JCPenney 2004 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

27

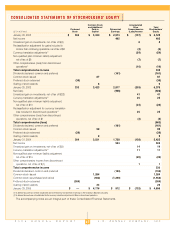

CONSOLIDATED STATEMENTS OF STOCKHOLDERS’ EQUITY

Common Stock Accumulated

and Additional Other Total

Preferred Paid-in Reinvested Comprehensive Stockholders’

($ in millions)

Stock Capital Earnings (Loss)/Income Equity

January 26, 2002

$ 363 $ 3,330 $ 2,573 $ (137) $ 6,129

Net income

405 405

Unrealized gain on investments, net of tax of $(4)

8 8

Reclassification adjustment for gains included in

income from continuing operations, net of tax of $2

(3) (3)

Currency translation adjustments(1)

(54) (54)

Non-qualified plan minimum liability adjustment,

net of tax of $6

(7) (7)

Other comprehensive (loss) from discontinued

operations(2)

(10) (10)

Total comprehensive income

339

Dividends declared, common and preferred

(161) (161)

Common stock issued

87 87

Preferred stock redeemed

(30) (30)

Vesting of stock awards

66

January 25, 2003

333 3,423 2,817 (203) 6,370

Net (loss)

(928) (928)

Unrealized gain on investments, net of tax of $(22)

41 41

Currency translation adjustments(1)

25 25

Non-qualified plan minimum liability adjustment,

net of tax of $13

(24) (24)

Reclassification adjustment for currency translation

loss included in discontinued operations(2)

25 25

Other comprehensive (loss) from discontinued

operations, net of tax of $1

(2) (2)

Total comprehensive (loss)

(863)

Dividends declared, common and preferred

(161) (161)

Common stock issued

99 99

Preferred stock redeemed

(29) (29)

Vesting of stock awards

9 9

January 31, 2004

304 3,531 1,728 (138) 5,425

Net income

524 524

Unrealized gain on investments, net of tax of $(9)

14 14

Currency translation adjustments(1)

11 11

Non-qualified plan minimum liability adjustment,

net of tax of $14

(20) (20)

Other comprehensive income from discontinued

operations, net of tax of $(1)

11

Total comprehensive income

530

Dividends declared, common and preferred

(150) (150)

Common stock issued

1,284 1,284

Common stock repurchased and retired

(662) (1,290) (1,952)

Preferred stock redeemed

(304) (304)

Vesting of stock awards

23 23

January 29, 2005

$ –– $ 4,176 $ 812 $ (132) $ 4,856

(1) A deferred tax asset has not been established due to the historical reinvestment of earnings in the Company’s Brazilian subsidiary.

(2) A deferred tax asset was not established for the currency translation adjustment of Mexico discontinued operations.

The accompanying notes are an integral part of these Consolidated Financial Statements.