JCPenney 2004 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2004 JCPenney annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

J.C. PENNEY COMPANY, INC.2 004 ANNUAL REPORT

Notes to the Consolidated Financial Statements

41

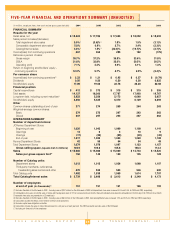

As of January 29, 2005, future minimum lease payments for non-

cancelable operating and capital leases were:

($ in millions)

Operating Capital

2005

$ 226 $ 10

2006

185 17

2007

149 5

2008

130 3

2009

110 ––

Thereafter

397 ––

Total minimum lease payments

$ 1,197 $ 35

Present value

$ 711 $ 31

Weighted-average interest rate

9.0% 5.3%

In connection with recent guidance issued by the Securities and

Exchange Commission, the Company reviewed its lease account-

ing practices. As a result of this review, a cumulative pre-tax

expense adjustment of $8 million was recorded, $3 million of which

related to recognizing rent on a straight-line basis over the lease

term. The remaining $5 million was to synchronize depreciation

periods for fixed assets with the related lease terms. The impact

for prior years was not material. In addition, the Company record-

ed a $111 million balance sheet adjustment at January 29, 2005 to

increase Property and Equipment, Net and establish a deferred

rent liability, included in Other Liabilities in the Company’s

Consolidated Balance Sheet, for the unamortized balance of devel-

oper/tenant allowances.

17 RETIREMENT BENEFIT PLANS

The Company provides retirement and other postretirement ben-

efits to substantially all employees (associates). Associates hired

or rehired on or after January 1, 2002 are not eligible for retiree

medical or dental coverage. Retirement benefits are an important

part of the Company’s total compensation and benefits program

designed to attract and retain qualified and talented associates.

The Company’s retirement benefit plans consist of a non-contribu-

tory qualified pension plan (primary pension plan), non-contributo-

ry supplemental retirement and deferred compensation plans for

certain management associates, a 1997 voluntary early retirement

program, a contributory medical and dental plan and a 401(k) and

employee stock ownership plan. Total Company expense for all

retirement-related benefit plans was $167 million, $207 million and

$106 million in 2004, 2003 and 2002, respectively. These plans are

described in more detail below. See Management’s Discussion and

Analysis under Critical Accounting Policies on pages 19-21 for addi-

tional discussion of the Company’s defined benefit pension plan and

Note 1 on pages 30-31 for the Company’s accounting policies regard-

ing retirement-related benefits.

Defined Benefit Retirement Plans

Primary Pension Plan — Funded

The Company and certain of its subsidiaries provide a non-con-

tributory pension plan to associates who have completed at least

1,000 hours of service, generally in a 12-consecutive-month period

and have attained age 21. The plan is funded by Company contri-

butions to a trust fund, which is held for the sole benefit of partici-

pants and beneficiaries. Participants generally become 100%

vested in the plan after five years of employment or at age 65.

Pension benefits are calculated based on an associate’s average

final pay, an average of the social security wage base, and the

associate’s credited service (up to 35 years), as defined in the plan

document.

Supplemental Retirement Plans — Unfunded

The Company has unfunded supplemental retirement plans,

which provide retirement benefits to certain management associ-

ates and other key employees. The Company pays ongoing ben-

efits from operating cash flow and cash investments. The primary

plans are a Supplemental Retirement Plan, a Benefit Restoration

Plan and a Voluntary Early Retirement Plan. Benefits for the

Supplemental Retirement Plan and Benefits Restoration Plan are

based on length of service and final average compensation. The

Benefit Restoration Plan is intended to make up benefits that could

not be paid by the qualified pension plan due to governmental lim-

its on the amount of benefits and the level of pay considered in the

calculation of benefits. The Supplemental Retirement Plan also

offers participants who leave the Company between ages 60 and

62 benefits equal to the estimated social security benefits payable

at age 62. Participation in this plan is limited to associates who

were profit-sharing management associates at the end of 1995.

The Voluntary Early Retirement Program was offered in 1997 to

management associates who were at least age 55 with a minimum

of 10 years of service and who elected to take early retirement.

These plans were amended in December 2003 to provide partici-

pants a one-time irrevocable election to receive remaining unpaid

benefits over a five-year period in equal annual installments.

Several other smaller plans and agreements are also included.

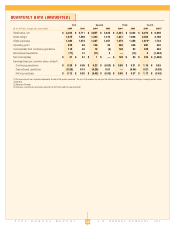

Expense for Defined Benefit Retirement Plans

—

Expense is

based upon the annual service cost of benefits (the actuarial cost

of benefits attributed to a period) and the interest cost on plan lia-

bilities, less the expected return on plan assets for the primary pen-

sion plan. Differences in actual experience in relation to assump-

tions are not recognized immediately but are deferred and amor-

tized over the average remaining service period. The components

of net periodic pension expense were as follows:

Primary Pension Plan Expense

($ in millions)

2004 2003 2002

Service costs

$ 87 $ 75 $ 71

Interest costs

203 195 187

Projected return on assets

(305) (249) (274)

Net amortization

97 109 40

Net periodic pension

plan expense

$ 82 $ 130 $ 24

Supplemental Plans Expense

($ in millions)

2004 2003 2002

Service costs

$––$ 3$ 2

Interest costs

25 23 19

Net amortization

13 8 9

Curtailment loss

3 –– ––

Net supplemental

plans expense

$ 41 $ 34 $ 30

Assumptions

—

The weighted-average actuarial assumptions used

to determine expense for 2004, 2003 and 2002 were as follows:

2004 2003 2002

Discount rate

6.35% 7.10% 7.25%

Expected return on plan

assets

8.9% 8.9% 9.5%

Salary increase

4.0% 4.0% 4.0%