Konica Minolta 2013 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2013 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

35

Liabilities

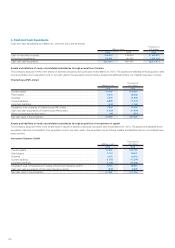

(1) Notes and accounts payable–trade and (2) Short-term debt

The fair value equates to the book value due to the short-term nature of these instruments.

(3) Current portion of long-term debt and (5) Long-term debt

Fair value of long-term debt with fi xed interest rates is based on the present value of future cash fl ows discounted using the current borrowing rate for

similar debt of a comparable maturity.

Fair value of long-term debt with variable interest rates approximates book value as the Company’s credit risk has not signifi cantly changed since

the date of commencement of the borrowing.

For debt subject to the special treatment of interest-rate swaps (Please see ‘Derivatives’ below), the total amount of the principal and interest that

were accounted for as a single item with the relevant interest-rate swap is discounted with a rate that is assumed to be applied when a new, similar

debt is issued.

(4) Bonds

The fair value of bonds payable is based on the value provided by third-party fi nancial institutions.

Derivatives

Derivatives are described further in Note 24. DERIVATIVES.

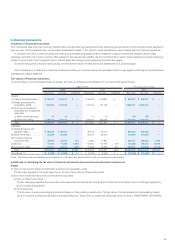

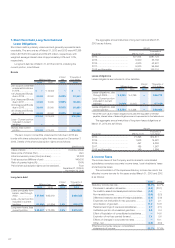

(ii) Financial instruments for which the fair value is extremely diffi cult to measure

Millions of yen

Thousands of

U.S. dollars

2013 2012 2013

Book value Book value Book value

Unlisted equity securities ................................................................................. ¥1,010 ¥ 560 $10,739

Investments in unconsolidated subsidiaries and affi liated companies ..................... 3,306 2,819 35,152

Above are not included in ‘(3)(ii) Other securities’ because there is no market value and it is diffi cult to measure the fair value.

(iii) Redemption schedule for money claims and securities with maturity dates subsequent to the consolidated balance sheet date

Millions of yen Thousands of U.S. dollars

2013 2012 2013

Within one year

More than one

year, within fi ve

years Within one year

More than one

year, within fi ve

years Within one year

More than one

year, within fi ve

years

Cash on hand and in banks .............................................. ¥ 93,413

¥— ¥ 90,640 ¥ — $ 993,227 $ —

Notes and accounts receivable–trade ................................ 194,038 — 174,193 — 2,063,137 —

Short-term investment securities and investment securities

Held-to-maturity securities ............................................. — 10 — 10 — 106

Other securities

(1) Bonds ..................................................................... 9,001 — 7,593 — 95,704 —

(2) Other ...................................................................... 111,500 — 133,700 — 1,185,540 —

Total .............................................................................. ¥407,952

¥10 ¥406,126 ¥10 $4,337,608 $106

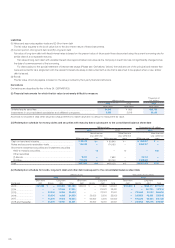

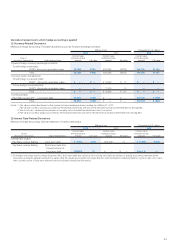

(iv) Redemption schedule for bonds, long-term debt and other debt subsequent to the consolidated balance sheet date

Millions of yen Thousands of U.S. dollars

2013 2012 2013

Fiscal year

Short-term

debt Bonds

Long-term

debt Total

Short-term

debt Bonds

Long-term

debt Total

Short-term

debt Bonds

Long-term

debt Total

2013 ....................... ¥67,398 ¥ — ¥23,990 ¥91,389 ¥32,913 ¥ — ¥11,994 ¥44,907 $716,619 $ — $255,077 $971,707

2014 ....................... — — 27,004 27,004 — — 23,021 23,021 — — 287,124 287,124

2015 ....................... — 20,000 5,000 25,000 — — 27,001 27,001 —212,653 53,163 265,816

2016 ....................... — 20,000 4,000 24,000 — 20,000 5,000 25,000 —212,653 42,531 255,183

2017 ....................... — 10,000 9,000 19,000 — 60,000 4,000 64,000 —106,326 95,694 202,020

2018 and thereafter .. — 20,000 18,501 38,501 — 30,000 14,001 44,001 — 212,653 196,715 409,367