Kodak 2001 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

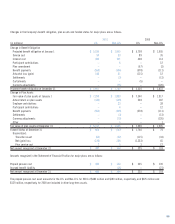

The following table summarizes information about stock options at December 31, 2001:

(Number of options in thousands) Options Outstanding Options Exercisable

Weighted-

Range of Exercise Prices Average Weighted- Weighted-

Remaining Average Average

At Less Contractual Exercise Exercise

Least Than Options Life Price Options Price

$25 – $40 6,175 7.98 $ 32.08 1,351 $ 33.81

$40 – $55 14,356 6.26 $ 47.87 4,999 $ 45.31

$55 – $70 20,060 6.55 $ 62.52 15,711 $ 63.44

$70 – $85 7,512 5.16 $ 73.42 7,158 $ 73.40

Over $85 2,352 5.17 $ 90.01 2,352 $ 90.01

50,455 31,571

Note 19: Acquisitions, Joint Ventures and

Business Ventures

2001 On December 4, 2001, the Company and SANYO Electric Co., Ltd.

announced the formation of a global business venture, the SK Display

Corporation, to manufacture organic light emitting diode (OLED) displays

for consumer devices such as cameras, personal data assistants (PDAs),

and portable entertainment machines. Kodak will hold a 34% stake in

the business venture and will contribute approximately $19 million in

cash and $100 million in loan guarantees during 2002 and 2003. SANYO

will hold a 66% stake in the business venture and will contribute

approximately $36 million in cash and $195 million in loan guarantees

during the same periods.

On June 4, 2001, the Company completed its acquisition of Ofoto,

Inc. The purchase price of this stock acquisition was approximately $58

million in cash. The acquisition was accounted for as a purchase with

$10 million allocated to tangible net assets, $37 million allocated to

goodwill and $11 million allocated to other intangible assets. The

acquisition of Ofoto will accelerate Kodak’s growth in the online

photography market and help drive more rapid adoption of digital and

online services. Ofoto offers digital processing of digital images and

traditional film, top-quality prints, private online image storage, sharing,

editing and creative tools, frames, cards and other merchandise.

On February 7, 2001, the Company completed its acquisition of

substantially all of the imaging services operations of Bell & Howell

Company. The purchase price of this stock and asset acquisition was

$141 million in cash. The acquisition was accounted for as a purchase

with $15 million allocated to tangible net assets, $70 million allocated to

goodwill, and $56 million allocated to other intangible assets, primarily

customer contracts. The acquired units provide customers worldwide with

maintenance for document imaging components, micrographic-related

equipment, supplies, parts and service.

During 2001, the Company also completed additional acquisitions,

none of which are individually material to the Company’s financial

position, results of operations or cash flows, which had an aggregate

purchase price of approximately $122 million in cash and stock.

2000 During the second quarter, the Company acquired the remaining

ownership interest in PictureVision, Inc. for cash and assumed liabilities

with a total transaction value of approximately $90 million. In relation to

this acquisition, the Company’s second quarter results included

$10 million in charges for acquired in-process R&D and approximately

$15 million for other acquisition-related charges. The Company used

independent professional appraisal consultants to assess and allocate

values to the in-process R&D.

During 2000, the Company also completed additional acquisitions,

none of which are individually material to the Company’s financial

position, results of operations or cash flows, which had an aggregate

purchase price of approximately $79 million in cash.

1999 In connection with the sale of the Company’s digital printer, copier-

duplicator, and roller assembly operations primarily associated with the

Office Imaging operations (See Note 20), the Company and Heidelberger

Druckmaschinen AG (Heidelberg) also announced an agreement to

expand their joint venture company, NexPress, to include the black-and-

white electrophotographic operations. The Company contributed R&D

resources to NexPress, as well as its toner and developer operations in

Rochester and Kirkby, England. This transaction did not have a material

effect on the Company’s results of operations or financial position in

1999. Kodak and Heidelberg established the NexPress joint venture in