Konica Minolta 2013 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2013 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

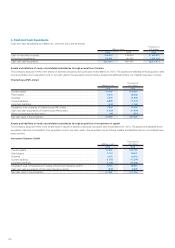

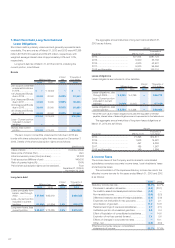

As Lessor

Operating Leases

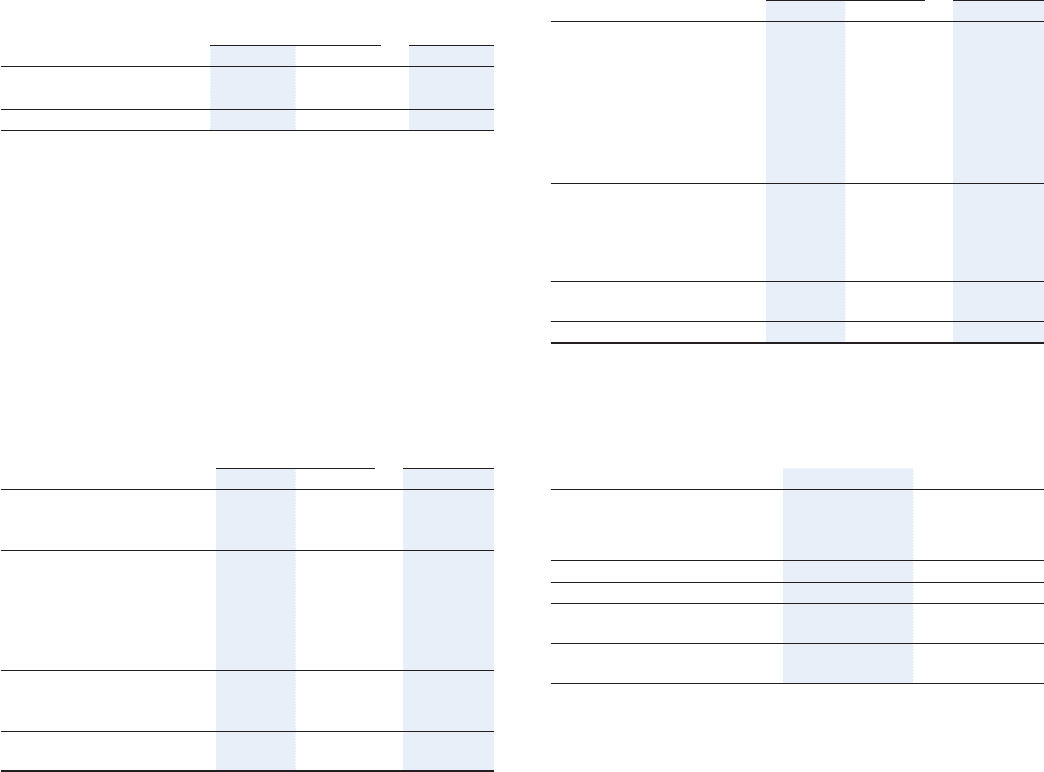

The scheduled maturities of future rental incomes of operating

noncancelable leases as of March 31, 2013 and 2012 are as follows:

Millions of yen

Thousands of

U.S. dollars

2013 2012 2013

Due within one year ............. ¥2,092 ¥1,616 $22,243

Due over one year ............... 2,832 2,322 30,112

Total .................................. ¥4,924 ¥3,938 $52,355

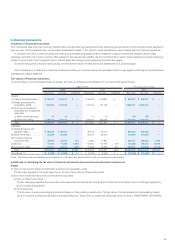

23. Retirement Benefi t Plans

The Companies have defi ned benefi t retirement plans that include

corporate defi ned benefi t pensions plans, tax-qualifi ed pension plans

and lump-sum payment plans. In addition, the Companies have defi ned

contributory pension plans. Certain overseas consolidated subsidiaries

have defi ned benefi t retirement plans and defi ned contribution

retirement plans. The Companies may pay additional retirement benefi ts

to employees at their discretion.

Additionally, the Company and certain domestic consolidated

subsidiaries contribute to retirement benefi t trusts.

The reserve for retirement benefi ts as of March 31, 2013 and 2012 is

calculated as follows:

Millions of yen

Thousands of

U.S. dollars

2013 2012 2013

a. Retirement benefi t

obligations ....................... ¥(168,817) ¥(151,396) $(1,794,971)

b. Plan assets ...................... 109,085 97,614 1,159,862

c. Unfunded retirement benefi t

obligations (a+b) ............... (59,731) (53,781) (635,098)

d. Unrecognized actuarial

differences....................... 18,214 12,681 193,663

e. Unrecognized prior service

costs ............................... (987) (2,203) (10,494)

f. Net amount on consolidated

balance sheets (c+d+e) ....... (42,504) (43,303) (451,930)

g. Prepaid pension costs ....... 1,249 1,242 13,280

h. Accrued retirement benefi ts

(f-g) ................................. ¥ (43,754) ¥ (44,545) $ (465,221)

Note: Certain subsidiaries use a simplifi ed method for the calculation of benefi t

obligation.

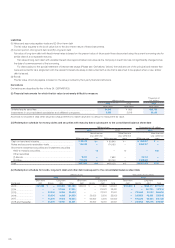

Net retirement benefi t costs for the years ended March 31, 2013 and

2012 are as follows:

Millions of yen

Thousands of

U.S. dollars

2013 2012 2013

a. Service costs ................... ¥ 4,597 ¥ 4,973 $ 48,878

b. Interest costs ................... 3,885 3,981 41,308

c. Expected return on plan

assets ............................. (2,196) (2,084) (23,349)

d. Amortization of actuarial

differences....................... 1,739 2,089 18,490

e. Amortization of prior service

costs ............................... (1,234) (1,222) (13,121)

f. Retirement benefi t costs

(a+b+c+d+e) ..................... 6,793 7,738 72,228

g. Gain/loss on changing to

the defi ned contribution

pension plan .................... 0 —0

h.

Contributions to defi ned

contribution pension plans

... 3,492 3,278 37,129

Total (f+g+h)......................... ¥10,285 ¥11,017 $109,357

Note: Retirement benefi t costs of consolidated subsidiaries using a simplifi ed

method are included in ‘a. Service costs.’

Assumptions used in the calculation of the above information for the

main schemes of the Company and its domestic consolidated

subsidiaries are as follows:

2013 2012

Method of attributing retirement

benefi ts to periods of service

Periodic allocation

method for

projected benefi t

obligations

Periodic allocation

method for

projected benefi t

obligations

Discount rate Mainly 1.7% Mainly 2.5%

Expected rate of return on plan assets

Mainly 1.25% Mainly 1.25%

Amortization of unrecognized

prior service costs Mainly 10 years Mainly 10 years

Amortization of unrecognized

actuarial differences Mainly 10 years Mainly 10 years