Kodak 2001 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

60

At December 31, 2001 and 2000, the Company’s equity investment in

these unconsolidated affiliates was $360 million and $317 million,

respectively, and is reported within other long-term assets. The Company

records its equity in the income or losses of these investees and reports

such amounts in other income (charges). See Note 12. These investments

do not meet the Regulation S-X significance test requiring the inclusion

of separate investee financial statements.

The Company also has certain investments with less than a 20%

ownership interest in various private companies whereby the Company

does not have the ability to exercise significant influence. Such

investments are accounted for under the cost method. At December 31,

2001 and 2000, the carrying value of these investments aggregated

$51 million and $55 million, respectively, and is reported in other long-

term assets. During 2001, the Company recorded an asset impairment

charge of $15 million on certain strategic and non-strategic investments

which exhibited other-than-temporary declines in their fair value. See

Note 14.

Kodak sells certain of its long-term lease receivables relating to

the sale of photofinishing equipment to ESF without recourse to the

Company. Sales of long-term lease receivables to ESF were approximately

$83 million, $153 million and $397 million in 2001, 2000 and 1999,

respectively. See Note 10.

The Company sells graphics film and other products to its equity

affiliate, KPG. Sales to KPG for the years ended December 31, 2001, 2000

and 1999 amounted to $350 million, $419 million and $540 million,

respectively, and cost of goods sold on these sales amounted to $258

million, $290 million and $359 million for the years ended December 31,

2001, 2000 and 1999, respectively. These sales and cost of goods sold

amounts are reported in the Consolidated Statement of Earnings. The

Company eliminates profits on these sales, to the extent the inventory

has not been sold through to third parties on the basis of its 50%

interest. At December 31, 2001 and 2000, amounts due from KPG on

such sales were $40 million and $52 million, respectively, and are

reported in receivables, net. Additionally, the Company has guaranteed

certain debt obligations of KPG up to $175 million which is included in

the total guarantees amount of $277 million at December 31, 2001, as

discussed in Note 10.

The Company also sells toner products to its 50% owned equity

affiliate, NexPress. However, these sales transactions are not material to

the Company’s results of operations or financial position.

Kodak has no other material activities with its investees.

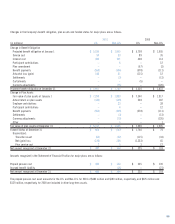

Note 7: Accounts Payable and Other Current Liabilities

(in millions) 2001 2000

Accounts payable, trade $674 $817

Accrued advertising and

promotional expenses 568 578

Accrued employment-related liabilities 749 780

Accrued restructuring liabilities 318 –

Dividends payable –128

Other 967 1,100

Total payables $3,276 $3,403

The Other component above consists of other miscellaneous current

liabilities which, individually, are less than 5% of the Total current

liabilities component within the Consolidated Statement of Financial

Position, and therefore, have been aggregated in accordance with

Regulation S-X.

Note 8: Short-Term Borrowings and Long-Term Debt

Short-Term Borrowings

The Company’s short-term borrowings at December 31, 2001 and 2000

were as follows:

(in millions) 2001 2000

Commercial paper $1,140 $1,809

Current portion of long-term debt 156 148

Short-term bank borrowings 238 249

Total short-term borrowings $1,534 $2,206

The weighted-average interest rates for commercial paper outstanding

during 2001 and 2000 were 3.6% and 6.6%, respectively. The weighted-

average interest rates for short-term borrowings outstanding during 2001

and 2000 were 6.2% and 5.4%, respectively.

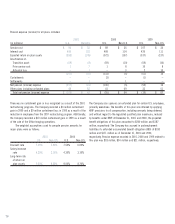

The Company has $2.45 billion in revolving credit facilities

established in 2001, which are available to support the Company’s

commercial paper program and for general corporate purposes. The credit

agreements are comprised of a 364-day commitment at $1.225 billion

expiring in July 2002 and a 5-year commitment at $1.225 billion expiring

in July 2006. If unused, they have a commitment fee of $3 million per

year, at the Company’s current credit rating. Interest on amounts

borrowed under these facilities is calculated at rates based on the

Company’s credit rating and spreads above certain reference rates. There

were no amounts outstanding under these arrangements or the prior year

arrangement at December 31, 2001 and 2000, respectively. The facility

includes a covenant which requires the Company to maintain a certain

EBITDA (earnings before interest, income taxes, depreciation and