Kodak 2001 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2001 Kodak annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

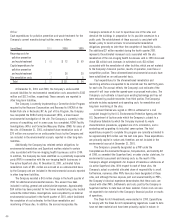

Graphics, an unconsolidated affiliate in which the Company has a 50%

ownership interest. The balance of the amount is principally comprised of

other loan guarantees and guarantees of customer amounts due to banks

in connection with various banks’ financing of customers’ purchase of

equipment and products from Kodak. These guarantees would require

payment from Kodak only in the event of default on payment by the

respective debtor. Management believes the likelihood is remote that

material payments will be required under these guarantees.

In connection with the formation of the SK Display Corporation with

SANYO Electric Co., Ltd., the Company will contribute approximately $119

million, comprised of $19 million in cash and $100 million in loan

guarantees during 2002 and 2003.

Qualex, a wholly-owned subsidiary of Kodak, has a 50% ownership

interest in Express Stop Financing (ESF), which is a joint venture

partnership between Qualex and Dana Credit Corporation (DCC), a

wholly-owned subsidiary of Dana Corporation. Qualex accounts for its

investment in ESF under the equity method of accounting. ESF provides a

long-term financing solution to Qualex’s photofinishing customers in

connection with Qualex’s leasing of photofinishing equipment to third

parties, as opposed to Qualex extending long-term credit. As part of the

operations of its photofinishing business, Qualex sells equipment under a

sales-type lease arrangement and records a long-term receivable. These

long-term receivables are subsequently sold to ESF without recourse to

Qualex. ESF incurs long-term debt to finance a portion of the purchase of

the receivables from Qualex. This debt is collateralized solely by the long-

term receivables purchased from Qualex and, in part, by a $60 million

guarantee from DCC. Qualex provides no guarantee or collateral to ESF’s

creditors in connection with the debt, and ESF’s debt is non-recourse to

Qualex. Qualex’s only continued involvement in connection with the sale

of the long-term receivables is the servicing of the related equipment

under the leases. Qualex has continued revenue streams in connection

with this equipment through future sales of photofinishing consumables,

including paper and chemicals, and maintenance.

Qualex has risk with respect to the ESF arrangement as it

relates to its continued ability to procure spare parts from the primary

photofinishing equipment vendor to fulfill its servicing obligations under

the leases. The primary photofinishing equipment vendor is currently

experiencing financial difficulty, which raises concern about Qualex’s

ability to procure the required service parts. Although the lessees’

requirement to pay ESF under the lease agreements is not contingent

upon Qualex’s fulfillment of its servicing obligations under the leases,

under the agreement with ESF, Qualex would be responsible for any

deficiency in the amount of rent not paid to ESF as a result of any

lessee’s claim regarding maintenance or supply services not provided by

Qualex. Such lease payments would be made in accordance with the

original lease terms, which generally extend over 5 to 7 years. ESF’s

outstanding lease receivable amount was approximately $570 million at

December 31, 2001. To mitigate the risk of not being able to fulfill its

service obligations, Qualex has built up its inventory of these spare parts

and has begun refurbishing used parts. Additionally, Qualex has entered

into spare parts escrow agreements under which bills of materials, parts

drawings, intellectual property and other information necessary to

manufacture the parts were put into escrow arrangements. In the event

that the primary photofinishing equipment vendor were unable to supply

the necessary parts to Qualex, Qualex would gain access to the

information in the escrow arrangements to either manufacture or have

manufactured the parts necessary to fulfill its servicing obligations.

Management is currently negotiating alternatives with the photofinishing

equipment vendor to further mitigate the above risks.

In December 2001, Standard & Poor’s downgraded the credit ratings

of Dana Corporation to BB for long-term debt and B for short-term debt,

which are below investment grade. This action created a Guarantor

Termination Event under the Receivables Purchase Agreement (RPA) that

ESF has with its banks under the RPA. To cure the Guarantor

Termination Event, in January 2002, ESF posted $60 million of additional

collateral in the form of cash and long-term lease receivables. At that

time, if Dana Corporation were downgraded to below BB by Standard &

Poor’s or below Ba2 by Moody’s, that action would constitute a

Termination Event under the RPA and ESF would be forced to renegotiate

its debt arrangements with the banks. On February 22, 2002, Moody’s

downgraded Dana Corporation to a Ba3 credit rating, thus creating a

Termination Event.

Under the Termination Event, the banks can require ESF to put up an

additional 6% collateral against the debt (on a debt balance of

approximately $405 million at the time of filing the annual report, the

additional collateral would be approximately $24 million), the interest rate

on the debt could be increased 2 percentage points and Qualex could be

precluded from selling any new receivables to ESF until the Termination

Event has been waived by the banks. ESF does not currently have the

ability to put up the additional collateral and, therefore, ESF would require

additional capital infusions by DCC and Qualex. If DCC and/or Qualex do

not provide the additional capital funding to ESF, the banks could

accelerate the debt and force ESF to liquidate its long-term lease

receivables to service the debt. Management believes that it is unlikely

that the banks would accelerate the debt, and force ESF to sell the

receivables to a third party to generate cash to satisfy the debt, due to

the high-quality nature of the underlying long-term receivable portfolio.

Furthermore, under this scenario, the banks would not have any recourse

against Qualex; rather, the impact on Qualex would be limited to the need

to find an alternative source of financing for future photofinishing

equipment placements. Additionally, under this scenario, it is not expected

that the operations of the customers who are leasing the equipment under

these long-term lease arrangements would be affected such that Qualex’s

revenue stream for future sales of photofinishing consumables would be

jeopardized. ESF is beginning negotiations with the banks to resolve the

Termination Event.