Konica Minolta 2013 Annual Report Download - page 20

Download and view the complete annual report

Please find page 20 of the 2013 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

As a result, Industrial Business segment sales amounted to ¥146.7 billion, and

segment profi t stood at ¥23.6 billion. Sales volume increased for the segment’s main

products overall, with the exception of some products in fi elds such as the optical

products fi eld. Both segment sales and profi t increased.

Healthcare Business

In the Healthcare Business, the Company worked to expand sales of digital X-ray

diagnostic systems to medical facilities in Japan and overseas. The AeroDR, a

cassette-style digital X-ray system featuring a proprietary high-image quality scintillator

developed and manufactured by the Company is compact and the world’s lightest

system while delivering lower exposure and high image quality. Sales for applications

such as regular X-ray equipment and hospital rounds are expanding further, offsetting

the decline in sales of fi lm products chiefl y in developed countries.

As a result, Healthcare Business segment sales amounted to ¥72.7 billion, down

0.4% year on year, and segment profi t increased substantially from ¥90 million in the

previous fi scal year to ¥3.3 billion as a result of the increase in gross profi t associated

with rising sales of digital X-ray systems and initiatives to improve profi tability.

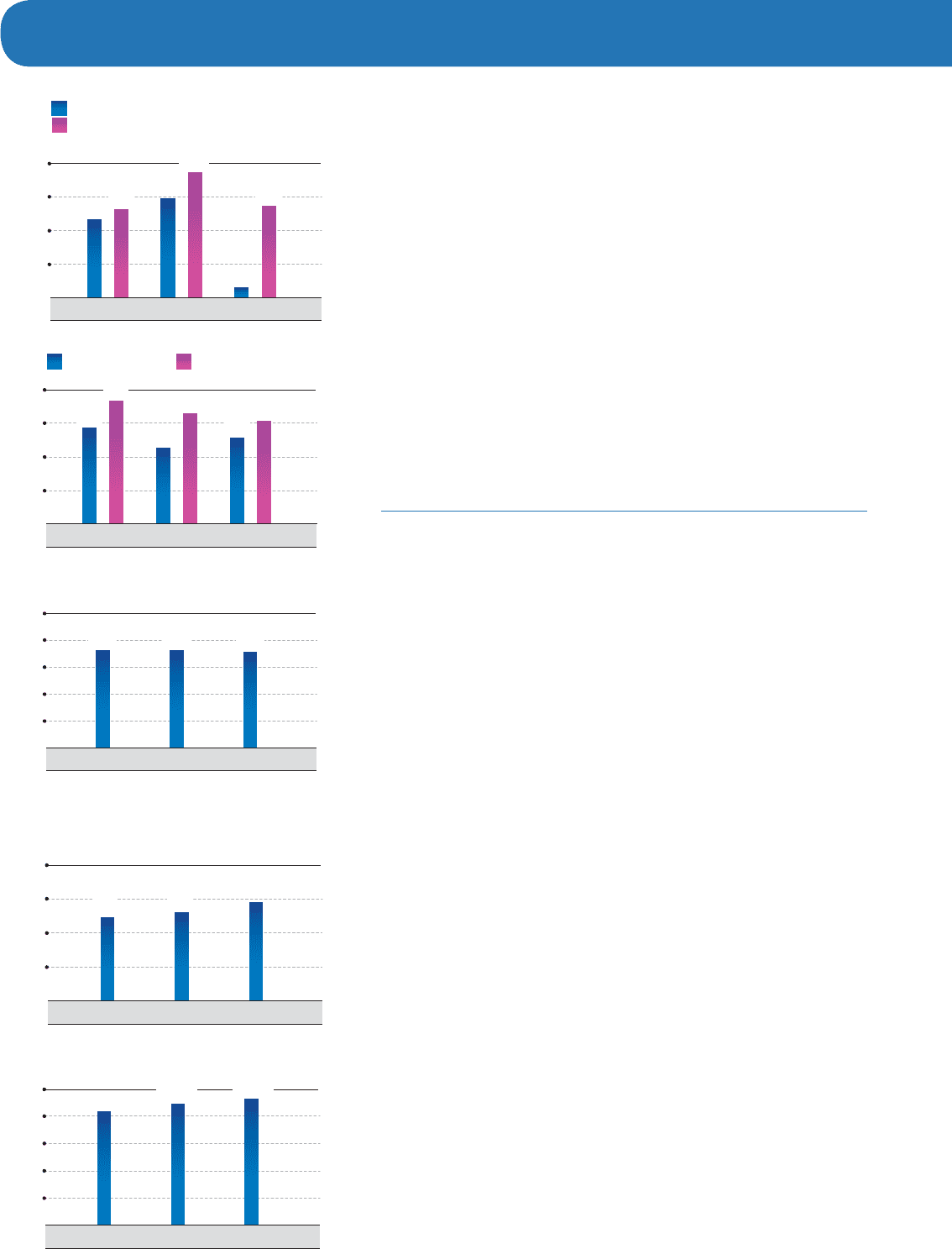

Cash Flows

Cash Flows from Operating Activities:

Net cash provided by operating activities was ¥66.4 billion, compared with ¥72.3

billion for the previous fi scal year. Income before income taxes and minority interests

provided cash of ¥33.8 billion. Depreciation and amortization totaled ¥45.9 billion, and

amortization of goodwill totaled ¥9.8 billion. Uses of cash included a decrease in

working capital of ¥11.1 billion and income taxes paid of ¥13.5 billion.

Cash Flows from Investing Activities:

Net cash used in investing activities was ¥63.4 billion, compared with ¥42.7 billion for

the previous fi scal year. Payment for acquisition of property, plant and equipment used

cash of ¥31 billion. Principal investments included molds for new products in the

