Kodak 2001 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

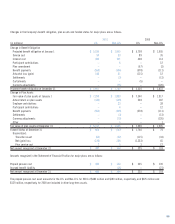

Note 17: Accumulated Other Comprehensive (Loss) Income

The components of accumulated other comprehensive (loss) income at

December 31, 2001, 2000 and 1999 were as follows:

(in millions) 2001 2000 1999

Accumulated unrealized

holding (losses) gains related

to available-for-sale securities $(6) $7 $113

Accumulated unrealized losses

related to hedging activity (5) (38) –

Accumulated translation

adjustments (524) (425) (231)

Accumulated minimum

pension liability adjustments (62) (26) (27)

Total $(597) $(482) $ (145)

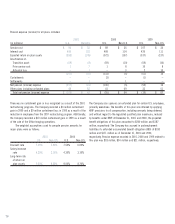

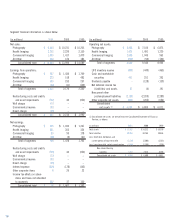

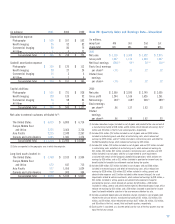

Note 18: Stock Option and Compensation Plans

The Company’s stock incentive plans consist of the 2000 Omnibus Long-

Term Compensation Plan (the 2000 Plan), the 1995 Omnibus Long-Term

Compensation Plan (the 1995 Plan), and the 1990 Omnibus Long-Term

Compensation Plan (the 1990 Plan). The Plans are administered by

the Executive Compensation and Development Committee of the

Board of Directors.

Under the 2000 Plan, 22 million shares of the Company’s common

stock may be granted to a variety of employees between January 1, 2000

and December 31, 2004. The 2000 Plan is substantially similar to, and is

intended to replace, the 1995 Plan, which expired on December 31, 1999.

Under the 1995 Plan, 22 million shares of the Company’s common

stock were eligible for grant to a variety of employees between February

1, 1995 and December 31, 1999. Option prices are not less than 100%

of the per share fair market value on the date of grant, and the options

generally expire ten years from the date of grant, but may expire sooner

if the optionee’s employment terminates. The 1995 Plan also provides for

Stock Appreciation Rights (SARs) to be granted, either in tandem with

options or freestanding. SARs allow optionees to receive payment equal

to the difference between the Company’s stock market price on grant

date and exercise date. At December 31, 2001, 226,515 freestanding

SARs were outstanding at option prices ranging from $56.31 to $71.81.

Under the 1990 Plan, 22 million shares of the Company’s common

stock were eligible for grant to key employees between February 1, 1990

and January 31, 1995. Option prices could not be less than 50% of the

per share fair market value on the date of grant; however, no options

below fair market value were granted. The options generally expire ten

years from the date of grant, but may expire sooner if the optionee’s

employment terminates. The 1990 Plan also provided that options with

dividend equivalents, tandem SARs and freestanding SARs could be

granted. At December 31, 2001, 98,046 freestanding SARs were

outstanding at option prices ranging from $32.50 to $44.50.

In January 2002, the Company’s shareholders voted in favor of a

proposed stock option exchange program for its employees. The voluntary

program offers employees a one-time opportunity to exchange stock

options they currently hold for new options. The new options are expected

to be granted on or about August 26, 2002. The new options will have

a grant price equal to the fair market value of Kodak common stock

on the new grant date. The number of new options employees will

ultimately receive has been determined, prior to the inception of the

exchange program, based on the fair value of the existing options, as

determined using the Black-Scholes option pricing model. In most cases,

employees will receive fewer options in exchange for their current options.

The exchange generally applies to all outstanding options held by

employees, including two all-employee grants made in 1998 and 2000.

The exchange program is not expected to result in the recording of any

compensation expense.