JCPenney 2004 Annual Report Download - page 13

Download and view the complete annual report

Please find page 13 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Management’s Discussion and Analysis of Financial Condition and Results of Operations

11

on- and off-balance sheet obligations were retired during 2004 as

follows:

• JCP’s 7.375% Notes in the amount of $208 million matured and

were paid.

•JCP retired its 9.75% Debentures Due 2021. Of the total

balance of $117.2 million, $25 million was retired at par, and the

remaining $92.2 million was redeemed at a price of 103.2%

plus accrued interest.

•JCP retired the entire $195.7 million balance of its 8.25%

Debentures Due 2022. $37.5 million of the balance was retired

at par, with the remaining $158.2 million being redeemed at a

price of 103.096% plus accrued interest.

•JCP redeemed its $200 million face amount 6.0% Original

Issue Discount Debentures Due 2006. At the date of

redemption, these debentures had a recorded balance of $175

million, due to the unamortized discount of $25 million.

•The Company purchased approximately $100 million of JCP’s

7.6% Notes Due 2007 in the open market.

•The Company called all of JCP’s outstanding $650 million 5.0%

Convertible Subordinated Notes Due 2008. Holders of the

Notes had the option to convert the Notes into shares of the

Company’s common stock at a conversion price of $28.50.

All but $0.7 million of the Notes were converted into

approximately 22.8 million shares, and the remaining Notes

were redeemed at a price of 102.5% plus accrued interest.

•As reflected in Cash (Paid to)/Received from Discontinued

Operations on the Consolidated Statements of Cash Flows,

Eckerd’s managed care receivables securitization program

was paid off for a total of $221 million and the program was

terminated.

During 2003:

•The Company issued $600 million principal amount of

unsecured 8.0% Notes Due 2010 at an effective interest rate of

8.125%.

•The Company retired $442 million of long-term debt,

principally debt issues that matured during 2003.

During 2002:

•The Company completed a debt exchange in which certain

bondholders tendered approximately $227 million principal

amount of three existing debt issues in exchange for new 9.0%

Notes Due 2012 with a principal amount of approximately $230

million. Bondholders exchanged $79 million principal amount

of the Company’s 6.125% Notes Due 2003, $67 million

principal amount of its 7.375% Notes Due 2004 and $81 million

principal amount of its 6.9% Debentures Due 2026. This

transaction effectively extended the maturity on amounts

represented by the exchanged notes and strengthened the

Company’s liquidity.

• Approximately $920 million of long-term debt matured and was

paid.

Equity

—During 2004, the Company returned approximately

$2.1 billion to stockholders through common stock repurchases and

dividend payments. The Company repurchased 50.1 million shares

of common stock for approximately $2.0 billion, including approxi-

mately $51 million of cash paid after January 29, 2005 for settlement

of repurchases. Common stock is retired on the same day it is repur-

chased and the related cash settlements are completed on the third

business day following the repurchase. No common stock repur-

chases were made during 2003 or 2002.

JCPenney paid quarterly dividends on its common stock of

$0.125 per share in 2004, 2003 and 2002. The Company’s Board of

Directors reviews the dividend policy and rate on a quarterly basis,

taking into consideration the overall financial and strategic outlook

for the Company, earnings, liquidity and cash flow projections, as

well as competitive factors. The Company also paid semi-annual

dividends on its Series B ESOP Convertible Preferred Stock at an

annual rate of $2.37 per common share equivalent, until all out-

standing shares were converted to common shares on August 26,

2004.

Net proceeds from the exercise of stock options were approxi-

mately $248 million in 2004, compared to $31 million in 2003 and $9

million in 2002.

