Kodak 2001 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

of this slowdown. These actions include efforts to better manage

production and inventory levels and reduce capital spending, while at the

same time reducing discretionary spending to further hold down costs.

The Company will also complete the implementation of the restructuring

programs announced in 2001 to make its operations more cost

competitive and improve margins, particularly in its health imaging and

consumer digital camera businesses.

During 2000, the Company completed an ongoing program of real

estate divestitures and portfolio rationalization that contributed to other

income (charges) reaching an annual average of $100 million over the

past three years. Now that this program is largely complete, the other

income (charges) category is expected to run in the negative $50 million

to negative $100 million range annually.

The Company expects its effective tax rate to approximate 29% in

2002. The lower rate is attributable to favorable tax benefits from the

elimination of goodwill amortization and expected increased earnings

from operations in certain lower-taxed jurisdictions outside the U.S.

From a liquidity and capital resource perspective, the Company

expects to generate $6 billion in cash flow after dividends during the

next six years, with approximately $400 million of this being achieved in

2002. This will enable the Company to maintain its dividend, pay down

debt and make acquisitions that promote profitable growth. Cash flow is

defined as net cash flows (after dividends), excluding the impacts from

debt and transactions in the Company’s own equity, such as stock

repurchases and proceeds from the exercise of stock options.

The Euro

The Treaty on European Union provided that an economic and monetary

union (EMU) be established in Europe whereby a single European

currency, the Euro, replaces the currencies of participating member

states. The Euro was introduced on January 1, 1999, at which time the

value of participating member state currencies was irrevocably fixed

against the Euro and the European Currency Unit (ECU) was replaced at

the rate of one Euro to one ECU. For the three-year transitional period

ending December 31, 2001, the national currencies of member states

continued to circulate, but as sub-units of the Euro. New public debt was

issued in Euros and existing debt was redenominated into Euros. At the

end of the transitional period, Euro banknotes and coins were issued,

and the national currencies of the member states will cease to be legal

tender no later than June 30, 2002. The countries that adopted the Euro

on January 1, 1999 were Austria, Belgium, Finland, France, Germany,

Ireland, Italy, Luxembourg, The Netherlands, Portugal, and Spain. Greece

was part of the transition. The Company has operations in all of these

countries.

As a result of the Euro conversion, it is possible that selling prices

of the Company’s products and services will experience downward

pressure, as current price variations among countries are reduced due to

easy comparability of Euro prices across countries. Prices will tend to

harmonize, although value-added taxes and transportation costs will still

justify price differentials. Adoption of the Euro will probably accelerate

existing market and pricing trends including pan-European buying and

general price erosion.

On the other hand, currency exchange and hedging costs will be

reduced; lower prices and pan-European buying will benefit the Company

in its purchasing endeavors; the number of banks and suppliers needed

will be reduced; there will be less variation in payment terms; and it will

be easier for the Company to expand into new marketing channels such

as mail-order and Internet marketing.

The Company made changes in areas such as marketing and

pricing, purchasing, contracts, payroll, taxes, cash management and

treasury operations. Under the “no compulsion no prohibition” rules,

billing systems were modified so that the Company is able to show total

gross, value-added tax, and net in Euros on national currency invoices.

This enables customers to pay in the new Euro currency if they wish to

do so. Countries that have installed ERP/SAP software in connection with

the Company’s enterprise resource planning project are able to invoice

and receive payments in Euros as well as in other currencies. Systems for

pricing, payroll and expense reimbursements continued to use national

currencies until year-end 2001. The functional currencies in the affected

countries were the national currencies until May 2001 (except Germany

and Austria (October 2001)), when they changed to the Euro. Systems

changes for countries not on SAP (Finland and Greece) were implemented

in 2001.

Liquidity and Capital Resources

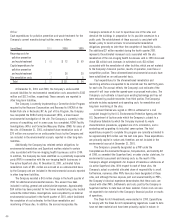

2001 Net cash provided by operating activities in 2001 was $2,065

million, as net earnings of $76 million, adjusted for depreciation and

amortization, and restructuring costs, asset impairments and other

charges provided $1,825 million of operating cash. Also contributing to

operating cash was a decrease in receivables of $252 million and a

decrease in inventories of $461 million. This was partially offset by

decreases in liabilities, excluding borrowings, of $529 million related

primarily to severance payments for restructuring programs and

reductions in accounts payable and accrued benefit costs. Net cash used

in investing activities of $1,047 million in 2001 was utilized primarily for

capital expenditures of $743 million and business acquisitions of $306

million. Net cash used in financing activities of $808 million in 2001

was primarily the result of stock repurchases and dividend payments as

discussed below.

The Company declared cash dividends per share of $.44 in each of

the first three quarters and $.89 in the fourth quarter of 2001. Total cash

dividends of $643 million were paid in 2001. In October 2001, the

Company’s Board of Directors approved a change in dividend policy

from quarterly dividend payments to semi-annual dividend payments.