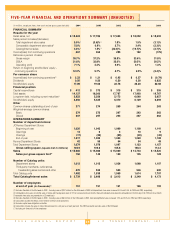

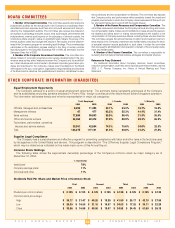

JCPenney 2004 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Notes to the Consolidated Financial Statements

42

The discount rate used to measure pension expense each year

is the rate as of the beginning of the year (i.e., the prior measure-

ment date). The discount rate is based on a portfolio of high-qual-

ity corporate bonds with similar average cash flow durations to the

pension liability. The rate as of the end of 2004, which will be used

to measure 2005 pension expense, was reduced to 5.85%. The

expected return on plan assets is based on the plan’s long-term

asset allocation policy, historical returns for plan assets and overall

capital market returns, taking into account current and expected

market conditions. Given lower asset returns over the 2000-2002

period and lower expected future returns, the Company lowered

the expected rate of return on plan assets from 9.5% to 8.9% as of

October 31, 2002, which was used to develop the pension

expense for 2003 and 2004. The combination of assumption

changes and poor investment returns in 2002 and 2001 resulted in

an increase in 2003 pension expense of $106 million. Subsequent

improvements in investment returns in 2003 combined with the

Company’s contribution of $300 million pre-tax led to a decrease in

pension expense of $48 million in 2004.

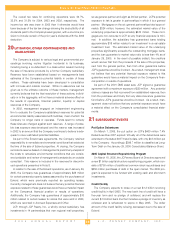

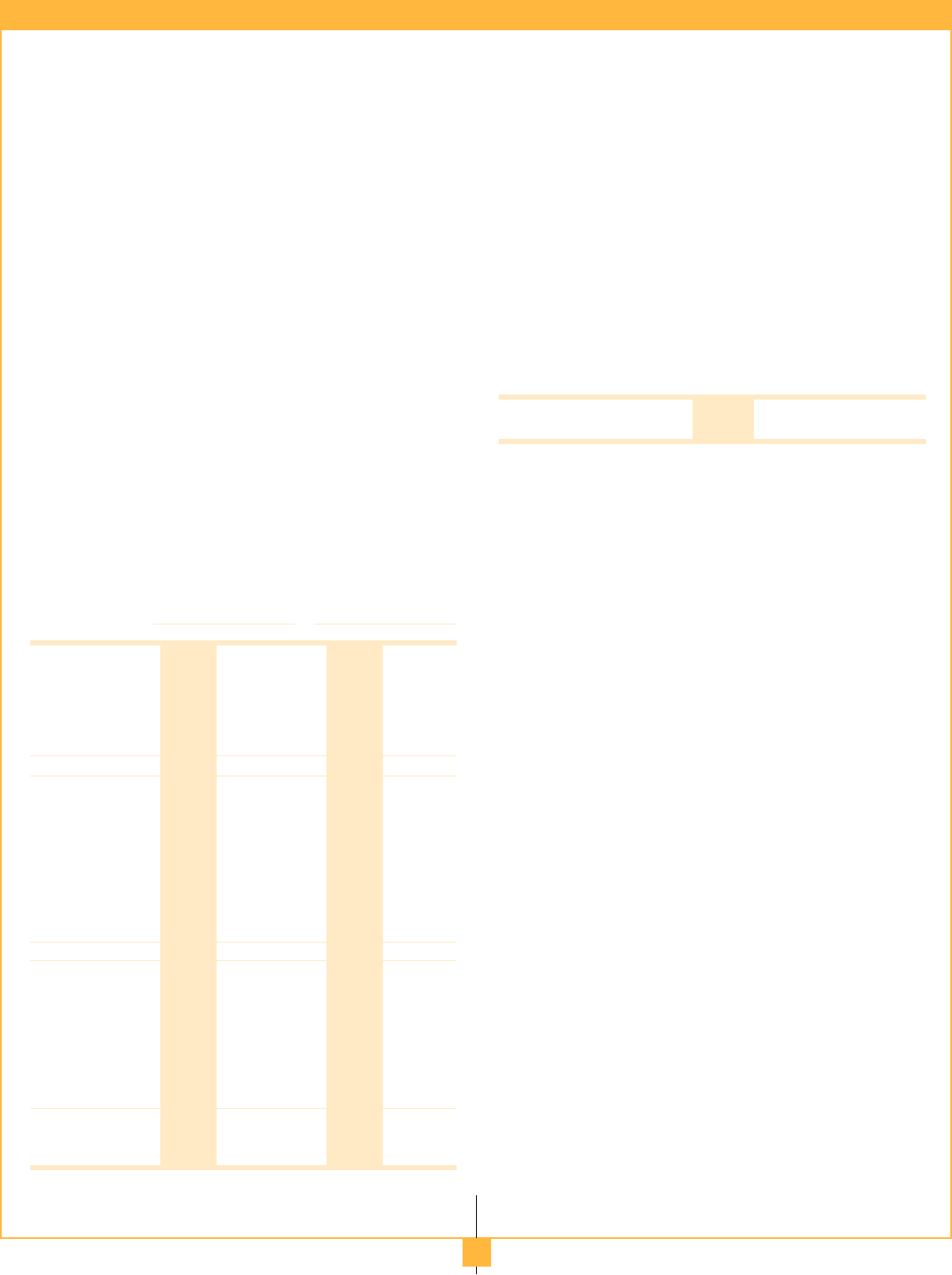

Funded Status

—

The table below provides a reconciliation of

benefit obligations, plan assets and the funded status of the

defined benefit pension and supplemental retirement plans. The

projected benefit obligation (PBO) is the present value of benefits

earned to date by plan participants, including the effect of

assumed future salary increases. Assets used in calculating the

funded status are measured at fair value at October 31 (the plan’s

measurement date).

