¥49,849 ¥57,654 $530,027

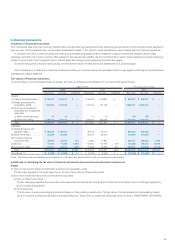

9. Acquisitions

Charterhouse PM Limited

In December 2012, the Companies acquired a 100% stake of

Charterhouse PM Limited (Charterhouse), a leading European marketing

services production company, through Konica Minolta Business

Solutions Europe GmbH, a wholly owned subsidiary of the Company.

The acquisition provides the Companies with know-how in marketing

and consulting for document management, as well as Charterhouse’s

European sales network. The Companies aim to strengthen their

marketing capabilities to offer practical solutions to customers’

challenges and expand new services. The Companies have recognized

the acquisition cost of ¥3,959 million ($42,095 thousand). The results of

Charterhouse for the period from December 1, 2012 to March 31, 2013,

are recognized in the consolidated fi nancial statements.

The Companies have recognized goodwill of ¥4,878 million ($51,866

thousand), which is amortized on a straight-line basis over its estimated

useful life (14 years). The amounts recognized in the consolidated

fi nancial statements are provisional based on information currently

available to the Companies and certain assumptions that the

Companies consider to be reasonable, because the purchase price

allocation is incomplete.

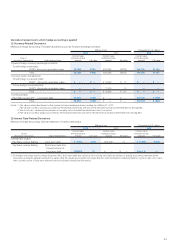

(1) Assets acquired and liabilities assumed at the date of business

combination

Millions of yen

Thousands of

U.S. dollars

2013 2013

Current assets ..................................... ¥ 3,635 $ 38,650

Long-term assets ................................. 3,013 32,036

Total assets ......................................... ¥ 6,649 $ 70,696

Current liabilities ................................... ¥(6,891) $(73,270)

Long-term liabilities............................... (676) (7,188)

Total liabilities....................................... ¥(7,567) $(80,457)

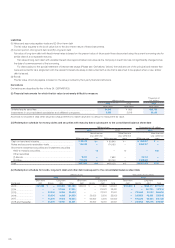

(2) Amounts and amortization period of major items allocated to

intangibles recognized separately from goodwill

Major items allocated to

intangibles recognized

separately from goodwill

Amounts Amortization

period

weighted

average

Millions of yen

Thousands of

U.S. dollars

2013 2013

Customer-related

assets ........................ ¥2,819 $29,973 11 years

Total intangible assets .... ¥2,819 $29,973 11 years

(3) Allocation of acquisition costs

Allocation of acquisition costs was not completed since the assessment

of identifi able assets and liabilities was not fi nished at the end of the

fi s c a l y e a r .

(4) Approximate effects on the consolidated statements of income

for the year ended March 31, 2013 assuming that the business

combination was completed on April 1, 2012.

Millions of yen

Thousands of

U.S. dollars

2013 2013

Net sales ............................................. ¥8,603 $91,473

Operating profi t .................................... (239) (2,541)

Net income for the year ......................... (444) (4,721)