Kodak 2001 Annual Report Download - page 61

Download and view the complete annual report

Please find page 61 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

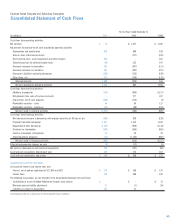

Note 2: Receivables, net

(in millions) 2001 2000

Trade receivables $1,966 $2,245

Miscellaneous receivables 371 408

Total (net of allowances of

$109 and $89) $2,337 $2,653

In the fourth quarter of 2001, the Company recorded a charge of $20

million to provide for the potential uncollectible amounts due from Kmart,

who filed a petition for reorganization under Chapter 11 of the United

States Bankruptcy Code in January 2002. The amount of $20 million is

included in selling, general and administrative expenses and in the total

allowance of $109 million at December 31, 2001.

Note 3: Inventories, net

(in millions) 2001 2000

At FIFO or average cost

(approximates current cost)

Finished goods $851 $1,155

Work in process 318 423

Raw materials and supplies 412 589

1,581 2,167

LIFO reserve (444) (449)

Total $1,137 $1,718

Inventories valued on the LIFO method are approximately 48% and 47%

of total inventories in 2001 and 2000, respectively. During 2001,

inventory usage resulted in liquidations of LIFO inventory quantities. In

the aggregate, these inventories were carried at the lower costs

prevailing in prior years as compared with the cost of current purchases.

The effect of these LIFO liquidations was to reduce cost of goods sold by

$14 million in 2001. No LIFO layer liquidations occurred in 2000 or 1999.

The Company provides for potentially excess, obsolete or slow-

moving inventory based on management’s analysis of inventory levels

and future sales forecasts. The Company also provides for inventories

whose cost is in excess of market. At December 31, 2001 and 2000,

aggregate excess, obsolete, slow-moving and lower of cost or market

reserves were $99 million and $96 million, respectively.

Note 4: Property, Plant and Equipment, net

(in millions) 2001 2000

Land $127 $141

Buildings and building improvements 2,602 2,285

Machinery and equipment 9,884 9,585

Construction in progress 369 952

12,982 12,963

Accumulated depreciation (7,323) (7,044)

Net properties $5,659 $5,919

Depreciation expense was $765 million, $738 million and $773 million

for the years 2001, 2000, and 1999, respectively.

Note 5: Goodwill, net

(in millions) 2001 2000

Goodwill $1,868 $1,724

Accumulated amortization 920 777

Goodwill, net $948 $947

During 2001, the Company purchased Ofoto, Inc. and substantially all

of the imaging service operations of the Bell & Howell Company. The

Company recorded goodwill in connection with these two acquisitions of

$37 million and $70 million, respectively. The additional net increase in

goodwill results from additional acquisitions, which are all individually

immaterial. See Note 19.

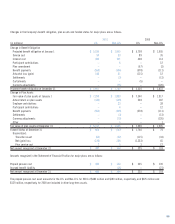

Note 6: Investments

At December 31, 2001, the Company’s significant equity method

investees and the Company’s approximate ownership interest in each

investee were as follows:

Kodak Polychrome Graphics (KPG) 50%

NexPress Solutions LLC 50%

Phogenix Imaging LLC 50%

Matsushita-Ultra Technologies

Battery Corporation 30%

Express Stop Financing (ESF) 50%

SK Display Corporation 34%

59