Assets and Obligations

Pension Plans Supplemental Plans

($ in millions)

2004 2003 2004 2003

Change in PBO

Beginning of year

$ 3,302 $ 2,839 $ 405 $ 339

Service and

interest costs

290 270 25 26

Actuarial loss

344 379 53 67

Benefits (paid)(1)

(205) (186) (28) (27)

End of year

$ 3,731 $ 3,302 $ 455 $ 405

Change in fair

value of plan

assets

Beginning of year

$ 3,523 $ 2,886 $ — $ —

Company

contributions

300 300 28 27

Actual return

on assets

383 523 — —

Benefits (paid)(1)

(205) (186) (28) (27)

End of year

$ 4,001 $ 3,523 $ — $ —

Funded status

of plan

Excess of fair value

over projected

benefits

$ 270 $ 221 $ (455) $ (405)

Unrecognized

losses and prior

service cost

1,268 1,099 261(2) 177(2)

Prepaid pension

cost/(accrued

liability)

$ 1,538 $ 1,320 $ (194) $ (228)

(1) Does not include plan administrative expenses.

(2) Includes fourth quarter Company contributions of approximately $56 million and $9 million in 2004

and 2003, respectively.

In the reconciliation of the fair value of plan assets, the actual

return on net assets of $383 million in 2004, which is net of plan

administrative expenses, was due to continued improvement in

capital market returns in 2004 following the market rebound in

2003. The actual one-year return on pension plan assets at the

October 31 measurement date in 2004 and 2003 was 11.7% and

19.5%, respectively.

The unrecognized losses, including prior service cost, of $1,268

million will be amortized, subject to a corridor as permitted under

SFAS No. 87, as pension expense over the average remaining

service period of the covered workforce. Such amortization,

included in total pension expense, will reduce the prepaid pension

cost.

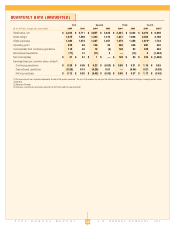

A

ssumptions to Determine Obligations

—

The weighted-aver-

age actuarial assumptions used to determine benefit obligations at

the October 31 measurement dates were as follows:

2004 2003 2002

Discount rate

5.85% 6.35% 7.10%

Salary progression rate

4.0% 4.0% 4.0%

For purposes of estimating demographic mortality in the measure-

ment of the Company’s pension obligation, as of October 31, 2004,

the Company began using the Retirement Plans 2000 Table of

Combined Healthy Lives, projected to 2005, using Scale AA to

forecast mortality improvements five years into the future to 2005.

Previously, the Company had utilized the 1983 Group Annuity

Mortality Table, which it continues to use for calculating funding

requirements based on Internal Revenue Service regulations.

Accumulated Benefit Obligation (ABO)

—

The ABO is the pres-

ent value of benefits earned to date, assuming no future salary

growth. The ABO for the Company’s primary pension plan was

$3.4 billion and $3.0 billion as of October 31, 2004 and 2003,

respectively. Plan assets of $4.0 billion for the primary pension

plan exceeded the ABO by approximately $0.6 billion, due to total

cash contributions of $600 million made to the plan during 2004

and 2003, combined with strong asset returns in 2004 and 2003.

The ABO for the Company’s unfunded supplemental pension plans

was $419 million and $372 million as of October 31, 2004 and

2003, respectively. The unfunded ABO for the supplemental plans

exceeded the recorded liability at year-end 2004 by $169 million,

which required an additional minimum liability adjustment. See fur-

ther discussion below.

Additional Minimum Liability

—

At the measurement date of

October 31, the fair value of pension plan assets in the primary

pension plan exceeded both the PBO and the ABO. Therefore, the

Company was not required to reflect a minimum liability adjustment

under SFAS No. 87, which would have removed the prepaid pen-

sion cost (asset) of $1.5 billion with the offset of approximately $0.9

billion, net of taxes, charged against stockholders’ equity. Prepaid

Pension on the Company’s Consolidated Balance Sheet as of year-

end 2004 represents pension funding in excess of pension

expense recognized through the Consolidated Statement of

Operations. The prepaid pension cost has accumulated from the

inception of the pension plan in 1966, principally as a result of the

Company’s policy to target a funded ratio in the range of 110% to

130%.

As a result of the weakness in the global equity markets over the

2000-2002 timeframe, the pension surplus of the defined benefit

pension plan declined from approximately $1.2 billion in 2000 to a

surplus of $45 million at the measurement date in 2002. With the