Konica Minolta 2013 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2013 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

46

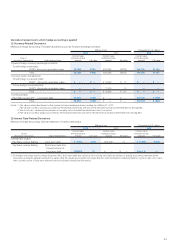

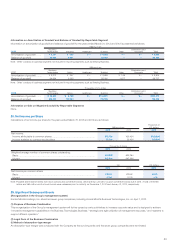

The following table summarizes the movement of outstanding stock

options for the years ended March 31, 2013 and 2012.

Number of Shares

Stock options outstanding at March 31, 2011 .... 746,500

Granted ....................................................... 239,500

Exercised ..................................................... 68,000

Forfeited ...................................................... 2,000

Stock options outstanding at March 31, 2012 .... 916,000

Granted ....................................................... 285,500

Exercised ..................................................... 47,500

Forfeited ...................................................... 6,000

Stock options outstanding at March 31, 2013 .... 1,148,000

The following table summarizes price information of stock options

exercised during the period and outstanding stock options as of March

31, 2013.

Per unit information Exercised

Outstanding at

March 31, 2013

Exercise price of stock options ............. ¥ 1 ¥ 1

Average market price of the stock at the

time of exercise ................................ 651 —

Fair value per unit (as of grant date) ....... 1,242 750

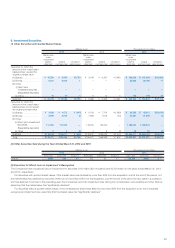

26. Investment and Rental Property

(1) Conditions and Fair Values of Investment and Rental Property

The Companies have offi ce buildings for rent and idle assets, etc., in

Japan and overseas.

The book value on the consolidated balance sheet, the changes

and the fair value as of March 31, 2013 and 2012 are as follows:

Millions of yen

Thousands of

U.S. dollars

2013 2012 2013

Book value

Balance at the beginning

..... ¥4,486 ¥3,560 $47,698

Increase (Decrease)–net .... (558) 926 (5,933)

Balance at the end ............ ¥3,928 ¥4,486 $41,765

Fair value at the end............. ¥4,457 ¥5,042 $47,390

Notes: 1. Book value is calculated by subtracting accumulated depreciation

and accumulated impairment losses from acquisition cost.

2. Fair value is recorded as follows:

(1) Fair value of major domestic properties has been calculated by

the Companies based on a method similar to the Real-estate

Appraisal Standards.

Latest appraisal reports are utilized, or in the case where there

are no signifi cant changes in the index refl ected fair value, prior

period reports may be used.

Fair value of other domestic properties has been calculated

based on certain appraisal or criteria, which appears to best

refl ect the fair value of the property.

(2) Fair value of overseas properties has been primarily calculated by

local real-estate appraisers.

(2) Income and Expenses on Investment and Rental Property

Millions of yen

Thousands of

U.S. dollars

2013 2012 2013

Income .............................. ¥161 ¥184 $1,712

Expenses ........................... 89 92 946

Difference .......................... 72 92 766

Other losses on sales, etc. .... (94) (164) (999)

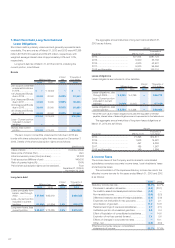

27. Segment Information

Information and Measurement of Segments

(1) Overview of reportable segments

The Company’s reportable segments are components of the Company

for which separate fi nancial information is available and evaluated

regularly by management in deciding how to allocate resources and

assess performance.

The Company has business companies for different products and

services within Japan. Each business company creates a

comprehensive domestic and overseas strategy for their products and

services, and conducts its business activities accordingly.

As such, the Company is comprised of three segments for different

products and services with a business company at the center of each.

The three reportable segments are: Business Technologies, Industrial

and Healthcare.

Business Technologies manufactures and sells MFPs, printers, and

equipment for production printing systems and graphic arts, and

provides related solution services. The Industrial Business

manufactures and sells electronic materials (TAC fi lms, etc.),

performance materials, optical products (pickup lenses, etc.), and

measuring instruments for industrial and healthcare applications. The

Healthcare Business manufactures and sells consumables and

equipment for healthcare systems.

Upon reorganization of the Group during the fi scal year ended

March 31, 2013, the reportable segments were changed from the

Business Technologies Business, Optics Business, and Healthcare

Business to the Business Technologies Business, Industrial Business

and Healthcare Business beginning from the fi rst quarter of the fi scal

year ended March 31, 2013. The Optics business included the

manufacturing and sale of optical products (pickup lenses, etc.) and

electronic materials (TAC fi lms, etc.) while the Industrial Business

includes the manufacturing and sale of electronic materials (TAC fi lms,

etc.), performance materials, optical products (pickup lenses, etc.) and

measuring instruments for industrial and healthcare applications.

Meanwhile the main products and types of services both in Business

Technologies Business and Healthcare Business were not changed.

Segment information for the previous fi scal year in accordance with the

revised reportable segments is not disclosed except for external sales,

amortization of goodwill and investments in equity method affi liates

because it is not practicable to accurately calculate cost of sales,

selling, general and administrative expenses, assets and liabilities

retroactively. Also, segment information for the fi scal year ended March

31, 2013 in accordance with the reportable segments used for the

previous fi scal year is not disclosed because it is not practicable to

obtain the necessary information and it is not reported to management

in consideration of the usefulness of the information. If we prepared

segment information for the previous year in accordance with the

revised reportable segments, external sales are ¥135,117 million in the

Industrial Business and ¥12,139 million in Other. Also, amortization of

goodwill is ¥492 million in the Industrial Business and ¥0 in Other, and

unamortized goodwill is ¥5,032 million in the Industrial Business and ¥0

in Other. In addition, investments in equity method affi liates is ¥0 in the

Industrial Business.