Kodak 2001 Annual Report Download - page 114

Download and view the complete annual report

Please find page 114 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Long-Term Incentives: Long-term compensation is delivered through stock options, the Performance Stock

Program and restricted stock.

The Company maintains a management stock option program. Stock options encourage the Company’s

executives to act as owners, which helps to further align their interests with the interests of the Company’s

shareholders. The Committee generally grants stock options once a year under this program. The options are

priced at 100% of the fair market value of the Company’s stock on the day of grant. The Company bases target

grant ranges on the median survey values of the companies it surveys. Grants to individual executives are then

adjusted based in large part on the executive’s performance potential.

To coordinate the timing of the management stock option grant with the annual management appraisal process,

awards will now be made in the fourth quarter, rather than the first quarter, of the year. As a result of this

change, two grants under the program were made in 2001; one in January 2001 and the other in November

2001. Assuming the Committee approves a grant for 2002, the awards will be made in the fourth quarter of

2002.

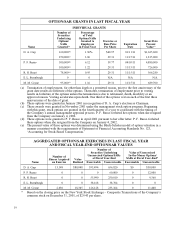

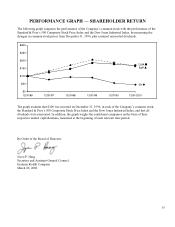

The Performance Stock Program places a portion of our top executives’ long-term compensation at risk. The

program measures performance over a three year period based on the Company’s total shareholder return

relative to those companies within the Standard & Poor’s 500 Composite Price Index. A description of the

program, as well as the threshold, target and maximum awards for the named executive officers appears on

page 20. Based on the Company’s performance over the three-year performance cycle ending in 2001, no

awards were paid for this cycle.

From time to time, the Company grants restricted stock awards to selected executives. These awards are

generally made to either (1) induce the recipients to remain with or to become employed by the Company; or

(2) recognize exceptional performance.

Share Ownership Program

The interests of the Company’s executives should be inseparable from those of its shareholders. The Company

aims to link these interests by encouraging stock ownership on the part of its executives.

One program designed to meet this objective is the Company’s share ownership program. Under this program,

each senior executive is required to own stock of the Company worth a multiple of his or her base salary. These

multiples range from one times base salary to four times base salary for the CEO.

To assist the program’s participants in meeting their ownership requirements, the Company permitted them to

receive their January 2001 stock option grant in the form of restricted units of the Company’s common stock.

For purposes of determining the number of units to be granted in place of the stock option award, the options

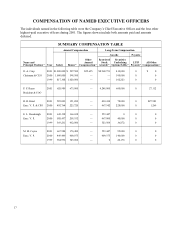

were valued at 90% of their then Black-Scholes value. As shown in the Summary Compensation Table on

page 17, all of the named executive officers elected to receive restricted stock units.

Today, the program applies to approximately 20 senior executives, all of whom have either satisfied or are on

track to satisfy the requirements.

Stock Option Exchange Program

Upon recommendation of the Committee, the Board of Directors approved the Stock Option Exchange

Program. The Company’s shareholders subsequently approved the plan amendments necessary to implement

this program at their Special Meeting on January 25, 2002. Under this program, all of the Company’s

27