Kodak 2001 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

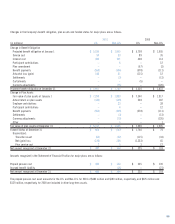

Further information relating to options is as follows:

Weighted

Shares Average

(Amounts in thousands, Under Range of Price Exercise Price

except per share amounts) Option Per Share Per Share

Outstanding on

December 31, 1998 34,331 $30.25–$92.31 $61.04

Granted 4,276 $60.13–$79.63 $65.17

Exercised 1,101 $30.25–$74.31 $39.73

Terminated, Canceled

or Surrendered 473 $31.45–$92.31 $63.80

Outstanding on

December 31, 1999 37,033 $30.25–$92.31 $62.12

Granted 12,533 $37.25–$69.53 $54.38

Exercised 1,326 $30.25–$58.63 $32.64

Terminated, Canceled

or Surrendered 3,394 $31.45–$90.50 $62.22

Outstanding on

December 31, 2000 44,846 $32.50–$92.31 $60.87

Granted 8,575 $26.90–$74.31 $36.49

Exercised 615 $32.50–$43.18 $35.91

Terminated, Canceled

or Surrendered 2,351 $32.50–$90.75 $50.33

Outstanding on

December 31, 2001 50,455 $25.92–$92.31 $57.53

Exercisable on

December 31, 1999 19,913 $30.25–$92.31 $57.08

Exercisable on

December 31, 2000 28,783 $32.50–$92.31 $62.13

Exercisable on

December 31, 2001 31,571 $26.90–$92.31 $63.54

The table above excludes approximately 68,000 options granted by the

Company at an exercise price of $.05–$21.91 as part of an acquisition.

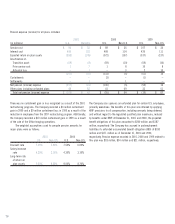

As allowed by SFAS No. 123, “Accounting for Stock-Based

Compensation,” the Company has elected to continue to follow APB

Opinion No. 25, “Accounting for Stock Issued to Employees,” in

accounting for its stock option plans. Under APB No. 25, the Company

does not recognize compensation expense upon the issuance of its stock

options because the option terms are fixed and the exercise price equals

the market price of the underlying stock on the grant date. The Company

has determined the pro forma information as if the Company had

accounted for stock options granted under the fair value method of SFAS

No. 123. The Black-Scholes option pricing model was used with the

following weighted-average assumptions for options issued in each year:

2001 2000 1999

Risk-free interest rates 4.2% 6.2% 5.1%

Expected option lives 6 years 7 years 7 years

Expected volatilities 34% 29% 28%

Expected dividend yields 4.43% 3.19% 2.76%

The weighted-average fair value of options granted was $8.37, $16.79

and $18.77 for 2001, 2000 and 1999, respectively.

For purposes of pro forma disclosures, the estimated fair value of

the options is amortized to expense over the options’ vesting period

(2–3 years). The Company’s pro forma information follows:

Year Ended December 31

(in millions,

except per share data) 2001 2000 1999

Net earnings

As reported $76 $1,407 $1,392

Pro forma (3) 1,346 1,263

Basic earnings per share

As reported $.26 $4.62 $ 4.38

Pro forma (.01) 4.41 3.97

Diluted earnings per share

As reported $.26 $4.59 $ 4.33

Pro forma (.01) 4.41 3.96