Konica Minolta 2013 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2013 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

5. Financial Instruments

Conditions of Financial Instruments

The Companies raise short-term working capital mainly through bank borrowings and invest temporary surplus funds in fi nancial instruments deemed to

have low risk. The Companies enter into derivative transactions based on the need for these transactions in accordance with their internal regulations.

In principle, the risk of currency fl uctuations relating to receivables and payables denominated in foreign currencies are hedged using forward

exchange contracts and currency options. With respect to the interest rate volatility risk and cost fl uctuation risk for future capital procurement arising on

certain long-term debt, the Companies lock in interest expenses using currency swaps and interest-rate swaps.

Investment securities comprise mainly stocks, and the market values of listed stocks are determined on a quarterly basis.

The Companies try to reduce the credit risk of customers arising on notes and accounts receivable–trade through regular monitoring and comprehensive

management of aging balances.

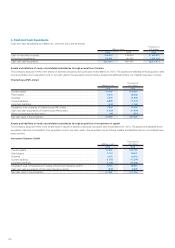

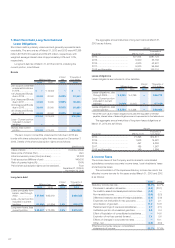

Fair Values of Financial Instruments

The book value on the consolidated balance sheets, fair value, and difference as of March 31, 2013 and 2012 are as follows:

Millions of yen Thousands of U.S. dollars

2013 2012 2013

Book value Fair value Difference Book value Fair value Difference Book value Fair value Difference

Assets

(1)

Cash on hand and in banks

... ¥ 93,413 ¥ 93,413 ¥ —¥ 90,640 ¥ 90,640 ¥ — $ 993,227 $ 993,227 $ —

(2) Notes and accounts

receivable–trade ............ 194,038 194,038 — 174,193 174,193 — 2,063,137 2,063,137 —

(3) Short-term investment

securities and investment

securities

(i)

Held-to-maturity securities

... 10 10 — 10 10 — 106 106 —

(ii) Other securities .......... 139,411 139,411 — 156,977 156,977 — 1,482,307 1,482,307 —

Total ............................. ¥426,872 ¥426,872 ¥ —¥421,820 ¥421,820 ¥ — $4,538,777 $4,538,777 $ —

Liabilities

(1) Notes and accounts

payable–trade ................ ¥ 85,424 ¥ 85,424 — 88,129 88,129 — 908,283 908,283 —

(2) Short-term debt ............. 67,398 67,398 — 32,913 32,913 — 716,619 716,619 —

(3) Current portion of

long-term debt ............... 23,990 24,094 104 11,994 11,994 — 255,077 256,183 1,106

(4) Bonds .......................... 70,000 71,309 1,309 110,000 110,278 278 744,285 758,203 13,918

(5) Long-term debt .............. 63,507 63,346 (161) 73,025 73,366 341 675,247 673,535 (1,712)

Total ............................. ¥310,321 ¥311,573 ¥1,251 ¥316,062 ¥316,681 ¥619 $3,299,532 $3,312,844 $13,301

Derivatives (*) ..................... ¥ (1,058) ¥ (1,058) ¥ —¥ (2,032) ¥ (2,032) ¥ — $ (11,249) $ (11,249) $ —

Notes: Derivative assets and liabilities are presented on a net basis, and the net liability position is enclosed in parentheses.

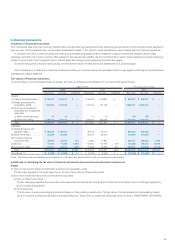

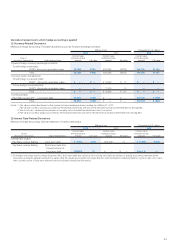

(i) Methods of calculating the fair value of fi nancial instruments and securities and derivative transactions

Assets

(1) Cash on hand and in banks and (2) Notes and accounts receivable–trade

The fair value equates to the book value due to the short-term nature of these instruments.

(3) Short-term investment securities and Investment securities

(i) Held-to-maturity securities

The fair value approximates the book value as the securities are entirely school bonds and credit risk of the issuers has not changed signifi cantly

since the date of acquisition.

(ii) Other securities

The fair value of equity securities is determined based on the prevailing market price. The fair value of bonds is based on the prevailing market

price or the price provided by third-party fi nancial institutions. These other securities are described further in Note 6. INVESTMENT SECURITIES.