JCPenney 2004 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Notes to the Consolidated Financial Statements

45

Management Transition Costs

In 2004, the Company recorded a $29 million charge related to

the previously announced senior management transition.

Other

Other expenses in 2002 included operating losses of $10 million

related to third-party fulfillment operations that were discontinued

in 2002.

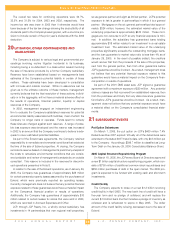

19 INCOME TAXES

Deferred tax assets and liabilities reflected in the accompanying

Consolidated Balance Sheets were measured using enacted tax

rates expected to apply to taxable income in the years in which

those temporary differences are expected to be recovered or set-

tled. Deferred tax assets and liabilities from continuing operations

as of January 29, 2005 and January 31, 2004 were comprised of

the following:

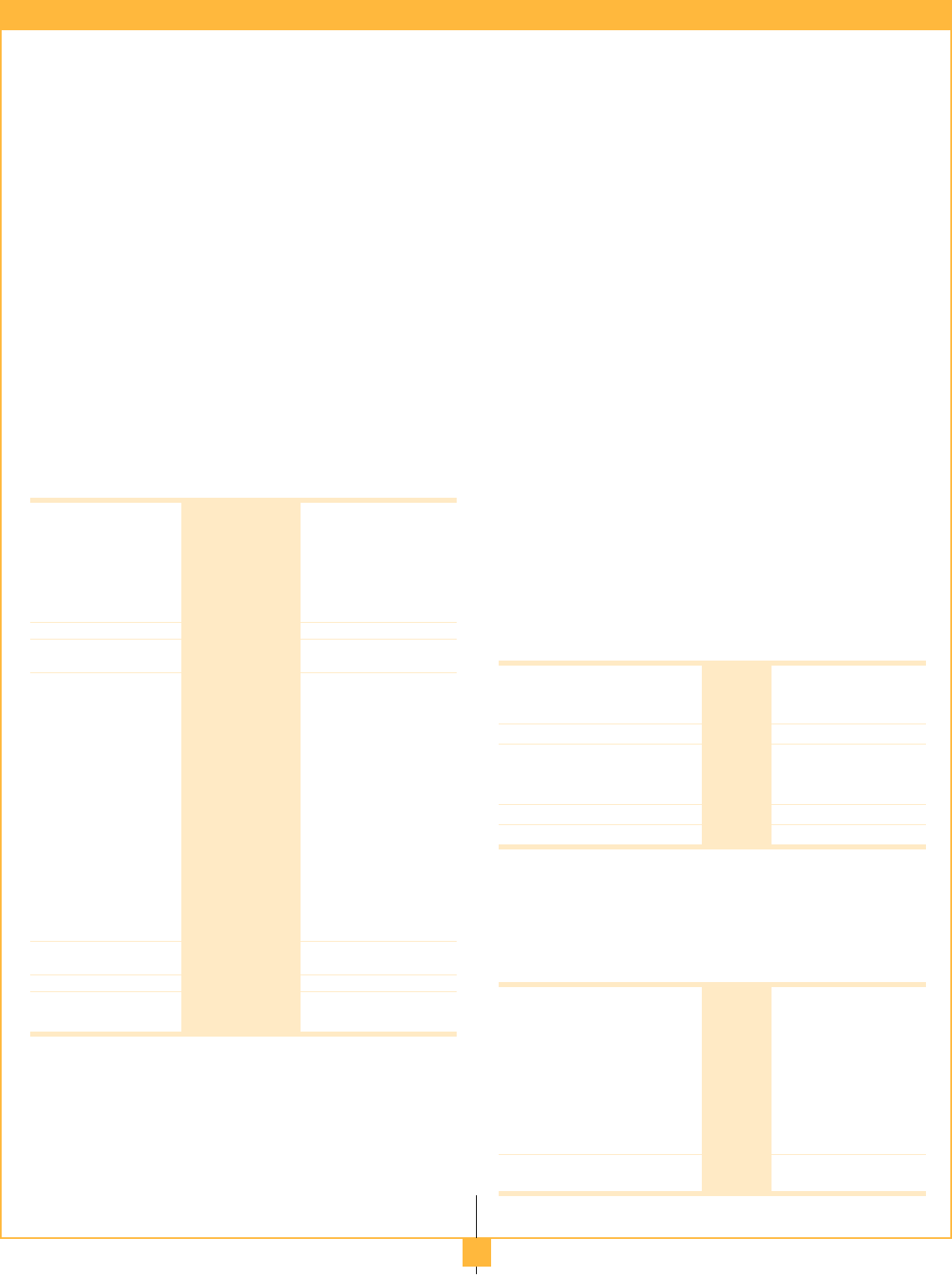

2004 2003

Deferred Tax Deferred Tax Deferred Tax Deferred Tax

($ in millions)

