Kodak 2001 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

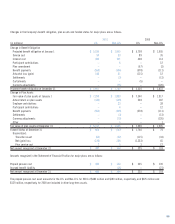

In 2001, the Company recorded a $77 million charge associated

with the bankruptcy of the Wolf Camera Inc. consumer retail business.

This amount is reflected in restructuring costs and other.

During 2001, the Company recorded a $42 million charge

representing the write-off of certain lease residuals, receivables and

capital assets resulting primarily from technology changes in the

transition from optical to digital photofinishing equipment within the

Company’s onsite photofinishing operations. The charges for the lease

residuals and capital assets totaling $19 million have been included in

cost of goods sold. The remaining $23 million has been included in

restructuring costs and other.

1999 Program

During the third quarter of 1999, the Company recorded a restructuring

charge of $350 million relating to worldwide manufacturing and

photofinishing consolidation and reductions in selling, general and

administrative positions worldwide. Approximately $250 million of the

$350 million restructuring charge was for severance covering 3,400

worldwide positions. The geographic breakdown included approximately

1,475 employees in the U.S. and Canada and 1,925 throughout the rest

of the world. These reductions were associated with the realignment of

manufacturing (1,500) and service and photofinishing operations (870),

and the consolidation of sales and marketing (460), R&D (70) and

administrative (500) functions in various locations of the Company’s

worldwide operations.

In the second quarter of 2000, the Company reversed approximately

$44 million of severance-related costs originally recorded as part of this

program. The reversal was the result of two factors which occurred

during the second quarter. First, certain manufacturing operations

originally planned to be outsourced were retained, as cost-beneficial

arrangements for the Company could not be reached. Second, severance

actions in Japan and Europe were completed at a cost less than

originally estimated. Consequently, approximately 500 (450

manufacturing and 50 administrative) fewer employees were separated.

The original $350 million charge in 1999 and the $44 million reversal are

included in restructuring costs and other. Aside from the actions

described above, all other projects included in this program were

effectively completed by December 31, 2000. A total of 2,900 employees

were terminated under this program in 2000 and 1999.

Also included in restructuring costs and other are $90 million for

asset write-downs and $10 million for shutdown costs. These charges are

primarily for vacant buildings to be sold, equipment to be shut down and

other costs related to the Company’s sale and exit of its Elmgrove

manufacturing facility.

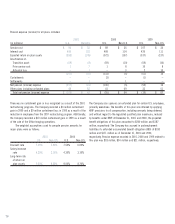

Other Cost Reductions In addition to the charges discussed above, the

Company incurred charges of approximately 18 million, $50 million and

$11 million in 2001, 2000, and 1999, respectively, for the accelerated

depreciation of certain assets which remained in use until the Company

sold its Elmgrove manufacturing facility in the second quarter of 2000,

and related relocation costs. These charges were included in cost of

goods sold. The sale of this facility did not result in a material gain or

loss to the Company.

Note 15: Retirement Plans

Substantially all U.S. employees are covered by a noncontributory plan,

the Kodak Retirement Income Plan (KRIP), which is funded by Company

contributions to an irrevocable trust fund. The funding policy for KRIP is

to contribute amounts sufficient to meet minimum funding requirements

as determined by employee benefit and tax laws plus additional amounts

the Company determines to be appropriate. Generally, benefits are based

on a formula recognizing length of service and final average earnings.

Assets in the fund are held for the sole benefit of participating

employees and retirees. The assets of the trust fund are comprised of

corporate equity and debt securities, U.S. government securities,

partnership and joint venture investments, interests in pooled funds, and

various types of interest rate, foreign currency and equity market

financial instruments. Kodak common stock represents approximately

3.4% of trust assets.

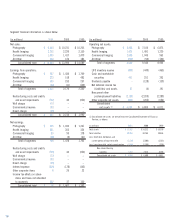

On March 25, 1999, the Company amended this plan to include a

separate cash balance formula for all U.S. employees hired after

February 1999. All U.S. employees hired prior to that date were granted

the option to choose the KRIP plan or the Cash Balance Plus plan.

Written elections were made by employees in 1999, and were effective

January 1, 2000. The Cash Balance Plus plan credits employees’

accounts with an amount equal to 4% of their pay, plus interest based

on the 30-year treasury bond rate. In addition, for employees

participating in this plan and the Company’s defined contribution plan,

the Savings and Investment Plan (SIP), the Company will match SIP

contributions for an amount up to 3% of pay, for employee contributions

of up to 5% of pay. Company contributions to SIP were $15 million and

$11 million for 2001 and 2000, respectively. As a result of employee

elections to the Cash Balance Plus plan, the reductions in future

pension expense will be almost entirely offset by the cost of matching

employee contributions to SIP. The impact of the Cash Balance Plus plan

is shown as a plan amendment.

Most subsidiaries and branches operating outside the U.S. have

retirement plans covering substantially all employees. Contributions by the

Company for these plans are typically deposited under government or

other fiduciary-type arrangements. Retirement benefits are generally

based on contractual agreements that provide for benefit formulas using

years of service and/or compensation prior to retirement. The actuarial

assumptions used for these plans reflect the diverse economic

environments within the various countries in which the Company operates.