Business Technologies Business and investment in new businesses and enhancing

production effi ciency in the Industrial Business. Other uses of cash included ¥23.1

billion for payment for acquisition of shares in subsidiaries and transfer of business

associated with acquisitions in Japan, Europe, the United States and Asia to

strengthen production print and IT service capabilities in the Business Technologies

Business and acquisition of equity in subsidiaries in the Industrial Business.

As a result, free cash fl ow, calculated as the sum of cash fl ows from operating

and investing activities, was ¥3.0 billion, compared with free cash fl ow of ¥29.6 billion

for the previous fi scal year.

Cash Flows from Financing Activities

Net cash used in fi nancing activities was ¥24.5 billion, compared with net cash

provided of ¥26.3 billion in the previous fi scal year. Uses of cash included payment of

¥40 billion for the redemption of corporate bonds and cash dividends paid of ¥7.9

billion while a net increase in short-term and long-term loans payable provided cash of

¥24.9 billion.

Capital Expenditure and Depreciation

Total capital expenditure for the year ended March 31, 2013 increased ¥4.4 billion, or

13.0%, year on year to ¥38.4 billion. By business segment, capital expenditure totaled

¥22.0 in the Business Technologies Business, ¥9.4 billion in the Industrial Business

and ¥1.5 billion in the Healthcare Business. Principal capital expenditure for the fi scal

year ended March 31, 2013 included investment in molds for new products in the

23.2

29.6

10

20

30

40

0

26.2

37.4

3.0

27.4

Free cash flow

CF from operating activities -

CF from investing activities

FY2011FY2010 FY2012

(Billions

of yen)

R&D expenses for common technology

platforms and leading-edge technologies

12.4 13.1

5

10

15

20

0

14.6

FY2011FY2010 FY2012

(Billions of yen)

42.9

34.0

0

55.1 49.2

38.4

45.9

CAPEX Depreciation

FY2011FY2010 FY2012

(Billions of yen)

15

30

45

60

Total assets

845.4 902.0

0

940.5

FY2011FY2010 FY2012

(Billions of yen)

1,000

200

400

600

800

R&D expenses

72.6 72.5

20

40

60

80

0

71.5

FY2011FY2010 FY2012

(Billions of yen)

100

19