JCPenney 2004 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

26

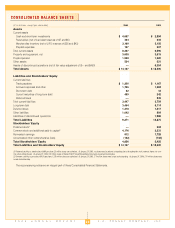

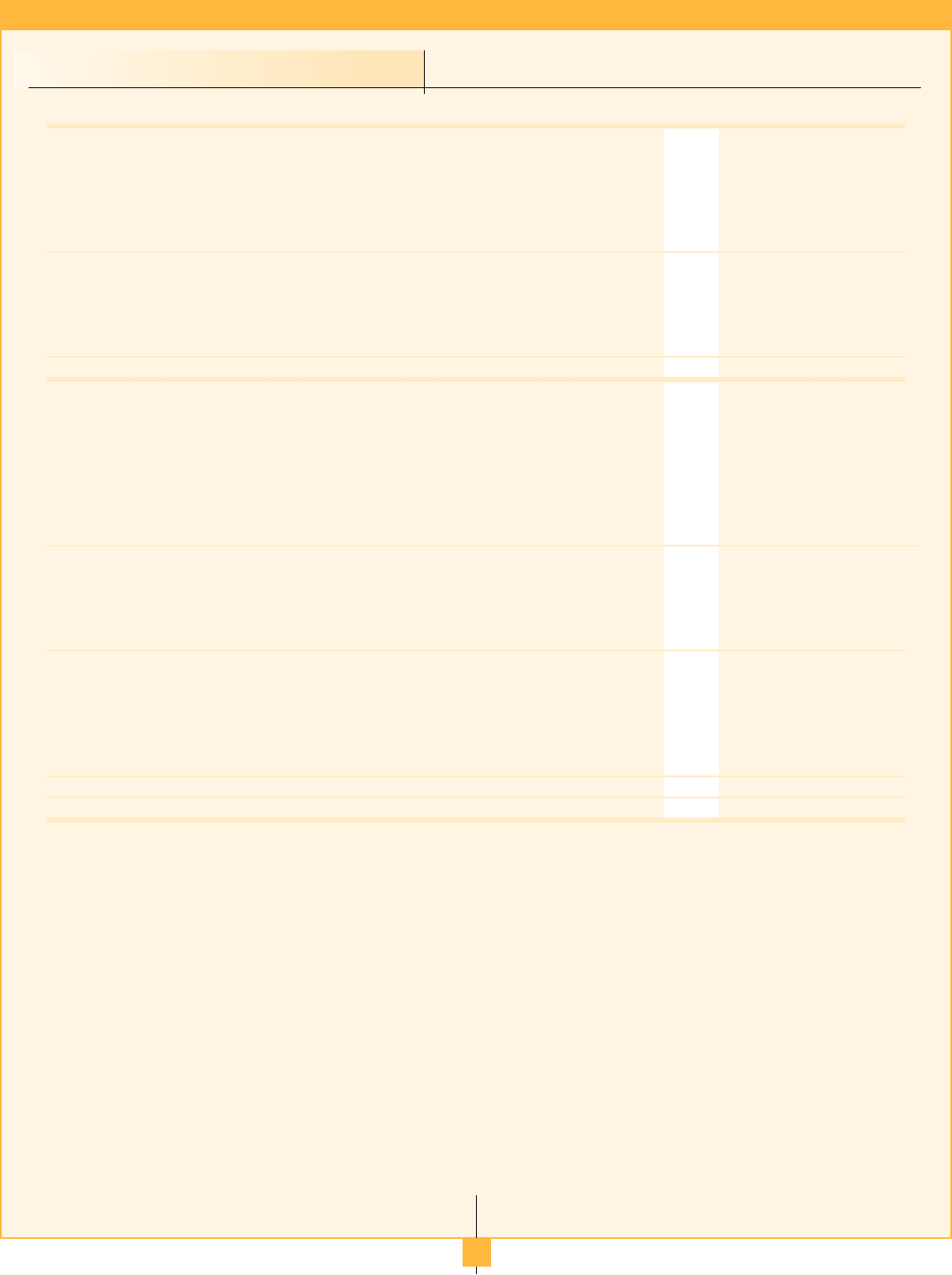

CONSOLIDATED BALANCE SHEETS

($ in millions, except per share data)

2004 2003

Assets

Current assets

Cash and short-term investments

$ 4,687 $ 2,994

Receivables (net of bad debt reserves of $7 and $5)

404 233

Merchandise inventory (net of LIFO reserves of $25 and $43)

3,169 3,156

Prepaid expenses

167 207

Total current assets

8,427 6,590

Property and equipment, net

3,638 3,515

Prepaid pension

1,538 1,320

Other assets

524 521

Assets of discontinued operations (net of fair value adjustment of $–– and $450)

–– 6,354

Total Assets

$ 14,127 $ 18,300

Liabilities and Stockholders’ Equity

Current liabilities

Trade payables

$ 1,200 $ 1,167

Accrued expenses and other

1,766 1,384

Short-term debt

22 18

Current maturities of long-term debt

459 242

Deferred taxes

–– 943

Total current liabilities

3,447 3,754

Long-term debt

3,464 5,114

Deferred taxes

1,318 1,217

Other liabilities

1,042 804

Liabilities of discontinued operations

–– 1,986

Total Liabilities

9,271 12,875

Stockholders’ Equity

Preferred stock(1)

–– 304

Common stock and additional paid-in capital(2)

4,176 3,531

Reinvested earnings

812 1,728

Accumulated other comprehensive (loss)

(132) (138)

Total Stockholders’ Equity

4,856 5,425

Total Liabilities and Stockholders’ Equity

$ 14,127 $ 18,300

(1) Preferred stock has a stated value of $600 per share; 25 million shares are authorized. At January 29, 2005, no shares were issued and outstanding due to the redemption of all preferred shares into com-

mon stock during the year. At January 31, 2004, 0.5 million shares of Series B ESOP convertible preferred stock were issued and outstanding.

(2) Common stock has a par value of $0.50 per share; 1,250 million shares are authorized. At January 29, 2005, 271 million shares were issued and outstanding. At January 31, 2004, 274 million shares were

issued and outstanding.

The accompanying notes are an integral part of these Consolidated Financial Statements.