Konica Minolta 2013 Annual Report Download - page 11

Download and view the complete annual report

Please find page 11 of the 2013 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Sales of main products increase, driving up income and revenue

•

TAC and VA-TAC perform well

Competitive advantage of thin fi lm products strength-

ened; increased presence in the mobile market

Display Materials Field

Our mainstay 40m TAC fi lm for LCD polarizers, VA-TAC fi lm for increasing

theviewing angle of large TVs, 60m TAC fi lm, and other thin-fi lm products

performed well, with a sales volume exceeding that of the previous fi scal year.

Theunprecedented 25m ultra-thin TAC fi lm for the mobile market went into

massproduction from November 2012, further boosting our competitive strength

inthin-fi lm products.

•

Substantial growth in replacement lenses for digital

single lens refl ex cameras and other growth domains

Optics Field

Although under the infl uence of worsening market conditions sales were slow for

glass substrates for HDDs and pickup lenses for optical disks, the adoption of our

products grew in growth domains such as projector lenses for digital cinemas and

replacement lenses for digital single lens refl ex cameras. Shipments of lens units for

smartphones commenced from the beginning of 2012 and the sales volume of all

products exceeded the previous fi scal year.

•

Expansion of sales through the acquisition of major

accounts

Progress in efforts to strengthen the revenue structure

Measurement Instrument Field

Sales volumes exceeded the previous fi scal year, having acquired large orders for

light-source color measurement equipment such as the CL-200A Chroma Meter and

the CA-310 Color Analyzer used in quality management of the manufacturing

process for smartphone displays and LED lighting.

To enhance our competitive strengths in the light-source color measurement

domain, in November 2012 we acquired Instrument Systems GmbH (HO: Germany),

which possesses a large share in the high-end segment of such products

inparticular. The company is a leader in the LED and lighting industry and has strong

technical and sales capabilities in the fi eld. This acquisition will expand our product

line-up in the display measurement fi eld, in which we already possess the top share.

It will also help to maintain the Group’s fi rm leading position in comprehensive

light-source color measurement, including the rapidly expanding LED lighting and

OLED fi elds, in which strong growth isexpected in the future. In addition, synergy

between the next-generation lighting and materials business including OLED and

this light-source measurement business is expected.

Review of Operations

Summary of Industrial Business

Based on these results, sales for the Industrial Business were ¥146.7 billion (YoY

+8.6%) and operating income was ¥23.6 billion (YoY +55.7%). Income and revenue

increased year on year through the expansion of sales volumes of all main products,

with the exception of some in the optics and other fi elds.

In this business, we will move away from a business model with an unbalanced

emphasis on supplying parts for products such as digital consumer electronics, and

shift to a business that maintains stable and high profi tability in domains where

future growth can be expected.

Our acquisitions in the measurement instrument fi eld are also part of this

strategy and made a solid contribution to business performance this fi scal year.

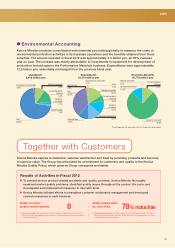

*Base index: FY2010=100

FY2012FY2011FY2010

0

50

100

150

100

121

149

Sales of TAC film (Units)

*Base index: FY2010=100

FY2012FY2011FY2010

0

50

100

150

200

250

100

173

246

Sales of interchangeable lenses for

digital single-lens reflex camera (Units)

*Base index: FY2010=100

FY2012FY2011FY2010

0

50

100

150

200

250

300

100

195

251

Sales of light source color

measurement (Units)

Lens unit Camera module

*Base index: FY2010=100

FY2012FY2011FY2010

0

50

100

150

200

250

100

32

68 44

63

65

137

107

201

Sales of optical units for mobile phones

with cameras (Units)

Operating income marginNet sales Operating income

FY2012FY2011FY2010

0

50

10

15

20

25

30

35

40

0

25

50

75

100

125

150

175

200

(Billions of yen)(Billions of yen)

9.8% 11. 2%

16.1%

129.8

12.8

124.3

14.0

146.7

23.6

Net sales, operating income, and

operating income margin

10