Konica Minolta 2013 Annual Report Download - page 51

Download and view the complete annual report

Please find page 51 of the 2013 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

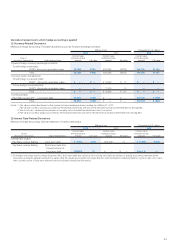

Information on Amortization of Goodwill and Balance of Goodwill by Reportable Segment

Information on amortization of goodwill and balance of goodwill for the years ended March 31, 2013 and 2012 is presented as follows:

Millions of yen

2013

Business

Technologies Industrial Healthcare Subtotal Other

Eliminations and

Corporate Total

Amortization of goodwill ........ ¥ 9,281 ¥ 582 ¥— ¥ 9,863 ¥— ¥— ¥ 9,863

Balance of goodwill .............. 59,863 9,601 — 69,465 — — 69,465

Note: ‘Other’ consists of business segments not included in reporting segments such as Sensing Business.

Millions of yen

2012

Business

Technologies Optics Healthcare Subtotal Other

Eliminations and

Corporate Total

Amortization of goodwill ......... ¥ 8,312 ¥ 347 ¥— ¥ 8,659 ¥ 145 ¥— ¥ 8,804

Balance of goodwill ............... 54,694 3,355 — 58,050 1,677 — 59,727

Note: ‘Other’ consists of business segments not included in reporting segments such as Sensing Business.

Thousands of U.S. dollars

2013

Business

Technologies Optics Healthcare Subtotal Other

Eliminations and

Corporate Total

Amortization of goodwill ........ $ 98,682 $ 6,188 $— $104,870 $— $— $104,870

Balance of goodwill .............. 636,502 102,084 — 738,596 — — 738,596

Information on Gain on Negative Goodwill by Reportable Segments

None.

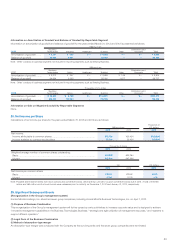

28. Net Income per Share

Calculations of net income per share for the years ended March 31, 2013 and 2012 are as follows:

Millions of yen

Thousands of

U.S. dollars

2013 2012 2013

Net income:

Income attributable to common shares ............................................................ ¥15,124 ¥20,424 $160,808

Income available to common stockholders ....................................................... 15,124 20,424 160,808

Thousands of shares

2013 2012

Weighted average number of common shares outstanding:

Basic .......................................................................................................... 530,292 530,254

Diluted ........................................................................................................ 542,904 547,896

Yen U.S. dollars

2013 2012 2013

Net income per common share:

Basic .......................................................................................................... ¥28.52 ¥38.52 $0.30

Diluted ........................................................................................................ 27.86 37.28 0.30

Note: Possible share dilution stems from stock options and convertible bonds, which are euro yen zero-coupon convertible bonds due in 2016. A total of ¥39,950

million and ¥50 million worth of such bonds were redeemed prior to maturity on December 7, 2012 and January 31, 2013, respectively.

29. Signifi cant Subsequent Events

(Reorganization in the Group’s management system)

Konica Minolta Holdings, Inc. absorbed seven group companies, including Konica Minolta Business Technologies, Inc. on April 1, 2013.

(1) Purpose of Business Combination

This reorganization of the Group’s management system will further speed up various initiatives to increase corporate value and is designed to achieve

“innovative management capabilities in the Business Technologies Business,” “strategic and agile utilization of management resources,” and “systems to

support effi cient operation.”

(2) Legal Form of the Business Combination

(i) Method of absorption-type merger

An absorption-type merger was conducted with the Company as the surviving entity and the seven group companies were terminated.