Assets (Liabilities) Assets (Liabilities)

Current

Discontinued operations-

Eckerd

$ 86 $ –– $ –– $ (875)

Accrued vacation pay

47 –– 51 ––

Inventories

17 –– –– (102)

Closed unit reserves

1 –– 8 ––

Other(1)

67 (55) 35 (60)

Total current

$ 218 $ (55) $ 94 $ (1,037)

Net current assets/

(liabilities)

$ 163(3) $ (943)

Non-current

Depreciation and

amortization

$ –– $ (921) $ –– $ (886)

Prepaid pension

–– (629) –– (539)

Pension and other

retiree obligations

261 –– 267 ––

Leveraged leases

–– (273) –– (280)

State taxes and net

operating losses

149 –– 164 ––

Workers’ compensation/

general liability

92 –– 83 ––

Discontinued operations-

Eckerd

44 –– –– ––

Closed unit reserves

8 –– 11 ––

Other(2)

107 (54) 122 (51)

Total noncurrent

$ 661 (1,877) $ 647 $ (1,756)

Valuation allowance

(102) –– (108) ––

Net noncurrent (liabilities)

$(1,318) $ (1,217)

Total net deferred tax

(liabilities)

$(1,155) $(2,160)

(1) Other current deferred tax assets include tax items related to gift cards and accruals for sales returns

and allowances. Other current deferred tax liabilities include tax items related to property taxes and pre-

paid expenses.

(2) Other noncurrent deferred tax assets include tax items related to deferred compensation and environ-

mental cleanup costs. Other noncurrent deferred tax liabilities include tax items related to unrealized

gain/loss and original issue discount.

(3) A current deferred tax asset of $163 million is included in Receivables in the Company’s 2004

Consolidated Balance Sheet.

At the end of 2003, the Company established an estimated cur-

rent deferred tax liability of $875 million based on the pending sale

of Eckerd. In accordance with SFAS No. 109, a tax liability for the

excess of the financial reporting basis over the outside tax basis of

an investment in a subsidiary shall be recognized when it is appar-

ent that the temporary difference will reverse in the foreseeable

future. This criteria was met as of year-end 2003 with Eckerd clas-

sified as a discontinued operation. Upon completion of the sale of

the Eckerd operations in July 2004, this current deferred tax liabili-

ty was reclassified to income taxes payable. Subsequent to the

close of the sale, the Company made payments totaling $822 mil-

lion in relation to these tax liabilities.

Deferred tax assets are evaluated for recoverability based on

estimated future taxable income. The character and nature of

future taxable income may not allow the Company to realize certain

tax benefits of state net operating losses (NOLs) within the pre-

scribed carryforward period. Accordingly, a valuation allowance

has been established for the amount of deferred tax assets gener-

ated by state NOLs that may not be realized.

Deferred tax liabilities are evaluated and adjusted as appropri-

ate considering the progress of audits of various taxing jurisdic-

tions. Management does not expect the outcome of tax audits to

have a material adverse effect on the Company’s financial condi-

tion, results of operations or cash flow.

U.S. income and foreign withholding taxes were not provided

on certain unremitted earnings of international affiliates that the

Company considers to be permanent investments.

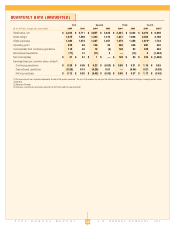

Income tax expense for continuing operations is as follows:

Income Tax Expense for Continuing Operations

($ in millions)

2004 2003 2002

Current

Federal and foreign

$ 340 $ 40 $ 22

State and local

14 5 13

354 45 35

Deferred

Federal and foreign

(8) 126 90

State and local

711 5

(1) 137 95

Total

$ 353 $ 182 $ 130

A reconciliation of the statutory federal income tax rate to the

effective rate for continuing operations is as follows:

Reconciliation of Tax Rates for Continuing Operations

(percent of pre-tax income)

2004 2003 2002

Federal income tax

at statutory rate

35.0% 35.0% 35.0%

State and local income

tax, less federal income

tax benefit

1.3 2.1 2.8

Tax effect of dividends on

ESOP shares

(1.0) (2.6) (6.0)

Other permanent

differences and credits

(0.6) (1.3) (0.3)

Effective tax rate for

continuing operations

34.7% 33.2% 31.5%