Kodak 2001 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

34

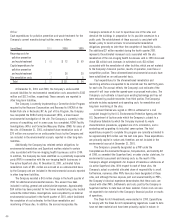

2000 Compared with 1999

Consolidated Net worldwide sales were $13,994 million for 2000 as

compared with $14,089 million for 1999, representing a decrease of $95

million, or 1%. Excluding portfolio adjustments and the negative impact

of foreign exchange, which reduced revenue by 2% and 3%, respectively,

net worldwide sales increased 4% as compared with 1999. Net sales in

the U.S. were $6,810 million for 2000 as compared with $6,594 million

for 1999, representing an increase of $216 million, or 3%. Net sales

outside the U.S. were $7,184 million for 2000 as compared with $7,495

million for 1999, representing a decrease of $311 million, or 4% as

reported, or an increase of 2% excluding the negative impact of

exchange. Deterioration in the U.S. economic conditions in the second

half of the year adversely impacted the Company’s sales, particularly

within the Photography segment. Net worldwide sales of consumer film

products, professional film products and traditional paper all decreased

in 2000 as compared with 1999. The decreases in these product groups

were partially offset by increases in film sales to the entertainment

industry, photofinishing revenues and consumer digital camera sales.

Sales in emerging markets increased 7% in 1999 as compared with

2000. The increase in emerging market sales is comprised of increases

in Latin America, Asia, EAMER Emerging Markets, Greater Russia and

Greater China of 3%, 9%, 2%, 39% and 10%, respectively.

Gross profit declined 6% with margins declining 2.4 percentage

points from 42.6% in 1999 to 40.2% in 2000. Excluding special charges

in both years, gross profit margins decreased 2.8 percentage points from

43.3% in 1999 to 40.5% in 2000. The decline in margin was driven

primarily by lower prices, increased sales of lower margin products, like

one-time-use cameras and consumer digital cameras, and the negative

impact of exchange. Productivity gains that were recognized earlier in the

year were partially offset during the fourth quarter as the Company

reduced inventories in the face of slowing demand and retailer inventory

reductions.

SG&A expenses decreased 7% from 19.2% of sales in 1999 to

18.0% in 2000. The reduction in SG&A expenses primarily reflects the

success of the Company’s cost-reduction initiatives and portfolio actions.

R&D expenses decreased 4% during the year from 5.8% of sales in

1999 to 5.6% in 2000. This decline primarily reflects the benefit of

portfolio actions, primarily the divestiture of Eastman Software.

Earnings from operations increased 11% or $224 million in 2000.

Adjusting for special charges in both years, earnings from operations

declined $190 million or 8% as increased sales volumes in many of the

Company’s businesses and the success of cost-savings initiatives did not

offset lower effective selling prices and adverse currency movements.

Interest expense increased 25% over 1999 reflecting higher average

borrowings and rising interest rates. Other income decreased by $165

million or 63% from 1999 due largely to the inclusion of gains of $120

million from the sale of the Image Bank and Motion Analysis Systems

Division in 1999. Excluding the gains from the sale of these businesses,

other income declined $45 million, primarily reflecting lower equity earnings

from the Company’s KPG joint venture.

Net earnings increased $15 million, or 1%, in 2000 as compared with

1999. Adjusting for special charges and credits in both years, net income

decreased $323 million, or 19%. The decrease in net earnings is primarily

attributable to a decline in the gross profit margin, an increase in interest

expense, and lower equity earnings from KPG.

The effective tax rate for both 2000 and 1999 was 34%.

Photography Net worldwide sales for the Photography segment were

$10,231 million for 2000 as compared with $10,265 million for 1999,

representing a decrease of $34 million, reflecting flat sales as reported,

or a 3% increase excluding the negative impact of exchange.

Photography net sales in the U.S. were $4,960 million for 2000 as

compared with $4,756 million for 1999, representing an increase of $204

million, or 4%. Photography net sales outside the U.S. were $5,271

million for 2000 as compared with $5,509 million for 1999, representing

a decrease of $238 million, or 4% as reported, or an increase of 2%

excluding the negative impact of exchange.

Net worldwide sales of the Company’s consumer film products,

which include traditional 35mm film, Advantix film and one-time-use

cameras in both the traditional and APS formats, decreased 1% in 2000

as compared with 1999, reflecting increased volumes in all major

categories, offset by declines attributable to pricing pressures and

adverse currency movements. Sales of the Company’s consumer film

products within the U.S. increased 2% in 2000 as compared with 1999,

reflecting a 17% volume increase in one-time-use cameras and a 15%

volume increase in Advantix film, partially offset by a 2% volume

decrease in traditional 35mm film. The Company maintained full-year

U.S. consumer film market share for the third consecutive year. Sales of

the Company’s consumer film products outside the U.S. decreased 4% in

2000 as compared with 1999, reflecting increased volumes which were

offset by lower prices and negative currency movements. During 2000,

the Company continued the efforts it began in 1998 to shift consumers

to the differentiated, higher value Max and Advantix film products. By the

fourth quarter of 2000, combined U.S. sales of Max and Advantix films

represented approximately 62% of total U.S. consumer roll film revenues,

up 6 percentage points as compared with the year-end 1999 level.

Net worldwide sales of origination and print film to the

entertainment industry increased 4% in 2000 as compared with 1999.

Print film sales increased 10% in 2000 as compared with 1999,

reflecting a 20% increase in volume, offset by declines due to price and

exchange of 6% and 4%, respectively. The increase in print film sales

were partially offset by a decrease in origination film sales, which

decreased 1% in 2000 as compared with 1999, reflecting a 2% increase

in volume offset by a 3% decline due to foreign exchange. The net sales