Kodak 2001 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

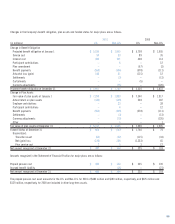

Pension expense (income) for all plans included:

2001 2000 1999

(in millions) U.S. Non-U.S. U.S. Non-U.S. U.S. Non-U.S.

Service cost $94 $ 33 $89 $36 $107 $ 34

Interest cost 406 101 408 114 426 111

Expected return on plan assets (599) (149) (572) (157) (537) (137)

Amortization of:

Transition asset (59) (9) (59) (10) (59) (10)

Prior service cost 1718108

Actuarial loss –1–3210

(157) (16) (133) (6) (51) 16

Curtailments ––(3) – (1) –

Settlements –1–1––

Net pension (income) expense (157) (15) (136) (5) (52) 16

Other plans including unfunded plans 48 82 41 69 33 51

Total net pension (income) expense $(109) $ 67 $(95) $ 64 $ (19) $ 67

There was no curtailment gain or loss recognized as a result of the 2001

restructuring programs. The Company recorded a $3 million curtailment

gain in 2000 and a $9 million curtailment loss in 1999 as a result of the

reduction in employees from the 1997 restructuring program. Additionally,

the Company recorded a $10 million curtailment gain in 1999 as a result

of the sale of the Office Imaging operations.

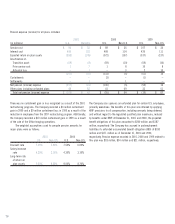

The weighted assumptions used to compute pension amounts for

major plans were as follows:

2001 2000

U.S. Non-U.S. U.S. Non-U.S.

Discount rate 7.25% 5.90% 7.50% 6.00%

Salary increase

rate 4.30% 3.10% 4.30% 3.10%

Long-term rate

of return on

plan assets 9.50% 8.50% 9.50% 8.70%

The Company also sponsors an unfunded plan for certain U.S. employees,

primarily executives. The benefits of this plan are obtained by applying

KRIP provisions to all compensation, including amounts being deferred,

and without regard to the legislated qualified plan maximums, reduced

by benefits under KRIP. At December 31, 2001 and 2000, the projected

benefit obligations of this plan amounted to $200 million and $187

million, respectively. The Company has accrued in postemployment

liabilities its unfunded accumulated benefit obligation (ABO) of $183

million and $171 million as of December 31, 2001 and 2000,

respectively. Pension expense recorded in 2001, 2000 and 1999 related to

this plan was $18 million, $34 million and $21 million, respectively.