Konica Minolta 2013 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2013 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

30

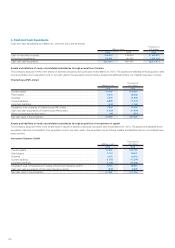

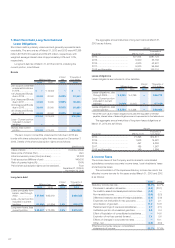

Millions of yen

Thousands of

U.S. dollars

(Note 3)

2013 2012 2013

Cash Flows from Operating Activities:

Income before income taxes and minority interests ......................................................... ¥ 33,836 ¥ 32,815 $ 359,766

Depreciation and amortization ...................................................................................... 45,999 49,239 489,091

Loss on impairment of fi xed assets ............................................................................... 2,902 893 30,856

Amortization of goodwill ............................................................................................... 9,863 8,804 104,870

Interest and dividend income ........................................................................................ (1,476) (1,563) (15,694)

Interest expense ......................................................................................................... 2,499 2,519 26,571

Loss on sales and disposals of property, plant and equipment ......................................... 1,661 1,693 17,661

Loss (Gain) on sales and valuation of investment securities .............................................. (53) 2,698 (564)

Gain on sales of investments in capital ........................................................................... — (604) —

Gain on reversal of foreign currency translation adjustment .............................................. — (3,730) —

Decrease in provision for bonuses ................................................................................ (178) (85) (1,893)

Increase (Decrease) in accrued retirement benefi ts.......................................................... (1,789) 359 (19,022)

Decrease in reserve for discontinued operations ............................................................. — (26) —

Decrease (Increase) in notes and accounts receivable–trade ............................................ 4,958 (13,442) 52,717

Decrease (Increase) in inventories ................................................................................. 4,963 (6,268) 52,770

Increase (Decrease) in notes and accounts payable–trade ............................................... (21,095) 14,715 (224,296)

Transfer of rental business-use assets ........................................................................... (6,169) (4,700) (65,593)

Decrease (Increase) in accounts receivable–other ........................................................... 1,749 (4,449) 18,596

Increase in accounts payable–other and accrued expenses ............................................. 855 866 9,091

Decrease/increase in consumption taxes receivable/payable ........................................... (473) 1,249 (5,029)

Other ......................................................................................................................... 2,986 (1,543) 31,749

Subtotal ................................................................................................................... 81,040 79,439 861,669

Interest and dividend income received ........................................................................... 1,530 1,534 16,268

Interest paid ............................................................................................................... (2,597) (2,414) (27,613)

Income taxes paid ....................................................................................................... (13,506) (6,192) (143,604)

Net cash provided by operating activities ....................................................................... 66,467 72,367 706,720

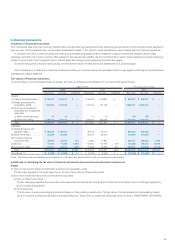

Cash Flows from Investing Activities:

Payment for acquisition of property, plant and equipment ................................................ (31,015) (29,104) (329,771)

Proceeds from sales of property, plant and equipment .................................................... 987 504 10,494

Payment for acquisition of intangible fi xed assets ............................................................ (8,092) (5,862) (86,039)

Payment for transfer of business ................................................................................... (2,199) (2,393) (23,381)

Purchase of investments in subsidiaries resulting in change of scope of consolidation (Note 4)

... (9,974) (5,506) (106,050)

Purchase of investments in capital of subsidiaries resulting in change of scope of consolidation (Note 4)

... (10,336) — (109,899)

Payment for loans receivable ........................................................................................ (301) (248) (3,200)

Proceeds from collection of loans receivable .................................................................. 96 138 1,021

Payment for acquisition of investment securities ............................................................. (744) (6) (7,911)

Proceeds from sales of investment securities ................................................................. 298 2 3,169

Proceeds from sales of investments in capital ................................................................. 0 1,315 0

Purchase of investments in subsidiaries ......................................................................... (607) — (6,454)

Payment for acquisition of other investments .................................................................. (2,347) (1,773) (24,955)

Other ......................................................................................................................... 795 177 8,453

Net cash used in investing activities ............................................................................. (63,442) (42,757) (674,556)

Cash Flows from Financing Activities:

Increase (Decrease) in short-term loans payable ............................................................. 22,701 (16,439) 241,372

Proceeds from long-term loans payable ......................................................................... 14,504 38,304 154,216

Repayment of long-term loans payable .......................................................................... (12,174) (25,805) (129,442)

Proceeds from issuance of bonds ................................................................................. — 40,000 —

Payment for redemption of bonds ................................................................................. (40,000) (425,306)

Repayments of lease obligations ................................................................................... (1,661) (1,715) (17,661)

Proceeds from disposal of treasury stock ...................................................................... 1 3 11

Payment for purchase of treasury stock ......................................................................... (9) (11) (96)

Dividend payments ..................................................................................................... (7,957) (7,945) (84,604)

Net cash provided by (used in) fi nancing activities ......................................................... (24,596) 26,390 (261,520)

Effect of Exchange Rate Changes on Cash and Cash Equivalents ................................... 3,552 785 37,767

Increase (Decrease) in Cash and Cash Equivalents ......................................................... (18,018) 56,785 (191,579)

Cash and Cash Equivalents at the Beginning of the Year (Note 4) ..................................... 231,933 175,148 2,466,061

Cash and Cash Equivalents at the End of the Year (Note 4) .............................................. ¥213,914 ¥231,933 $2,274,471

The accompanying Notes to the Consolidated Financial Statements are an integral part of these fi nancial statements.

CONSOLIDATED STATEMENTS OF CASH FLOWS

Konica Minolta, Inc. and Consolidated Subsidiaries

For the scal years ended March 31, 2013 and 2012