Kodak 2001 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

September 1997 for the purpose of developing and marketing new digital

color printing solutions for the graphic arts industry. In connection with

these arrangements, the Company serves as a supplier both to

Heidelberg and NexPress for consumables such as photoconductors and

raw materials for toner/developer manufacturing.

During 1999, the Company also completed additional acquisitions,

none of which are individually material to the Company’s financial

position, results of operations or cash flows, which had an aggregate

purchase price of approximately $3 million in cash.

Note 20: Sales of Assets and Divestitures

1999 In April 1999, the Company sold its digital printer, copier-

duplicator, and roller assembly operations primarily associated with its

Office Imaging operations, which included its operations in Rochester, NY,

Muehlhausen, Germany and Tijuana, Mexico to Heidelberg for

approximately $80 million. The transaction did not have a material effect

on the Company’s results of operations or financial position.

In November 1999, the Company sold The Image Bank, a wholly-

owned subsidiary which markets and licenses image reproduction

rights, to Getty Images, Inc. for $183 million in cash. As a result of

this transaction, the Company recorded a gain of $95 million in other

income (charges).

In November 1999, the Company sold its Motion Analysis Systems

Division, which manufactures digital cameras and digital video cameras

for the automotive and industrial markets, to Roper Industries, Inc.

for approximately $50 million in cash. As a result of this transaction,

the Company recorded a gain of $25 million in other income (charges).

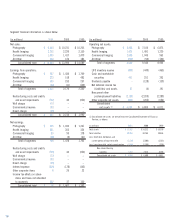

Note 21: Segment Information

Beginning in the fourth quarter of 2001, the Company changed its

operating structure, which was previously comprised of seven business

units, to be centered around strategic product groups. The strategic

product groups from existing businesses and geographies have been

integrated into segments that share common technology, manufacturing

and product platforms and customer sets. In accordance with the change

in the operating structure, certain of the Company’s product groups were

realigned to reflect how senior management now reviews the business,

makes investing and resource allocation decisions and assesses operating

performance. The realignment of certain of the Company’s strategic

product groups resulted in changes to the composition of the reportable

segments.

As a result of the change in composition of the reportable segments,

the accompanying 1999 and 2000 segment information has been

presented in accordance with the new structure and to conform to the

2001 presentation. The Company has three reportable segments:

Photography; Health Imaging; and Commercial Imaging.

The Photography segment derives revenues from consumer film

products, sales of origination and print film to the entertainment

industry, sales of professional film products, traditional and inkjet photo

paper, chemicals, traditional and digital cameras, photoprocessing

equipment and services, and digitization services, including online

services. The Health Imaging segment derives revenues from the sale of

digital products, including laser imagers, media, computed and direct

radiography equipment and picture archiving and communications

systems, as well as traditional medical products, including analog film,

equipment, chemistry, services and specialty products for the

mammography, oncology and dental fields. The Commercial Imaging

segment derives revenues from microfilm equipment and media, printers,

scanners, other business equipment, media sold to commercial and

government customers, and from graphics film products sold to the

Kodak Polychrome Graphics joint venture. The All Other group derives

revenues from the sale of organic light emitting diode (OLED) displays,

imaging sensor solutions and optical products to other manufacturers.

Transactions between segments, which are immaterial, are made on

a basis intended to reflect the market value of the products, recognizing

prevailing market prices and distributor discounts. Differences between

the reportable segments’ operating results and net assets, and the

Company’s consolidated financial statements relate primarily to items

held at the corporate level, and to other items excluded from segment

operating measurements.