Kodak 2001 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

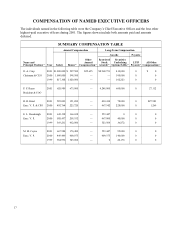

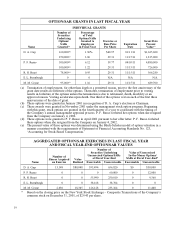

OPTION/SAR GRANTS IN LAST FISCAL YEAR

INDIVIDUAL GRANTS

Name

Number of

Securities

Underlying

Options/

SARs

Granted(a)

Percentage

of Total

Options/SARs

Granted to

Employees

in Fiscal Year

Exercise or

Base Price

Per Share

Expiration

Date

Grant Date

Present

Value(e)

D. A. Carp 160,000(b) 1.96% $40.97 01/11/11 $1,625,600

250,000(c) 3.06 29.31 11/15/11 1,815,000

P. F. Russo 500,000(d) 6.12 39.77 04/05/11 4,880,000

100,000(c) 1.22 29.31 11/15/11 726,000

R. H. Brust 78,000(c) 0.95 29.31 11/15/11 566,280

E. L. Steenburgh 0 0 N/A N/A N/A

M. M. Coyne 95,000(c) 1.16 29.31 11/15/11 689,700

(a) Termination of employment, for other than death or a permitted reason, prior to the first anniversary of the

grant date results in forfeiture of the options. Thereafter, termination of employment prior to vesting

results in forfeiture of the options unless the termination is due to retirement, death, disability or an

approved reason. Vesting accelerates upon death. One third of the options vest on each of the first three

anniversaries of the date of grant.

(b) These options were granted in January 2001 in recognition of D. A. Carp’s election as Chairman.

(c) These awards were granted in November 2001 under the management stock option program. Beginning

with this grant, stock options are granted in the fourth quarter of a year to coordinate with the timing of

the Company’s annual management appraisal process. P. F. Russo forfeited her options when she resigned

from the Company on January 4, 2002.

(d) These options were granted to P. F. Russo in April 2001 pursuant to her offer letter. P. F. Russo forfeited

these options when she resigned from the Company on January 4, 2002.

(e) The present value of these options was determined using the Black-Scholes model of option valuation in a

manner consistent with the requirements of Statement of Financial Accounting Standards No. 123,

“Accounting for Stock-Based Compensation.”

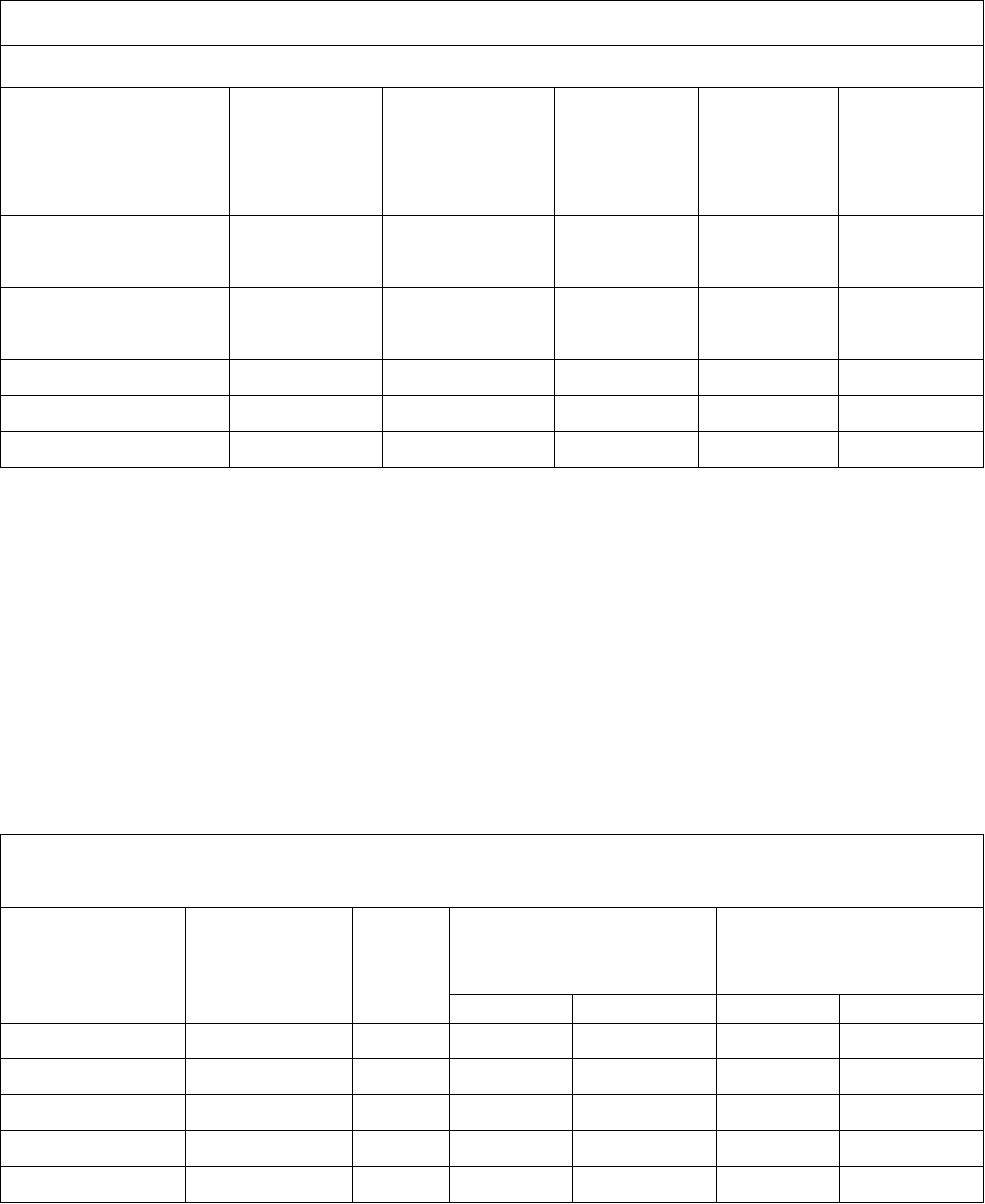

AGGREGATED OPTION/SAR EXERCISES IN LAST FISCAL YEAR

AND FISCAL YEAR-END OPTION/SAR VALUES

Number of

Shares Acquired

on Exercise

Value

Realized

Number of

Securities Underlying

Unexercised Options/SARs

at Fiscal Year-End

Value of Unexercised

In-the-Money Options/

SARs at Fiscal Year-End*

Name Exercisable Unexercisable Exercisable Unexercisable

D. A. Carp 13,148 $80,048 595,494 656,820 $0 $30,000

P. F. Russo 0 0 0 60,000 0 12,000

R. H. Brust 0 0 55,990 250,010 0 9,360

E. L. Steenburgh 0 0 38,168 38,704 0 0

M. M. Coyne 2,630 18,305 126,128 233,364 0 11,400

* Based on the closing price on the New York Stock Exchange – Composite Transactions of the Company’s

common stock on December 31, 2001, of $29.43 per share.

19