JCPenney 2004 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Notes to the Consolidated Financial Statements

43

strong return on plan assets in 2003 and continued improvement in

2004, this surplus increased to $221 million at the 2003 measure-

ment date and $270 million at the 2004 measurement date.

Aminimum liability adjustment for the supplemental retirement

plans was required again in 2004 due to the ABO exceeding the

recorded liability. In addition to the accrued liability for the supple-

mental retirement plans, the additional minimum liability balance

was $169 million and $134 million in 2004 and 2003, respectively.

Of the $169 million balance for 2004, approximately $1 million was

reflected as an intangible asset due to unrecognized prior service

cost. For the remaining increase from the prior year, a charge was

recorded to stockholders’ equity, net of income tax benefits, as a

component of other comprehensive loss in the amount of approxi-

mately $20 million. This adjustment does not impact current year

earnings or the funding requirements of the plan. See the

Consolidated Statements of Stockholders’ Equity for the charge

included in Other Comprehensive Income for each year.

Plan Assets

The fair value of pension plan assets as of October 31, 2004 and

2003, by asset category as a percent of total, and target allocation

ranges are as follows:

Plan Assets

Target October 31, October 31,

Asset Category Allocation Ranges 2004 2003

Equity securities

65% - 75% 65% 62%

(1)

Debt securities

15% - 25% 20% 20%

Real estate

5% - 15% 9% 9%

Cash and other(1)

0% - 5% 6% 9%

Total

100% 100%

(1) Cash investments exceeded the targeted range at both October 31, 2004 and 2003, and equity secu-

rities were less than the targeted range temporarily at October 31, 2003, due to the timing of contribu-

tions relative to investments made in equity and fixed income securities.

Asset Allocation Strategy

—

The Company’s investment strategy

is designed to provide a rate of return that, over the long term,

increases the ratio of plan assets to liabilities by maximizing invest-

ment return on assets, at an appropriate level of volatility risk. The

plan’s asset portfolio is actively managed and invested primarily in

equity securities, which have historically provided higher returns

than debt portfolios, balanced with fixed income (i.e., debt securi-

ties) and other asset classes to maintain an efficient risk/return

diversification profile. This strategy allows the pension plan to

serve as a funding vehicle to secure benefits for Company associ-

ates, while at the same time being cost effective to the Company.

The risk of loss in the plan’s equity portfolio is mitigated by invest-

ing in a broad range of equity types. Equity diversification includes

large-capitalization and small-capitalization companies, growth-

oriented and value-oriented investments and U.S. and non-U.S.

securities. Investment types, including high-yield versus invest-

ment-grade debt securities, illiquid assets such as real estate, the

use of derivatives and Company securities are set forth in written

guidelines established for each investment manager and moni-

tored by the Company. Direct investments in JCPenney securities

are not permitted, even though ERISA rules allow such investments

up to 10% of a plan’s assets. The plan’s asset allocation policy is

designed to meet the plan’s future pension benefit obligations. The

policy is periodically reviewed and rebalanced if necessary to

ensure that the mix continues to be appropriate relative to estab-

lished targets and ranges.

The Company has an internal Benefit Plans Investment

Committee, consisting of senior executives, who have established

and oversee risk management practices associated with the man-

agement of the plan’s assets. Key risk management practices

include having an established and broad decision-making frame-

work in place, focused on long-term plan objectives. This frame-

work consists of the Company and various third parties, including

investment managers, an investment consultant, an actuary and a

trustee/custodian. The funded status of the plan is monitored with

updated market and liability information at least annually. Actual

asset allocations are monitored monthly and rebalancing actions

are executed at least quarterly, if needed. To manage the risk

associated with an actively managed portfolio, the Company

reviews each manager’s portfolio on a quarterly basis and has writ-

ten manager guidelines in place, which are adjusted as necessary

to ensure appropriate diversification levels. Also, annual audits of

the investment managers are conducted by independent auditors.

Finally, to minimize operational risk, the Company utilizes a master

custodian for all plan assets, and each investment manager rec-

onciles its account with the custodian at least quarterly.

Other Postretirement Benefits

The Company provides medical and dental benefits to retirees

based on age and years of service. Benefits under these plans are

paid through a voluntary employees beneficiary association trust;

however, this is not considered to be a prefunding arrangement

under SFAS No. 106. The Company provides a defined dollar com-

mitment toward retiree medical premiums. In 2001, the Company

amended these plans to freeze eligibility for retiree coverage and

to further reduce and limit the Company’s contributions toward pre-

miums. These changes were accounted for as a negative plan

amendment in accordance with SFAS No. 106. Accordingly, the

effects of reducing eligibility and Company contributions toward

retiree premiums are being amortized over the remaining years of

service to eligibility of the active plan participants. The decrease

in the other postretirement expense presented in the table below is

due to declining participant enrollments in the plan.

Medicare Reform Act

—

The Company’s accumulated post-retire-

ment benefit obligation (APBO) and net cost recognized for other

postretirement plans do not reflect the effects of the Medicare

Prescription Drug, Improvement, and Modernization Act of 2003

(Act) passed in December 2003. The provisions of the Act provide

for a federal subsidy for plans that provide prescription drug ben-

efits and meet certain qualifications. Specific authoritative guid-

ance on the accounting for the federal subsidy was issued in

January 2005, and its impact on the Company’s actuarially deter-

mined APBO and net cost for other postretirement benefit plans is

currently being evaluated. Due to the cap on Company contribu-

tions, the potential effects of the Act are not expected to have a

material effect on the Company’s consolidated financial state-

ments. There was no impact on 2003 or 2002 since the measure-

ment dates for the Company’s other postretirement benefit plans

were October 31, 2003 and 2002, respectively, which were prior to

the date the Act was passed.

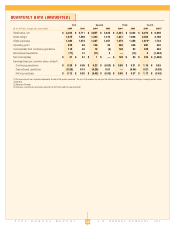

Postretirement (Income)/Expense

($ in millions)

2004 2003 2002

Service costs

$3$3$3

Interest costs

11 13 16

Net amortization

(22) (20) (16)

Net periodic postretirement

benefit (income)/expense

$ (8) $ (4) $ 3