JCPenney 2004 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Notes to the Consolidated Financial Statements

32

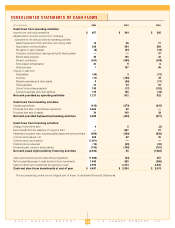

Cash and Short-Term Investments

All highly-liquid investments with original maturities of three

months or less are considered to be short-term investments. The

short-term investments consist primarily of eurodollar time deposits

and money market funds and are stated at cost, which approxi-

mates fair market value.

Total Cash and Short-Term Investments were $4,687 million and

$2,994 million for 2004 and 2003, respectively, and included

restricted short-term investment balances of $63 million and $87

million for the same periods. Restricted balances are pledged as

collateral for import letters of credit not included in the bank credit

facility and/or for a portion of casualty insurance program liabilities.

Cash and Short-Term Investments on the Consolidated Balance

Sheets included $46 million and $8 million of cash for 2004 and

2003, respectively.

Receivables, Net

Net Renner credit card receivables were $125 million and $89

million as of year-end 2004 and 2003, respectively. The corre-

sponding allowance for bad debts was $7 million and $5 million at

the end of 2004 and 2003, respectively. Also included in this clas-

sification are notes and miscellaneous receivables, including a

$163 million current deferred tax asset at year-end 2004.

Merchandise Inventories

Inventories are valued primarily at the lower of cost (using the last-

in, first-out or “LIFO” method) or market, determined by the retail

method for department stores and store distribution centers, and

standard cost, representing average vendor cost, for

Catalog/Internet and regional warehouses. The lower of cost or mar-

ket is determined on an aggregate basis for similar types of mer-

chandise. To estimate the effects of inflation/deflation on ending

inventory, an internal index measuring price changes from the begin-

ning to the end of the year is calculated using merchandise cost data

at the item level.

Total Company LIFO (credits)/charges included in Cost of Goods

Sold were $(18) million, $(6) million and $6 million in 2004, 2003 and

2002, respectively. If the first-in, first-out or “FIFO” method of inven-

tory valuation had been used instead of the LIFO method, invento-

ries would have been $25 million and $43 million higher at January

29, 2005 and January 31, 2004, respectively.

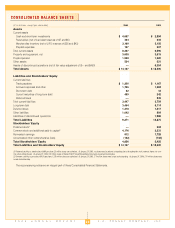

Property and Equipment, Net

Estimated

Useful Lives

($ in millions)

(Years) 2004 2003

Land

— $ 203 $ 206

Buildings

50 2,693 2,554

Furniture and equipment

3-20 2,145 2,203

Leasehold improvements

674 674

Accumulated depreciation (

2,077) (2,122)

Property and equipment, net

$ 3,638 $ 3,515

Property and equipment is stated at cost less accumulated

depreciation. Depreciation is computed primarily by using the

straight-line method over the estimated useful lives of the related

assets. Leasehold improvements are depreciated over the shorter

of the estimated useful lives of the improvements or the term of the

lease, including renewals determined to be reasonably assured.

Routine maintenance and repairs are expensed when incurred.

Major replacements and improvements are capitalized. The cost

of assets sold or retired and the related accumulated depreciation

or amortization are removed from the accounts with any resulting

gain or loss included in net income/(loss).

Capitalized Software Costs

Costs associated with the acquisition or development of software

for internal use are capitalized and amortized over the expected

useful life of the software, generally between three and seven

years. Subsequent additions, modifications or upgrades to inter-

nal-use software are capitalized only to the extent that they allow

the software to perform a task it previously did not perform.

Software maintenance and training costs are expensed in the peri-

od incurred.

Goodwill

Management evaluates the recoverability of goodwill annually and

whenever events or changes in circumstances indicate that the car-

rying value may not be recoverable. During 2004, management per-

formed the annual evaluation of goodwill as it relates to the

Company’s investment in its Renner Department Stores in Brazil.

The fair value of the Company’s Renner Department Store operation

was determined using the expected present value of corresponding

future cash flows, discounted at a risk-adjusted rate. Management

concluded that there was no evidence of impairment as of year-end

2004.

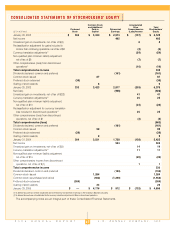

The 2004 change in the carrying amount of goodwill, included in

Other Assets, was as follows:

($ in millions)

Goodwill

Balance as of January 31, 2004

$42

Foreign currency translation adjustment

1

Balance as of January 29, 2005

$ 43

At year-end 2003, management had been authorized by the Board

of Directors to sell Eckerd and was engaged in active negotiations

with interested parties. The “more-likely-than-not” expectation that

Eckerd would be sold was a triggering event for possible goodwill

impairment, and a goodwill impairment review was performed at the

Eckerd reporting level. While no impairment was identified based on

the results of the two-step impairment test prescribed by SFAS No.

142, “Goodwill and Other Intangible Assets,” adjustments were

made at the end of 2003 to reduce the Company’s investment in

Eckerd to its fair value less costs to sell and to reflect the estimated

tax impact of a potential sale. See Note 2 for discussion of the

Eckerd disposition.

Impairment of Long-Lived Assets

In accordance with SFAS No. 144, “Accounting for the

Impairment or Disposal of Long-Lived Assets,” the Company eval-

uates long-lived assets for impairment whenever events or

changes in circumstances indicate that the carrying amount of

those assets may not be recoverable. Factors considered impor-

tant that could trigger an impairment review include, but are not

limited to, significant underperformance relative to historical or pro-

jected future operating results and significant changes in the man-

ner of use of the assets or the Company’s overall business strate-

gies. For long-lived assets held for use, SFAS No. 144 requires that

if the sum of the future cash flows expected to result from the use

and eventual disposition of a company’s long-lived assets, undis-

counted and without interest charges, is less than the reported

value of those assets, an evaluation must be performed to deter-

mine if an impairment loss has been incurred. The amount of any