Kodak 2001 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

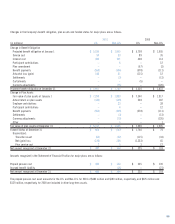

Note 13: Income Taxes

The components of earnings before income taxes and the related

provision for U.S. and other income taxes were as follows:

(in millions) 2001 2000 1999

Earnings (loss) before

income taxes

U.S. $(266) $1,294 $ 1,398

Outside the U.S. 374 838 711

Total $108 $2,132 $ 2,109

U.S. income taxes

Current (benefit) provision $(65) $145 $ 185

Deferred (benefit) provision (69) 225 215

Income taxes outside the U.S.

Current provision 177 268 225

Deferred (benefit) provision (5) 37 23

State and other income taxes

Current provision 335 60

Deferred (benefit) provision (9) 15 9

Total $32 $725 $ 717

The differences between the provision for income taxes and income taxes

computed using the U.S. federal income tax rate were as follows:

(in millions) 2001 2000 1999

Amount computed using

the statutory rate $38 $746 $ 738

Increase (reduction) in

taxes resulting from:

State and other income

taxes, net of federal (4) 33 45

Goodwill amortization 45 40 36

Export sales and

manufacturing credits (19) (48) (45)

Operations outside the U.S. (10) (70) (41)

Valuation allowance (18) (9) 5

Tax settlement (11) ––

Other, net 11 33 (21)

Provision for income taxes $32 $725 $ 717

During the third quarter of 2001, the Company reached a favorable tax

settlement, which resulted in a tax benefit of $11 million. In addition,

during the fourth quarter the Company recorded a $20 million tax benefit

due to a reduction in the estimated effective tax rate for the full year. The

reduction in the estimated effective tax rate was primarily attributable to a

shift in actual earnings versus estimates toward lower tax rate jurisdictions,

and an increase in creditable foreign tax credits as compared to estimates.

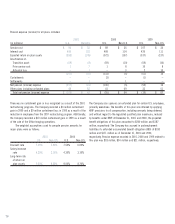

The significant components of deferred tax assets and liabilities

were as follows:

(in millions) 2001 2000

Deferred tax assets

Postemployment obligations $867 $916

Restructuring programs 122 –

Employee deferred compensation 120 116

Inventories 99 139

Tax loss carryforwards 56 103

Other 739 768

Total deferred tax assets 2,003 2,042

Deferred tax liabilities

Depreciation 612 555

Leasing 188 225

Other 535 591

Total deferred tax liabilities 1,335 1,371

Valuation allowance 56 103

Net deferred tax assets $612 $568

Deferred income tax assets (liabilities) are reported in the following

components within the Consolidated Statement of Financial Position:

(in millions) 2001 2000

Deferred income tax charges (current) $521 $575

Other long-term assets 201 88

Accrued income taxes (29) (34)

Other long-term liabilities (81) (61)

Net deferred income tax assets $612 $568

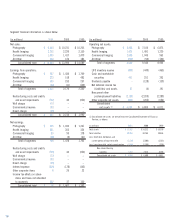

The valuation allowance is primarily attributable to certain net operating

loss carryforwards outside the U.S. The primary reason for the decline in

the valuation allowance from 2000 to 2001 was attributable to utilization

of tax loss carryforwards by certain units outside the U.S. A majority of

the net operating loss carryforwards are subject to a five-year expiration

period. Management believes that it is more likely than not that it will

generate taxable income in certain jurisdictions sufficient to realize the

remaining tax benefit associated with the future deductible temporary

differences identified above. This belief is based upon a review of all

available evidence, including historical operating results and projections

of future taxable income.

Retained earnings of subsidiary companies outside the U.S. were

approximately $1,491 million and $1,574 million at December 31, 2001

and 2000, respectively. Retained earnings at December 31, 2001 are

considered to be reinvested indefinitely. It is not practicable to determine

the deferred tax liability for temporary differences related to these

retained earnings if they were to be remitted.