Kodak 2001 Annual Report Download - page 108

Download and view the complete annual report

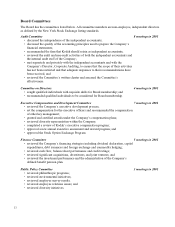

Please find page 108 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Employment Contracts and Arrangements

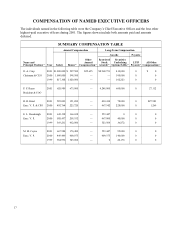

Daniel A. Carp – Effective December 10, 1999, the Company entered into a letter agreement with Mr. Carp

providing for his employment as President and Chief Executive Officer. The letter agreement provides for a

base salary of $1,000,000, subject to annual adjustment, and a target annual bonus of 105% of his base salary.

Mr. Carp’s compensation will be reviewed annually by the Executive Compensation and Development

Committee. In light of Mr. Carp’s promotion to Chairman in December 2000, the Executive Compensation and

Development Committee approved an increase to Mr. Carp’s target annual bonus to 145% of his base salary.

If the Company terminates Mr. Carp’s employment without cause, Mr. Carp will be permitted to retain his

stock options and restricted stock. He will also receive severance pay equal to three times his base salary plus

target annual bonus and prorated awards under the Company’s bonus plans. The letter agreement also provides

that for pension purposes, Mr. Carp will be treated as if he were age 55, if he is less than age 55 at the time of

his termination, or age 60, if he is age 55 or older but less than age 60, at the time of his termination of

employment.

In the event of Mr. Carp’s disability, he will receive the same severance pay as he would receive upon

termination without cause; except it will be reduced by the present value of any Company-provided disability

benefits he receives. The letter agreement also states that upon Mr. Carp’s disability, he will be permitted to

retain all of his stock options.

Eric L. Steenburgh – In April 1998, the Company hired Mr. Steenburgh under an offer letter dated March 12,

1998, that was subsequently amended on December 1, 2001. Effective April 1, 2002, Mr. Steenburgh will retire

from the Company. As a result, Mr. Steenburgh will receive the following benefits under his amended offer

letter: pay equal to one times his total target annual compensation, a retirement income benefit based on his

actual service plus 20 years of deemed service, and the ability to retain his Company-provided equity awards.

Mr. Steenburgh will also be covered under the Company's financial counseling program for two years and be

reimbursed for the cost to maintain life insurance coverage until age 70 at one times his total target annual

compensation.

Robert H. Brust – The Company employed Mr. Brust under an offer letter dated December 20, 1999, that was

amended on November 12, 2001. In addition to the information provided elsewhere in this Proxy Statement,

the amended offer letter provides Mr. Brust a special severance benefit. If, during the first seven years of Mr.

Brust’s employment, the Company terminates his employment without cause, he will receive severance pay

equal to two times his base salary plus target annual bonus. After completing five years of service with the

Company, Mr. Brust will be allowed to keep his stock options upon his termination of employment for other

than cause.

Martin M. Coyne – Effective November 15, 2001, the Company entered into a retention agreement with Mr.

Coyne. In addition to the information provided elsewhere in this Proxy Statement, the letter agreement

provides Mr. Coyne a special severance benefit equal to two times his total target annual compensation if he is

terminated without cause prior to February 7, 2004. The letter agreement also provides Mr. Coyne a target

award under the Company’s variable pay plan equal to 85% of Mr. Coyne’s annual base salary.

Patricia F. Russo – The Company employed Ms. Russo as President and Chief Operating officer under an

offer letter dated April 2001. In addition to the information described elsewhere in this Proxy Statement, the

offer letter provided Ms. Russo a base salary of $900,000 and a target award under the Company’s annual

variable pay plan of 100% of her base salary. As a hiring bonus, Ms. Russo received a grant of stock options

for 500,000 shares and 100,000 shares of restricted stock. Ms. Russo forfeited both the stock options and the

restricted stock as a result of her resignation. The offer letter also provided Ms. Russo a severance allowance

equal to two times her total target annual compensation if she terminated for good reason or was terminated

without cause. Given that Ms. Russo resigned from the Company, she did not receive any severance upon her

termination of employment.

21