JCPenney 2004 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Notes to the Consolidated Financial Statements

36

Series B Convertible Preferred Stock Redemption

On August 26, 2004, the Company redeemed, through conver-

sion to common stock, all of its outstanding shares of Series B ESOP

Convertible Preferred Stock (Preferred Stock), all of which were held

by the Company’s Savings, Profit-Sharing and Stock Ownership

Plan, a 401(k) savings plan (Savings Plan). Each holder of Preferred

Stock received 20 equivalent shares of JCPenney common stock for

each one share of Preferred Stock in their Savings Plan account in

accordance with the original terms of the Preferred Stock. Preferred

Stock shares, which were included in the diluted earnings/(loss) per

share calculation as appropriate, were converted into approximately

nine million common stock shares.

Common Stock Repurchases

The Company is executing a common stock repurchase program

of up to $3.0 billion, including the repurchase of up to $650 million

of common stock that had been contingent upon the now complet-

ed conversion of JCP’s 5.0% Convertible Subordinated Notes Due

2008. Share repurchases have been and will continue to be made

in open-market transactions, subject to market conditions, legal

requirements and other factors. The Company repurchased and

retired 50.1 million shares of common stock during 2004 at a cost of

approximately $2.0 billion. This represents approximately two-thirds

of the total planned common stock repurchases under the 2004

Capital Structure Repositioning Program. As of January 29, 2005,

approximately $1.0 billion remained authorized for share repur-

chases.

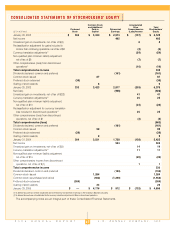

Common Stock Outstanding

During 2004, the number of shares of common stock changed as

follows, primarily as a result of the ongoing capital structure repo-

sitioning program:

Outstanding

(in millions)

Common Shares

Balance as of January 31, 2004

274

Repurchases of common stock

(50)

Conversion of $650 million of convertible

debt at $28.50 per share

23

Redemption of preferred stock

9

Exercise of stock options

13

Other

2

Balance as of January 29, 2005

271

4EARNINGS PER SHARE

Income from continuing operations and shares used to compute

earnings per share from continuing operations, basic and diluted,

are reconciled below:

($ in millions, except EPS)

2004 2003 2002

Earnings:

Income from continuing

operations

$ 667 $ 364 $ 285

Less: preferred stock dividends,

net of tax

12 25 27

Income from continuing

operations, basic

$ 655 $ 339 $ 258

Adjustments for assumed

dilution:

Interest on 5% convertible

debt, net of tax

17 22 22

Preferred stock dividends,

net of tax

12 –– ––

Income from continuing

operations, diluted

$ 684 $ 361 $ 280

Shares:

Average common shares

outstanding (basic shares)

279 272 267

Adjustments for assumed dilution:

Stock options and

restricted stock units

523

Shares from convertible debt

17 23 23

Shares from preferred stock

6–– ––

Average shares assuming

dilution (diluted shares)

307 297 293

EPS from continuing

operations:

Basic

$ 2.35 $ 1.25 $ 0.96

Diluted

$ 2.23 $ 1.21 $ 0.95

The following average potential shares of common stock were

excluded from the diluted EPS calculations because their effect

would be anti-dilutive:

(shares in millions)

2004 2003 2002

Stock options(1)

389

Preferred stock

–– 11 11

Total anti-dilutive

potential shares

3 19 20

(1) Exercise prices per share for the excluded stock options ranged from $37 to $71, $20 to $71 and $21

to $71 for 2004, 2003 and 2002, respectively.

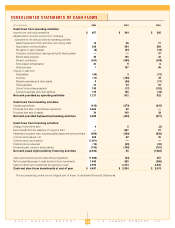

5SUPPLEMENTAL CASH FLOW INFORMATION

($ in millions)

2004 2003 2002

Total interest paid

$ 405 $ 420 $ 422

Less: interest paid attributableto

discontinued operations

95 159 158

Interest paid by continuing

operations

$ 310 $ 261 $ 264

Interest received

$ 57 $ 29 $ 40

Income taxes paid

$ 1,000 $ 91 $ 60

Less: income taxes paid/

(received) attributable to

discontinued operations

822 41 (76)

Income taxes paid by

continuing operations

$ 178 $ 50 $ 136