Kodak 2001 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

amortization) to interest ratio. In the event of violation of the covenant,

the facility would not be available for borrowing until the covenant

provisions were waived, amended or satisfied. The Company does not

anticipate that a violation is likely to occur.

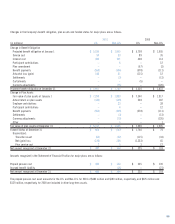

Long-Term Debt

Description and Maturity

Interest Rates Dates

of 2001 of 2001

Borrowings Borrowings

(in millions) 2001 2000

Notes:

3.74% 2003 $10 $–

6.38%–8.25% 2002–2006 959 473

9.20%–9.95% 2003–2021 191 191

Debentures:

1.11%–3.16% 2003–2004 42 61

Other:

2.42% 2004 190 –

5.94%–6.66% 2002–2010 430 591

1,822 1,316

Current portion of

long-term debt (156) (150)

Long-term debt,

net of current portion $1,666 $1,166

Annual maturities (in millions) of long-term debt outstanding at

December 31, 2001 are as follows: 2002: $13; 2003: $394; 2004: $379;

2005: $333; 2006: $500; 2007 and beyond: $47.

During the second quarter of 2001, the Company issued Medium-

Term Notes consisting of floating-rate notes in the amount of $150

million maturing on September 16, 2002 and 6.375% fixed notes in the

amount of $500 million maturing on June 15, 2006. The proceeds from

this offering were used to pay down a portion of the Company’s

outstanding commercial paper.

The Company has a shelf registration statement for medium-term

notes of which $1.35 billion remains available for issuance.

Note 9: Other Long-Term Liabilities

(in millions) 2001 2000

Deferred compensation $164 $166

Minority interest in Kodak companies 84 93

Environmental liabilities 162 113

Deferred income taxes 81 61

Other 229 248

Total $720 $681

The Other component above consists of other miscellaneous long-term

liabilities which, individually, are less than 5% of the Total liabilities

component in the Consolidated Statement of Financial Position, and

therefore, have been aggregated in accordance with Regulation S-X.

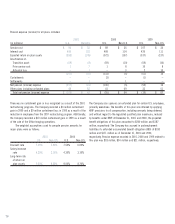

Note 10: Commitments and Contingencies

Environmental Cash expenditures for pollution prevention and waste

treatment for the Company’s current manufacturing facilities were as

follows:

(in millions) 2001 2000 1999

Recurring costs for

pollution prevention and

waste treatment $68 $72 $69

Capital expenditures

for pollution prevention

and waste treatment 27 36 20

Site remediation costs 235

Total $97 $111 $ 94

At December 31, 2001 and 2000, the Company’s undiscounted accrued

liabilities for environmental remediation costs amounted to $162 million

and $113 million, respectively. These amounts are reported in other long-

term liabilities.

The Company is currently implementing a Corrective Action Program

required by the Resource Conservation and Recovery Act (RCRA) at the

Kodak Park site in Rochester, NY. As part of this Program, the Company

has completed the RCRA Facility Assessment (RFA), a broad-based

environmental investigation of the site. The Company is currently in the

process of completing, and in some cases has completed, RCRA Facility

Investigations (RFIs) and Corrective Measures Studies (CMS) for areas at

the site. At December 31, 2001, estimated future remediation costs of

$70 million are accrued on an undiscounted basis by the Company and

are included in remediation accruals reported in other long-term liabilities.

61