Konica Minolta 2013 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2013 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

43

24. Derivatives

The Companies utilize derivative instruments, including foreign currency exchange forward contracts, currency options, currency swaps, and interest

rate swaps, to hedge against the adverse effects of fl uctuations in foreign currency exchange rates and interest rates. Additionally, the Companies have

a policy of limiting the activity of such transactions to only hedge identifi ed exposures and not to hold transactions for speculative or trading purposes.

Risks associated with derivative transactions

Although the Companies are exposed to credit-related risks and risks associated with the changes in interest rates and foreign exchange rates, such

derivative instruments are limited to hedging purposes only and the risks associated with these transactions are limited. All derivative contracts entered

into by the Companies are with selected major fi nancial institutions based upon their credit ratings and other factors. Such credit-related risks are not

anticipated to have a signifi cant impact on the Companies’ results.

Risk control system for derivative transactions

In order to manage market and credit risks, the Finance Division of the Company is responsible for setting or managing the position limits and credit

limits under the Company’s internal policies for derivative instruments. Resources are assigned to each function, including transaction execution,

administration, and risk management, independently, in order to clarify the responsibility and the role of each function.

The principal policies on foreign currency exchange instruments and other derivative instruments of the Company and its major subsidiaries are

approved by the Management Committee of the Company. Additionally, a Committee that consists of management from the Company and its major

subsidiaries meets regularly to discuss the principal policies on foreign currency exchange instruments and to reaffi rm and reassess other derivative

instruments and market risks. All derivative instruments are reported monthly to the respective responsible offi cer. Market risks and credit risks for other

subsidiaries are controlled and assessed based on internal rules. Derivative instruments are approved by the respective president or equivalent of each

subsidiary.

Interest rate swap contracts and currency swap contracts are approved by the Finance Manager of the Company and the President or equivalent of

other subsidiaries, respectively.

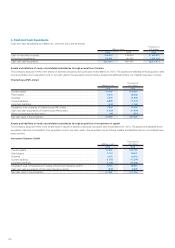

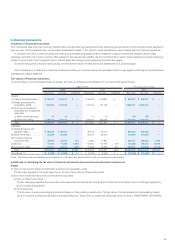

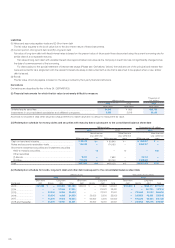

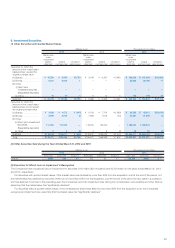

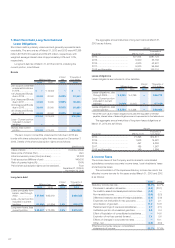

A summary of derivative instruments at March 31, 2013 and 2012 is as follows:

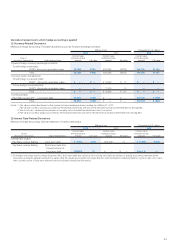

Derivative transactions to which hedge accounting is not applied

Currency-Related Derivatives

Millions of yen Thousands of U.S. dollars

2013 2012 2013

Contract value

(notional

principal

amount) Fair value

Unrealized gain

(loss)

Contract value

(notional

principal

amount) Fair value

Unrealized gain

(loss)

Contract value

(notional

principal

amount) Fair value

Unrealized gain

(loss)

Forward foreign currency

exchange contracts:

To sell foreign currencies:

US$....... ¥ 5,246 ¥ (65) ¥ (65) ¥ 7,817 ¥ (273) ¥ (273) ¥ 55,779 $ (691) $ (691)

EURO .... 14,369 (939) (939) 18,989 (1,247) (1,247) 152,780 (9,984) (9,984)

Other ..... 3,617 (85) (85) 3,310 (128) (128) 38,458 (904) (904)

To buy foreign currencies:

US$....... 109 (1) (1) —— — 1,159 (11) (11)

EURO .... 473 1 1 1,302 (26) (26) 5,029 11 11

Other ..... —— —707 11 11 —— —

Total .... ¥23,815 ¥(1,090) ¥(1,090) ¥32,127 ¥(1,664) ¥(1,664) $253,216 $(11,590) $(11,590)

Currency Swaps:

Pay JPY, receive US$ ........ ¥ 1,896 ¥ 14 ¥ 14 ¥ — ¥ — ¥ — $ 20,159 $ 149 $ 149

Total .... ¥ 1,896 ¥ 14 ¥ 14 ¥ — ¥ — ¥ — $ 20,159 $ 149 $ 149

Note: Fair value of foreign currency forward exchange contracts is calculated based on the foreign currency forward exchange rates prevailing as of March 31, 2013

and 2012, respectively.