Kodak 2001 Annual Report Download - page 110

Download and view the complete annual report

Please find page 110 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

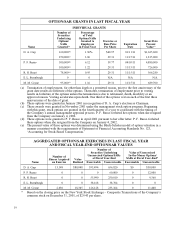

Retirement Plan

The Company funds a tax-qualified defined benefit pension plan for virtually all U.S. employees. Effective

January 1, 2000, the Company amended the plan to include a cash balance feature. All of the named executive

officers, with the exception of Mr. Brust and Ms. Russo, participate in the non-cash balance portion of the plan.

The cash balance feature covers all new employees hired after March 31, 1999, including Mr. Brust and Ms.

Russo. As a result of her resignation from the Company, Ms. Russo forfeited her benefits under the cash

balance portion of the plan.

Retirement income benefits are based upon an employee’s average participating compensation (APC). The

plan defines APC as one third of the sum of the employee’s participating compensation for the highest

consecutive 39 periods of earnings over the 10-year period ending immediately prior to retirement or

termination of employment. Participating compensation, in the case of the named executive officers in the

Summary Compensation Table, is base salary and Management Variable Compensation Plan awards, including

allowances in lieu of salary for authorized periods of absence, such as illness, vacation or holidays.

For an employee with up to 35 years of accrued service, the annual normal retirement income benefit is

calculated by multiplying the employee’s years of accrued service by the sum of (a) 1.3% of APC, plus

(b) 0.3% of APC in excess of the average Social Security wage base. For an employee with more than 35 years

of accrued service, the amount is increased by 1% for each year in excess of 35 years.

The retirement income benefit is not subject to any deductions for Social Security benefits or other offsets. The

normal form of benefit is an annuity, but a lump sum payment is available in limited situations.

PENSION PLAN TABLE – Annual Retirement Income Benefit

Straight Life Annuity Beginning at Age 65

Years of Service

Remuneration 3 20 25 30 35

$ 500,000 $24,000 $160,000 $200,000 $240,000 $ 280,000

750,000 36,000 240,000 300,000 360,000 420,000

1,000,000 48,000 320,000 400,000 480,000 560,000

1,250,000 60,000 400,000 500,000 600,000 700,000

1,500,000 72,000 480,000 600,000 720,000 840,000

1,750,000 84,000 560,000 700,000 840,000 980,000

2,000,000 96,000 640,000 800,000 960,000 1,120,000

NOTE: For purposes of this table, Remuneration means APC. To the extent that an employee’s annual

retirement income benefit exceeds the amount payable from the Company’s funded plan, it is paid from one or

more unfunded supplementary plans.

23