Konica Minolta 2013 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2013 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

19. Group Restructuring Expenses

Group restructuring expenses refer to expenses associated with the

reorganization of the Group’s management system conducted on

April1, 2013.

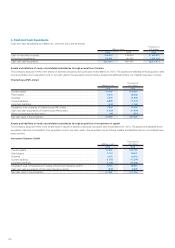

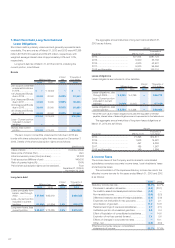

20. Other Comprehensive Income

Recycling and Tax Effect Relating to Other Comprehensive Income

Millions of yen

Thousands of

U.S. dollars

2013 2012 2013

Unrealized gains (losses) on

securities

Increase (decrease) during

the year .......................... ¥ 3,241 ¥ (247) $ 34,460

Reclassifi cation

adjustments .................... (53) 1,104 (564)

Sub-total, before tax .......... 3,188 856 33,897

Tax (expense) or benefi t ...... (1,031) (140) (10,962)

Sub-total, net of tax ........... 2,156 716 22,924

Unrealized losses on

hedging derivatives

Increase (decrease) during

the year .......................... (1,297) 161 (13,791)

Reclassifi cation

adjustments .................... 1,683 (369) 17,895

Sub-total, before tax .......... 385 (207) 4,094

Tax (expense) or benefi t ...... (155) 74 (1,648)

Sub-total, net of tax ........... 230 (133) 2,446

Foreign currency translation

adjustments

Increase (decrease) during

the year .......................... 21,939 (2,381) 233,270

Reclassifi cation

adjustments .................... —(3,730) —

Sub-total .......................... 21,939 (6,112) 233,270

Share of other

comprehensive income of

associates accounted for

using the equity method

Increase (decrease) during

the year ............................ 13 (12) 138

Total other comprehensive

income............................. ¥24,340 ¥(5,541) $258,799

21. Pension Liabilities Adjustment of Overseas

Subsidiaries

The pension liabilities adjustment of overseas subsidiaries results from

the accounting treatment of retirement benefi ts that affect a certain

consolidated subsidiary in the United States.

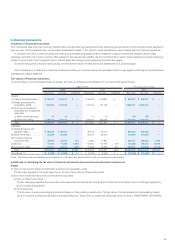

22. Lease Transactions

Proforma information on the Company and its domestic consolidated

subsidiaries’ fi nance lease transactions (except for those which are

deemed to transfer ownership of the leased assets to the lessee) and

operating lease transactions is as follows:

As Lessee

(1) Finance Leases (not involving transfer of ownership commencing on

or before March 31, 2008)

Millions of yen

Thousands of

U.S. dollars

2013 2012 2013

Purchase cost:

Buildings and structures ..... ¥ 5,690 ¥ 6,485 $ 60,500

Machinery and equipment .. 24 112 255

Tools and furniture ............. 236 560 2,509

5,951 7,157 63,275

Less: Accumulated

depreciation .................... (5,341) (6,304) (56,789)

Loss on impairment of

leased assets .................. (0) (0) (0)

Net book value .................... ¥ 609 ¥ 852 $ 6,475

The scheduled maturities of future lease rental payments on such

lease contracts at March 31, 2013 and 2012 are as follows:

Millions of yen

Thousands of

U.S. dollars

2013 2012 2013

Due within one year ............. ¥166 ¥243 $1,765

Due over one year ............... 443 610 4,710

Total .................................. ¥610 ¥853 $6,486

Lease rental expenses and depreciation equivalents under the

fi nance leases that are accounted for in the same manner as operating

leases for the years ended March 31, 2013 and 2012 are as follows:

Millions of yen

Thousands of

U.S. dollars

2013 2012 2013

Lease rental expenses for the period

.. ¥238 ¥438 $2,531

Depreciation equivalents ...... 238 438 2,531

Depreciation equivalents are calculated based on the straight-line

method over the lease terms of the leased assets.

Accumulated loss on impairment of leased assets as of March 31,

2013 and 2012 is as follows:

Millions of yen

Thousands of

U.S. dollars

2013 2012 2013

Reserve for loss .................. ¥0 ¥0 $0

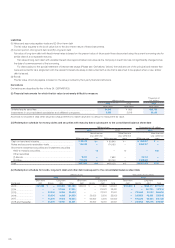

2) Operating Leases

The scheduled maturities of future rental payments of operating

noncancelable leases as of March 31, 2013 and 2012 are as follows:

Millions of yen

Thousands of

U.S. dollars

2013 2012 2013

Due within one year ............. ¥ 6,051 ¥ 4,439 $ 64,338

Due over one year ............... 15,545 11,314 165,284

Total .................................. ¥21,597 ¥15,753 $229,633