Kodak 2001 Annual Report Download - page 42

Download and view the complete annual report

Please find page 42 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

Dividends, when declared, will be paid on the 10th business day of July

and December to shareholders of record on the first business day of the

preceding month. These payment dates serve to better align the dividend

disbursements with the seasonal cash flow pattern of the business,

which is more concentrated in the second half of the year. This action

resulted in the Company making five dividend payments in 2001.

Net working capital, excluding short-term borrowings and the

current portion of long-term debt, decreased to $863 million from $1,482

million at year-end 2000. This decrease is mainly attributable to lower

receivable and inventory balances, as discussed above.

Capital additions, excluding equipment purchased for lease, were

$680 million in 2001, with the majority of the spending supporting new

products, manufacturing productivity and quality improvements,

infrastructure improvements, ongoing environmental and safety

initiatives, and renovations due to relocations associated with

restructuring actions taken in 1999. In 2002, the Company expects to

reduce its capital spending, excluding acquisitions and equipment

purchased for lease, to a range of $550 million to $600 million. Capital

additions by segment are included in Note 21.

Under the $4 billion stock repurchase program announced on April

15, 1999 and December 7, 2000, the Company repurchased $44 million

of its shares in 2001. As of March 2, 2001, the Company suspended the

stock repurchase program in a move designed to accelerate debt

reduction and increase financial flexibility. At the time of the suspension

of the program, the Company had repurchased approximately $1.8 billion

of its shares under this program.

The Company anticipates the net cash cost of the restructuring

charge recorded in 2001 to be approximately $182 million after tax,

which will be recovered through cost savings in less than two years. A

majority of the severance-related actions associated with this charge are

expected to be completed in the early part of 2002.

The Company currently expects to fund expenditures for capital

requirements, dividend payments and liquidity needs from cash

generated from operations. Cash balances and financing arrangements

will be used to bridge timing differences between expenditures and cash

generated from operations. The Company has $2.45 billion in revolving

credit facilities established in 2001, which are available to support the

Company’s commercial paper program and for general corporate purposes.

The credit agreements are comprised of a 364-day commitment at $1.225

billion expiring in July 2002 and a 5-year commitment at $1.225 billion

expiring in July 2006. If unused, they have a commitment fee of $3 million

per year, at the Company’s current credit rating. Interest on amounts

borrowed under these facilities is calculated at rates based on spreads

above certain reference rates and the Company’s credit rating.

At December 31, 2001, the Company had $1.1 billion in commercial

paper outstanding, with a weighted average interest rate of 3.6%. In

addition, the Company had short-term borrowings, excluding the current

portion of long-term debt, of $238 million at December 31, 2001, with a

weighted average interest rate of 6.2%.

During the second quarter of 2001, the Company increased its

medium-term note program from $1.0 billion to $2.2 billion for issuance

of debt securities due nine months or more from date of issue. At

December 31, 2001, the Company had debt securities outstanding of

$850 million under this medium-term note program, with $150 million of

this balance due within one year. The Company has $1.35 billion

available under its medium-term note program for the issuance of new

notes. Total long-term debt at December 31, 2001, including these

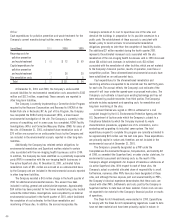

amounts, was as follows:

Description and Interest Maturity Dates

Rates of 2001 Borrowings of 2001 Borrowings 2001 2000

Notes:

3.74% 2003 $10$-

6.38% - 8.25% 2002 - 2006 959 473

9.20% - 9.95% 2003 - 2021 191 191

Debentures:

1.11% - 3.16% 2003 - 2004 42 61

Other:

2.42% 2004 190 -

5.94% - 6.66% 2002 - 2010 430 591

$1,822 $1,316

During the fourth quarter of 2001, the Company’s credit ratings

were lowered by Standard & Poor’s and Moody’s to A- and A3 for long-

term debt and A2 and P2 for short-term debt, respectively. These actions

were due to lower earnings as a result of the economic slowdown,

industry factors and other world events. The lower credit ratings caused

the Company to experience slightly higher interest rates, although the

relative cost of borrowing was very low on a comparative basis.

The Company is in compliance with all covenants or other

requirements set forth in its credit agreements or indentures. Further,

the Company does not have any rating downgrade triggers that would

accelerate the maturity dates of its debt, with the exception of a $110

million note due in 2003 that can be accelerated if the Company’s rating

falls below BBB. However, further downgrades in the Company’s credit

rating or disruptions in the capital markets could adversely impact

borrowing costs and the nature of its funding alternatives. The Company

has access to $2.45 billion in bank revolving credit facilities to meet

unanticipated funding needs should it be necessary.

The Company guarantees debt and other obligations under

agreements with certain affiliated companies and customers. At

December 31, 2001, these guarantees totaled approximately $277

million. Within the total amount of $277 million, the Company is

guaranteeing debt in the amount of $175 million for Kodak Polychrome