Kodak 2001 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Components of Executive Compensation Program

The three components of the Company’s executive compensation program are:

• base salary,

• short-term variable pay, and

• long-term incentives.

Base Salary: Base salary is the only fixed portion of an executive’s compensation. Each executive’s base

salary is reviewed annually based on (1) a compensation range which corresponds to the executive’s job

responsibilities; and (2) the executive’s individual performance.

Individual performance is measured in large part through the Company’s management appraisal process. This

process evaluates performance against a combination of financial and non-financial goals. The management

appraisal process also measures an executive’s performance relative to the Company values.

Short-Term Variable Pay: Under the short-term variable pay plan, a target bonus is set annually for each

executive. The target, which is a percentage of base salary, varies depending on the executive’s duties and

responsibilities. For 2001, target awards ranged from 25% of base salary to 145% of base salary for the CEO.

Despite significant achievements during 2001, Kodak’s financial performance for the year was mixed. The

continuing weakness in the global economy along with the tragic events of September 11th and their

continuing aftermath posed challenges for Kodak and other global companies that were unparalleled in recent

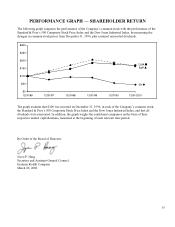

decades. The Performance Graph on page 30 shows the overall impact on both Kodak and others. These factors

significantly contributed to the Company’s inability to achieve the plan’s EVA-based 2001 performance goal

established by the Committee at the start of the year.

In contrast, the Company dramatically improved 2001 cash flow, prior to dividends and other financing

activities, over 2000 by more than $800 million to a total of approximately $1 billion. The Company reduced

inventories, net receivables and capital spending by $581, $316 and $202 million, respectively, as compared to

2000. The Company continues to be substantially on target with its restructuring commitments, including $450

million of annual cost savings and headcount reductions of approximately 7,200 employees. The Company

realigned its organizational structure along a new business model that matches the way its customers buy.

Looking at these achievements along with the extraordinary environment of 2001, the Committee adjusted the

plan’s performance goal through its discretion under the plan. As a result, the plan’s performance formula

created an award pool that funded payout at a 40% of target level.

The plan’s award pool for the year will be the smallest in any of the previous five years. When evaluating

Company 2001 performance against that achieved in each of these years, the Committee believes the payout is

in line with the plan’s awards for the prior years.

The Committee believes that senior management should be held more accountable for the Company’s

performance, whether that performance is above or below expectations, than other executives of the Company.

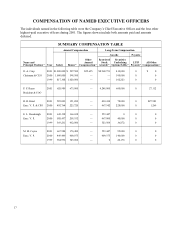

For this reason, the Committee awarded the named executive officers the awards listed in the Summary

Compensation Table which, with the exception of Ms. Russo’s award, are on average 35% of target. Ms.

Russo’s award of $675,000 was required under the terms of her agreement with the Company.

To ensure that all plan awards are fully deductible for U.S. federal income tax purposes, the plan states that any

discretion exercised by the Committee regarding the plan’s performance goal after the first 90 days of the year

cannot affect the payment of awards to the named executive officers. Given the unforeseen events and

conditions of this year, it was not possible for the Committee to act within this timeframe. To ameliorate this

result, the Committee chose to grant the named executive officers their awards as a discretionary bonus. To the

extent these bonuses are not deductible by the Company for U.S. federal income tax purposes, their payment

will be delayed until after termination of employment to preserve their deductibility.

26