Konica Minolta 2013 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2013 Konica Minolta annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

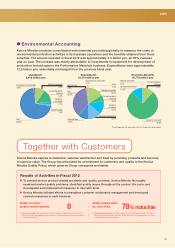

7% 7% 7%7% 7% 7%

KM A Company B Company C Company D Company E Company

32% 33% 30%

201220112010 201220112010

18% 19%19% 20%

20%

0

10

20

30

40

20%20% 19%

19% 20%20%

(%)

201220112010 201220112010

(Calendar years) (Calendar years) (Calendar years) (Calendar years)

New products helped increase the number of A3 color multifunctional peripherals (MFPs) sold year on year.

Although the market for A3 monochrome MFPs continues to mature and the number of units sold in major

markets such as Europe decreased, total sales of A3 MFPs surpassed that of the previous fi scal year. In OPS (a

service to provide an optimized print environment to the customer), which is a focus for growth in the fi eld,

structural preparations to strengthen our proposal and service provision capabilities for global projects were a

success, and sales increased 44% year on year to ¥29.3 billion. We also acquired 16 new GMAs including the

largest fi nancial group in Central and Eastern Europe, Erste Group Bank AG (HO: Austria) and a major European

energy company, resulting in total sales of ¥14.9 billion – a 35% increase year on year.

In order to strengthen the IT service and solution proposal capabilities that are

core to executing the business process improvement services we are

promoting along with OPS, we acquired the IT service provider Serians S.A.S.

(HO: France) in June 2012 and Raber+Märcker GmbH (HO: Germany) in

December the same year. This increased our capability to propose business

process improvements to small- to mid-sized companies. With a further fi ve

similar M&As in the United States, efforts to transform existing business

operations made major progress. Sales for IT services and solutions for the

fi scal year grew 78% year on year to ¥42.4 billion, partly as a result of these

M&As.

Konica Minolta share of A3 office color MFPs

Solid share of the A3 color MFP market in the U.S., Europe and China, where growth is expected

•

Successfully prepared structure for the implementation of OPS and

progressed smoothly with the development of GMAs

•

Strengthened the base for transforming business

operations with aggressive M&As and other

measures

U.S. Europe China Japan

Color B/W

*Base index: FY2010=100

FY2012FY2011FY2010

0

50

100

150

100

61

39

61

43

57

48

104 105

Sales of the A3 MFP for office (Units)

bizhub C554

Source: Konica Minolta calculations

6

Review of Operations