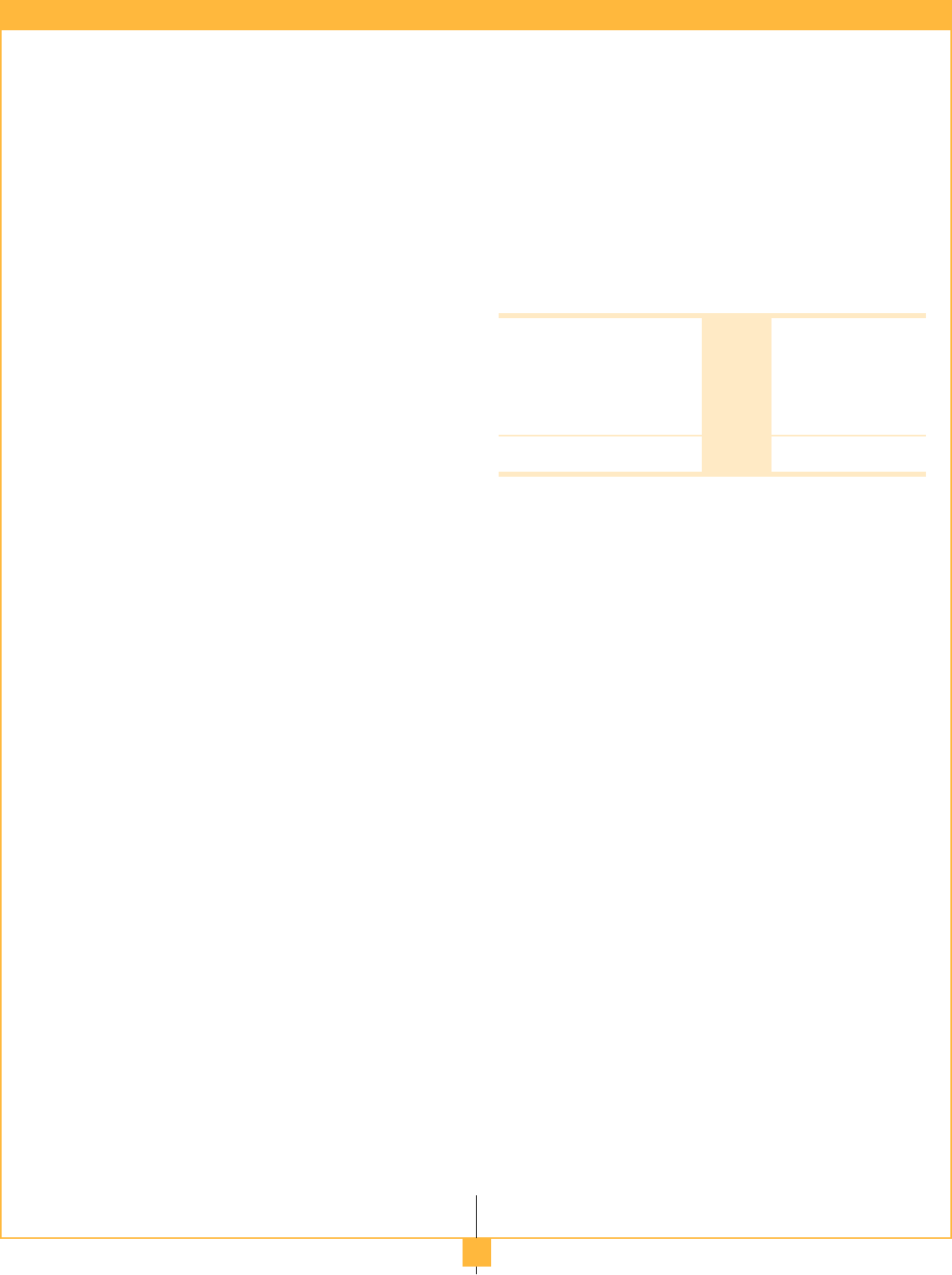

Free Cash Flow from Continuing Operations

($ in millions)

2004 2003 2002

Net cash provided by

operating activities (GAAP)

$1,127 $ 812 $ 522

Less:

Capital expenditures

(412) (373) (315)

Dividends paid

(150) (160) (161)

Plus:

Proceeds from sale of assets

34 100 38

Free cash flow from

continuing operations

$599 $ 379 $ 84

Free cash flow is an important financial measure, which is widely

focused upon by investors, the rating agencies and banks. Although it

is not a GAAP measure, it is derived from components of the

Company’s consolidated GAAP cash flow statement. Positive free

cash flow generated by a company indicates the amount of cash avail-

able for reinvestment in the business, or cash that can be returned to

investors through increased dividends, stock repurchase programs,

debt retirements, or a combination of these. Conversely, negative free

cash flow indicates the amount of cash that must be raised from

investors through new debt or equity issues, reduction in available cash

balances or a combination of these.

The Company generated $599 million of free cash flow in 2004,

which represented the fifth consecutive year of positive free cash flow.

The improvement from 2003 to 2004 was primarily the result of higher

income from continuing operations.

Cash Flow and Financing Outlook

The Company’s financial position strengthened significantly dur-

ing 2004 as a result of improved operating performance, positive

free cash flow, the sale of Eckerd and the capital structure reposi-

tioning program. As of year-end 2004, Cash and Short-Term

Investments were approximately $4.7 billion, of which, approxi-

mately $2.2 billion is planned to be used during 2005 to complete

the 2004 and 2005 capital structure repositioning programs.

In accordance with its financing strategy, the Company expects

to maintain a strong liquidity position. Until the Company’s credit

ratings improve to investment-grade levels, access to the capital

markets for cash needs will retain an element of uncertainty. As

such, management intends to maintain sufficient cash investment

levels to ensure support for strategic and operational business

needs, long-term debt maturities, dividends and contingency

items, such as the cash contributions made to the Company’s qual-

ified pension plan during the 2002-2004 period.

For 2005, free cash flow is expected to be approximately $100

million, reflecting an increase in capital expenditures to $700 mil-

lion in support of the Company’s investment in both new and exist-

ing stores, as well as new point-of-sale technology.

In accordance with its long-term financing strategy, the