JCPenney 2004 Annual Report Download - page 40

Download and view the complete annual report

Please find page 40 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Notes to the Consolidated Financial Statements

38

calculated at each quarter end. As of year-end 2004, the actual

leverage ratio was 2.14 to 1.0, well within the prescribed limit of

3.75 to 1.0.

Effective June 2, 2004, this credit facility was amended to permit

the sale of Eckerd Corporation and its affiliates and assets, to per-

mit a broader range of cash investments and to permit issuing

banks to extend maturities of certain letters of credit past the expi-

ration of the credit facility as long as they are collateralized with

cash at that time.

As discussed in Note 21, this credit facility is expected to be

replaced with a new $1.2 billion credit facility in April 2005.

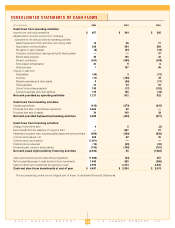

11 LONG-TERM DEBT

($ in millions)

2004 2003

Issue:

6.9% to 9.0% Notes, due 2004 to 2097

$ 1,857 $ 2,165

7.125% to 8.125% Debentures,

due 2016 to 2037

1,525 1,525

6.5% to 7.05% Medium-term notes,

due 2005 to 2015

493 493

5.0% Convertible subordinated

notes, due 2008

–– 650

8.25% to 9.75% Sinking fund

debentures, due 2021 to 2022

–– 313

6.0% Original issue discount

debentures, due 2006(1)

–– 167

6.35% to 7.33% Equipment

financing notes, due 2007

15 21

Total notes and debentures

3,890 5,334

Capital lease obligations and other

33 22

Total long-term debt, including

current maturities

3,923 5,356

Less: current maturities

459 242

Total long-term debt

$ 3,464 $ 5,114

(1) The face amount of these original issue discount debentures was $200 million.

As a part of the Company’s planned $2.3 billion debt reduction

program discussed in Note 3, approximately $1.7 billion of on- and

off-balance sheet obligations were eliminated during 2004 as fol-

lows:

• JCP’s 7.375% Notes in the amount of $208 million matured and

were paid.

•JCP retired its 9.75% Debentures Due 2021. Of the total

balance of $117.2 million, $25 million was retired at par, and the

remaining $92.2 million was redeemed at a price of 103.2%

plus accrued interest.

•JCP retired the entire $195.7 million balance of its 8.25%

Debentures Due 2022. $37.5 million of the balance was retired

at par, with the remaining $158.2 million being redeemed at a

price of 103.096% plus accrued interest.

•JCP redeemed its $200 million face amount 6.0% Original

Issue Discount Debentures Due 2006. At the date of

redemption, these debentures had a recorded balance of $175

million, due to the unamortized discount of $25 million.

•The Company purchased approximately $100 million of JCP’s

7.6% Notes Due 2007 in the open market.

•The Company called all of JCP’s outstanding $650 million 5.0%

Convertible Subordinated Notes Due 2008. Holders of the

Notes had the option to convert the Notes into shares of the

Company’s common stock at a conversion price of $28.50. All

but $0.7 million of the Notes were converted into approximately

22.8 million shares, and the remaining Notes were redeemed at

102.5% plus accrued interest.

•As reflected in Cash (Paid to)/Received from Discontinued

Operations on the Consolidated Statements of Cash Flows,

Eckerd’s managed care receivables securitization program

was paid off for a total of $221 million and the program was

terminated.

During 2003, borrowings and repayments of debt included the

following:

•On February 28, 2003, the Company issued $600 million

principal amount of 8.0% Notes Due 2010. These Notes are

redeemable in whole or in part, at the Company’s option at any

time, at a redemption price equal to the greater of: (a) 100% of

the principal amount of such Notes or (b) the sum of the

present values of the remaining scheduled payments, dis-

counted to the redemption date on a semi-annual basis at the

"treasury yield" plus 50 basis points, together in either case with

accrued interest to the date of redemption.

•In August 2003, bondholders exercised their option to redeem

approximately $117 million of the $119 million 6.9%

Debentures Due 2026.

•During 2003, the Company retired $62 million of JCP’s sinking

fund debentures through mandatory payments totaling $25

million and optional sinking fund payments totaling $37 million.

•The Company purchased approximately $17 million of JCP’s

8.25% Sinking Fund Debentures Due 2022.

•In November 2003, the outstanding amount of JCP’s 6.125%

Notes Due 2003, totaling $246 million, matured and

was paid in full.

Debt Covenants

The Company has indentures covering approximately $275 million

of long-term debt that contain a financial covenant requiring the

Company to have a minimum of 200% net tangible assets to senior

funded indebtedness (as defined in the respective indentures).

These indentures permit the Company to issue additional long-term

debt if it is in compliance with the covenant. At year-end 2004, the

Company’s percentage of net tangible assets to senior funded

indebtedness was 302%.

7.4% Debentures Due 2037

JCP’s $400 million 7.4% Debentures Due 2037 contained put

options whereby the investors could elect to have the debentures

redeemed at par on April 1, 2005. On March 1, 2005, the put option

expired, and virtually all of the debentures were extended, with only

$0.3 million put to the Company. Accordingly, $399.7 million was

reclassified to Long-Term Debt on the January 29, 2005

Consolidated Balance Sheet and is included in the 2010-2097 cat-

egory in the scheduled annual principal payments presented below.

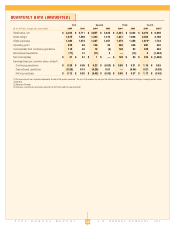

Scheduled Annual Principal Payments on Long-Term Debt:

($ in millions)

2005 2006 2007 2008 2009 2010-2097

$459 $21 $433 $203 $–– $2,807