Konica Minolta 2013 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2013 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

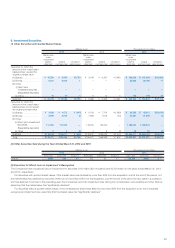

Approximate effects correspond to the acquired company’s net

sales and income/loss recorded on its consolidated statements of

income assuming that the business combination was completed April 1,

2012. The amortization cost was calculated based on the assumption

that the intangible assets, such as goodwill, had been recognized at the

beginning of the fi scal year ended March 31, 2013. These approximate

effects have not been audited.

Instrument Systems GmbH

In November 2012, the Companies acquired a 100% stake of

Instruments Systems Optische Messtechnik GmbH (Instrument

Systems GmbH, IS), a major German lighting measurement equipment

manufacturer, through Konica Minolta Optics, Inc. (KMOP), a wholly

owned subsidiary of the Company. The acquisition provides KMOP an

even broader product line up in the display measurement fi eld, where IS

has the top share, and further assists KMOP in maintaining its leading

position in comprehensive light source measurement including not only

the fast-growing LED light source but also in organic light emitting diode

(OLED) lighting with great future growth potential. In addition, the

Companies expect to create greater synergies between the light source

measurement business and the equipment and component business

for next-generation lighting, including OLED. The Companies have

recognized the acquisition cost of ¥8,120 million ($86,337 thousand)

including acquisition related cost of ¥178 million ($1,893 thousand) in

accordance with J-GAAP. The results of IS for the period from

December 1, 2012 to March 31, 2013 are recognized in the consolidated

fi nancial statements.

The Companies have recognized goodwill of ¥4,415 million ($46,943

thousand), which is amortized on a straight-line basis over its estimated

useful life (12 years).

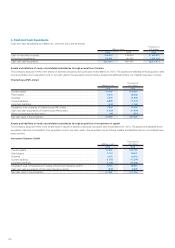

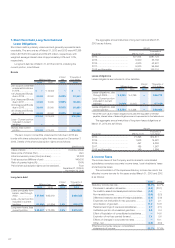

(1) Assets acquired and liabilities assumed at the date of business

combination

Millions of yen

Thousands of

U.S. dollars

2013 2013

Current assets ..................................... ¥ 2,329 $ 24,763

Long-term assets ................................. 3,710 39,447

Total assets ......................................... ¥ 6,040 $ 64,221

Current liabilities ................................... ¥(1,153) $(12,259)

Long-term liabilities............................... (1,182) (12,568)

Total liabilities....................................... ¥(2,335) $(24,827)

(2) Contents of the contingent consideration stipulated in the

business combination contract and its accounting treatment in

the fi scal year ended March 31, 2013 and thereafter

As stipulated in the business combination contract, an additional

payment shall be made if the performance of the merged company

meets the agreed target in the future. If this target is met, the acquisition

cost and goodwill and its amortization amount will be amended based

on the assumption that this additional payment had been made at the

business combination date.

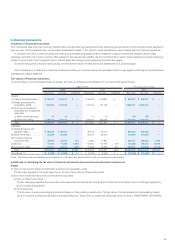

(3) Amounts and amortization period of major items allocated to

intangibles recognized separately from goodwill

Major items allocated to

intangibles recognized

separately from goodwill

Amounts Amortization

period

weighted

average

Millions of yen

Thousands of

U.S. dollars

2013 2013

Technology-based

assets ........................ ¥2,950 $31,366 7 years

Customer-based

assets ........................ 631 6,709 4 years

Total intangible assets .... ¥3,582 $38,086 6 years

(4) Approximate effects on the consolidated statements of income

for the year ended March 31, 2013 assuming that the business

combination was completed on April 1, 2012

Millions of yen

Thousands of

U.S. dollars

2013 2013

Net sales ............................................. ¥4,536 $48,230

Operating profi t .................................... 1,647 17,512

Net income for the year ......................... 1,024 10,888

Approximate effects correspond to the acquired company’s net sales

and income/loss recorded on its consolidated statements of income

assuming that the business combination was completed April 1, 2012.

The amortization cost was calculated based on the assumption that the

intangible assets, such as goodwill, had been recognized at the

beginning of the fi scal year ended March 31, 2012. These approximate

effects have not been audited.

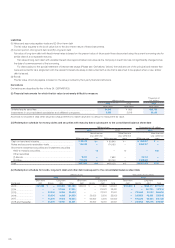

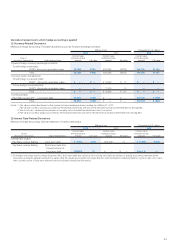

10. Net Assets

The Japanese Corporate Law became effective on May 1, 2006, replacing

the Commercial Code. Under Japanese laws and regulations, the entire

amount paid for new shares must be designated as common stock.

However, a company may, by a resolution of the Board of Directors,

designate an amount not exceeding one half of the price of the new

shares as additional paid-in capital, which is included in capital surplus.

The Japanese Corporate Law provides that an amount equal to

10% of distributions from retained earnings paid by the Company and

its Japanese subsidiaries be appropriated as additional paid-in capital

or legal earnings reserve. Legal earnings reserve is included in retained

earnings in the accompanying consolidated balance sheets. No further

appropriations are required when the total amount of the additional

paid-in capital and the legal earnings reserve equals 25% of their

respective stated capital. The Japanese Corporate Law also provides

that additional paid-in capital and legal earnings reserve are available for

appropriations by the resolution of the Board of Directors.

Cash dividends and appropriations to the additional paid-in capital

or the legal earnings reserve charged to retained earnings for the years

ended March 31, 2013 and 2012 represent dividends paid out during

those years and the related appropriations to the additional paid-in

capital or the legal earnings reserve.

Retained earnings at March 31, 2013 do not refl ect current year-end

dividends in the amount of ¥3,977 million ($42,286 thousand) approved

by the Board of Directors, which was already paid in May 2013.