JCPenney 2004 Annual Report Download - page 48

Download and view the complete annual report

Please find page 48 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

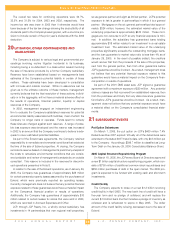

Notes to the Consolidated Financial Statements

46

The overall tax rates for continuing operations were 34.7%,

33.2% and 31.5% for 2004, 2003 and 2002, respectively. The

income tax rate was lower in 2002 than it otherwise would have

been because of the tax law change allowing the deductibility of all

dividends paid to the Company’s savings plan, with a one-time pro-

vision to include certain of the prior year’s dividends with the 2002

deduction.

20 LITIGATION, OTHER CONTINGENCIES AND

GUARANTEES

The Company is subject to various legal and governmental pro-

ceedings involving routine litigation incidental to its business,

including being a co-defendant in a class action lawsuit involving

the sale of insurance products by a former Company subsidiary.

Reserves have been established based on management’s best

estimates of the Company’s potential liability in certain of these

matters. These estimates have been developed in consultation

with in-house and outside counsel. While no assurance can be

given as to the ultimate outcome of these matters, management

currently believes that the final resolution of these actions, individ-

ually or in the aggregate, will not have a material adverse effect on

the results of operations, financial position, liquidity or capital

resources of the Company.

In 2002, management engaged an independent engineering

firm to evaluate the Company’s established reserves for potential

environmental liability associated with facilities, most of which the

Company no longer owns or operates. Funds spent to remedy

these sites are charged against such reserves. A range of possi-

ble loss exposure was developed and the reserve was increased

in 2002 to an amount that the Company continues to believe is ade-

quate to cover estimated potential liabilities.

As part of the Eckerd sale agreements, the Company retained

responsibility to remediate environmental conditions that existed at

the time of the sale of Eckerd properties. At closing, the Company

recorded a reserve based on management’s preliminary analysis of

the costs to remediate environmental conditions that are consid-

ered probable and review of management’s analysis by an outside

consultant. This reserve is included in the reserves for discontin-

ued operations presented in Note 8.

In relation to the sale of the Eckerd operations, as of January 29,

2005, the Company has guarantees of approximately $28 million

for certain personal property leases assumed by the purchasers of

Eckerd, which were previously reported as operating leases.

Currently, management does not believe that any potential financial

exposure related to these guarantees would have a material impact

on the Company’s financial position or results of operations.

Additionally, the Company has guarantees of approximately $10

million related to certain leases for stores that were sold in 2003,

which are recorded in Accrued Expenses and Other.

JCP, through JCP Realty, Inc., a wholly owned subsidiary, has

investments in 14 partnerships that own regional mall properties,

six as general partner and eight as limited partner. JCP’s potential

exposure to risk is greater in partnerships in which it is a general

partner. Mortgages on the six general partnerships total approxi-

mately $324 million; however, the estimated market value of the

underlying properties is approximately $610 million. These mort-

gages are non-recourse to JCP, so any financial exposure is mini-

mal. In addition, the subsidiary has guaranteed loans totaling

approximately $18 million related to an investment in a real estate

investment trust. The estimated market value of the underlying

properties significantly exceeds the outstanding mortgage loans,

and the loan guarantee to market value ratio is less than 4% as of

January 29, 2005. In the event of possible default, the creditors

would recover first from the proceeds of the sale of the properties,

next from the general partner, then from other guarantors before

JCP’s guarantee would be invoked. As a result, management does

not believe that any potential financial exposure related to this

guarantee would have a material impact on the Company’s finan-

cial position or results of operations.

As part of the 2001 DMS asset sale, JCP signed a guarantee

agreement with a maximum exposure of $20 million. Any potential

claims or losses are first recovered from established reserves, then

from the purchaser and finally from any state insurance guarantee

fund before JCP’s guarantee would be invoked. As a result, man-

agement does not believe that any potential exposure would have

amaterial effect on the Company’s consolidated financial state-

ments.

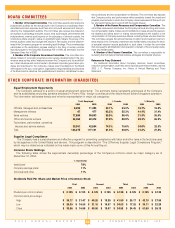

21 SUBSEQUENT EVENTS

Put Option Debentures

On March 1, 2005, the put option on JCP’s $400 million 7.4%

Debentures Due 2037 expired. Virtually all of the debentures were

extended to the stated 2037 maturity date, with only $0.3 million put

to the Company. Accordingly, $399.7 million is classified as Long-

Term Debt on the January 29, 2005 Consolidated Balance Sheet.

2005 Capital Structure Repositioning Program

On March 18, 2005, the JCPenney Board of Directors approved

anew $1 billion capital structure repositioning program, which con-

sists of $750 million of additional common stock repurchases and

$250 million purchases of debt in the open market. The 2005 pro-

gram is expected to be funded with existing cash and short-term

investments.

Credit Facility

The Company expects to close on a new $1.2 billion revolving

credit facility in April 2005. The new bank line of credit will have a

five-year term and no pledge of collateral, and will replace the

current $1.5 billion bank line that includes a pledge of inventory as

collateral and is scheduled to expire in May 2005. The dollar

amount of the credit facility is being decreased due to the sale of

Eckerd.